Tesla, Inc. (NASDAQ: TSLA) finds itself at a defining moment in its corporate history following the release of its Q4 2025 earnings report. As of February 9, 2026, the market is grappling with a paradox: Tesla’s core automotive deliveries fell by roughly 9% in 2025, yet its stock price remains resilient, trading in the $411 to $430 range. This valuation, which carries a forward price-to-earnings (P/E) ratio exceeding 190x, suggests that investors are no longer pricing Tesla as a car company, but as a dominant force in autonomous robotics and artificial intelligence.

The immediate implications of the recent earnings call are stark. While Tesla managed to beat revenue expectations by posting $24.9 billion for the quarter, the “double beat” was fueled less by car sales and more by a massive 20.1% recovery in gross margins and explosive growth in its energy storage division. For the public and the markets, the central question has shifted from “How many cars can Tesla sell?” to “Can Tesla’s AI-driven ‘optionality’ justify a trillion-dollar valuation while its traditional manufacturing growth stalls?”

A Year of Strategic Sacrifices and Margin Recovery

The Q4 2025 earnings call, held on January 28, 2026, detailed a year where Tesla prioritized efficiency over raw volume. For the full year of 2025, Tesla delivered 1,636,129 vehicles, a notable decline from 2024 levels. This contraction was a deliberate result of Tesla moving away from the aggressive price wars that plagued the sector in 2024. By stabilizing prices and focusing on cost-cutting through its “Unboxed” manufacturing techniques, the company managed to pull its GAAP gross margins back above the psychological 20% barrier—a feat many analysts thought impossible twelve months ago.

