For a technology that was once dismissed as a transitional curiosity, plug-in hybrid electric vehicles have staged a remarkable comeback in recent years. Automakers from BMW to Toyota have rushed new models to showrooms, consumers have embraced their promise of electric driving without range anxiety, and sales figures have surged to record levels. But just as the plug-in hybrid appears to be enjoying its golden age, a growing chorus of industry analysts and forecasters is warning that the party may be nearing its end — and sooner than most people expect.

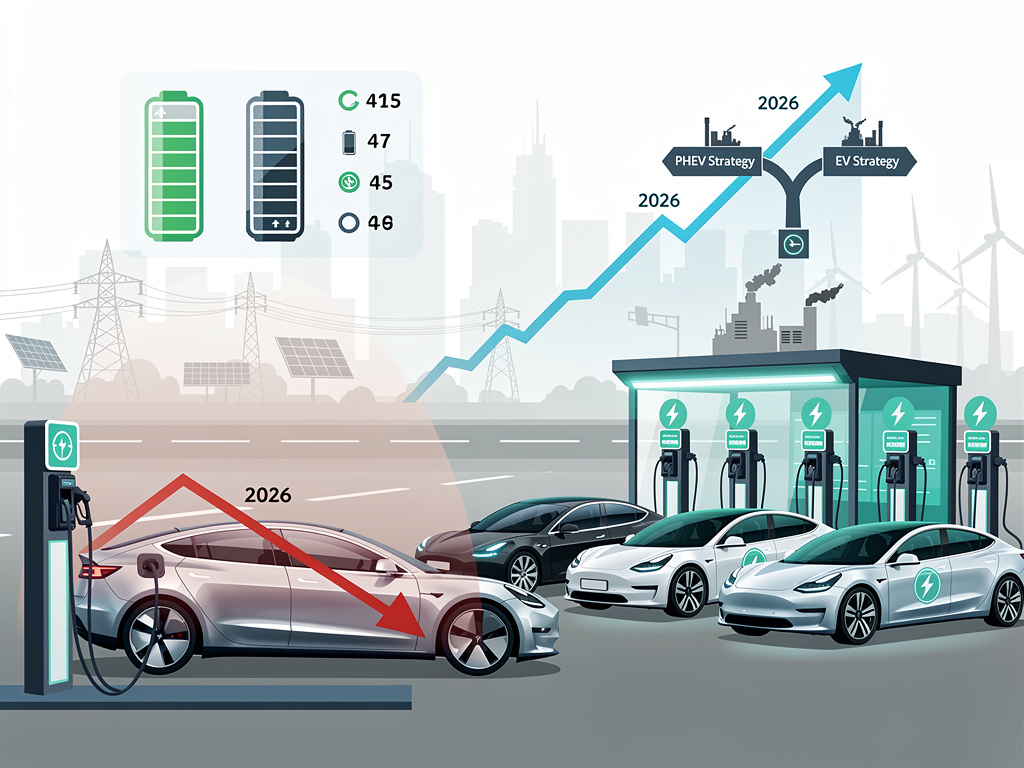

According to a detailed analysis published by Business Insider, global plug-in hybrid electric vehicle (PHEV) sales are projected to begin declining as early as 2026. The report draws on forecasts from S&P Global Mobility, which estimates that PHEV sales will peak and then enter a sustained downward trajectory as battery-electric vehicles (BEVs) become more affordable, more capable, and more widely available. The data suggests that what many in the auto industry have treated as a durable bridge technology may in fact be a narrow bridge — one that the market will cross faster than anticipated.

A Surge That Defied the Skeptics

The recent PHEV boom has been nothing short of impressive. In 2024, plug-in hybrid sales climbed sharply across nearly every major market, buoyed by a combination of consumer preference, regulatory incentives, and aggressive product launches from legacy automakers. In the United States, PHEV sales rose significantly as brands like Toyota, Jeep, and BMW expanded their plug-in offerings. In Europe, where emissions regulations have tightened considerably, PHEVs offered manufacturers a convenient pathway to compliance without committing fully to battery-electric platforms. In China, the world’s largest auto market, plug-in hybrids sold by BYD and other domestic manufacturers have been a dominant force, with some models outselling their fully electric counterparts.

The appeal of PHEVs to consumers is straightforward. They offer a limited all-electric range — typically between 25 and 60 miles — sufficient for most daily commutes, while retaining a gasoline engine for longer trips. This dual-powertrain approach eliminates the range anxiety that has been one of the most persistent barriers to BEV adoption. For buyers who are EV-curious but not yet ready to commit to a fully electric lifestyle, PHEVs have represented a comfortable middle ground. And for automakers, they have offered a way to electrify their lineups without the enormous capital expenditure required to develop dedicated BEV platforms.

The Economics Are Shifting Beneath the Surface

But the forces that propelled PHEVs to prominence are beginning to shift. The most significant factor is the rapidly declining cost of battery technology. Lithium-ion battery pack prices have fallen by roughly 90% over the past decade, and industry analysts expect further reductions as new chemistries — including lithium iron phosphate (LFP) and sodium-ion batteries — reach mass production. As battery costs fall, the price premium that has made BEVs more expensive than their internal combustion counterparts is narrowing. S&P Global Mobility’s forecasts, cited by Business Insider, indicate that by the middle of this decade, a growing number of BEVs will reach price parity with comparable PHEVs and conventional vehicles, fundamentally altering the consumer calculus.

When a fully electric vehicle costs roughly the same as a plug-in hybrid but offers lower operating costs, no gasoline dependency, and increasingly competitive range, the rationale for choosing a PHEV weakens considerably. Today’s best-selling BEVs already offer real-world ranges exceeding 300 miles, and the charging infrastructure — while still imperfect — is expanding rapidly in the United States, Europe, and China. The combination of falling prices and improving infrastructure is expected to pull an increasing share of buyers directly from internal combustion vehicles into BEVs, bypassing the PHEV stepping stone entirely.

Regulatory Winds Are Changing Direction

Regulatory dynamics are also working against plug-in hybrids. In Europe, where PHEVs have enjoyed favorable treatment under CO2 emissions regulations, policymakers are growing increasingly skeptical of the technology. Studies have repeatedly shown that real-world emissions from PHEVs are significantly higher than official test-cycle figures suggest, largely because many owners rarely charge their vehicles and instead rely primarily on the gasoline engine. The European Commission has signaled that future emissions standards will more accurately reflect real-world driving conditions, which could strip PHEVs of much of their regulatory advantage. Several European countries, including Norway and the Netherlands, have already moved to reduce or eliminate purchase incentives for plug-in hybrids.

In China, the government has been gradually tightening the definition of what qualifies as a “new energy vehicle” for the purposes of subsidies and purchase incentives. While PHEVs and extended-range electric vehicles (EREVs) currently qualify, Beijing’s long-term policy trajectory favors full electrification. Chinese automakers, led by BYD, are already pivoting their product strategies accordingly, investing heavily in affordable BEV platforms that can serve both domestic and export markets. The Chinese market, which accounts for more than half of global PHEV sales, could see a particularly sharp transition as domestic manufacturers scale up BEV production and drive prices lower.

Automakers Face a Strategic Dilemma

For legacy automakers, the projected PHEV decline presents a difficult strategic puzzle. Many companies have invested billions of dollars in plug-in hybrid powertrains, and their product plans extend years into the future. BMW, for instance, has made PHEVs a central pillar of its electrification strategy, offering plug-in versions of nearly every model in its lineup. Stellantis, the parent company of Jeep, Chrysler, and several European brands, has similarly leaned heavily on PHEVs as a transitional technology. Toyota, which long resisted full electrification in favor of hybrid and plug-in hybrid technology, has only recently begun to accelerate its BEV development in earnest.

If PHEV demand peaks in 2026 and begins a sustained decline, these companies could find themselves with stranded assets — factories, supply chains, and engineering teams oriented around a powertrain architecture that the market is leaving behind. The risk is particularly acute for companies that have used PHEVs as a substitute for, rather than a complement to, aggressive BEV investment. Automakers that treated plug-in hybrids as a destination rather than a waypoint may find themselves at a competitive disadvantage relative to companies like Tesla, BYD, and Hyundai-Kia, which have committed more decisively to battery-electric platforms.

The China Factor and Global Ripple Effects

China’s role in the PHEV trajectory cannot be overstated. BYD, which became the world’s largest seller of new energy vehicles in 2024, has demonstrated that it can produce compelling PHEVs and BEVs at price points that Western automakers struggle to match. The company’s DM-i plug-in hybrid system has been enormously successful in the Chinese market, but BYD is simultaneously scaling its pure electric offerings at a pace that suggests it views PHEVs as a transitional product rather than a permanent fixture. As BYD and other Chinese manufacturers push into export markets — including Southeast Asia, Latin America, and increasingly Europe — they are likely to accelerate the global shift from PHEVs to BEVs by offering affordable electric alternatives that undercut incumbent products.

The ripple effects of China’s manufacturing prowess extend beyond vehicle sales. Chinese battery manufacturers, including CATL and BYD’s in-house battery division, are driving down cell costs and accelerating the development of next-generation battery technologies. These advances benefit BEVs disproportionately, since fully electric vehicles require larger battery packs and therefore gain more from cost reductions on a per-vehicle basis. As battery prices continue to fall, the cost advantage of PHEVs — which use smaller, less expensive battery packs — diminishes, further eroding their competitive position.

What Happens After the Peak

The projected decline in PHEV sales does not mean the technology will vanish overnight. In markets with limited charging infrastructure, particularly in developing economies, plug-in hybrids may continue to serve a useful role for years to come. And for certain vehicle segments — large SUVs and trucks, where battery weight and cost remain significant challenges — PHEVs may retain their appeal longer than in the passenger car market. But the broad trajectory appears clear: plug-in hybrids are likely to follow a bell curve rather than a plateau, rising sharply, peaking, and then declining as the economics and infrastructure of full electrification improve.

For the auto industry, the lesson is one of timing and conviction. Companies that recognized PHEVs as a temporary tool and invested accordingly — using plug-in hybrid revenue to fund BEV development — are likely to navigate the transition most successfully. Those that mistook the PHEV surge for a durable trend may find themselves scrambling to catch up in a market that has moved on. As the data from S&P Global Mobility and reporting from Business Insider make clear, the plug-in hybrid’s moment in the sun, while bright, may prove to be remarkably brief. The automotive world is not standing still, and the window for technologies that straddle the old and the new is closing faster than many industry players anticipated.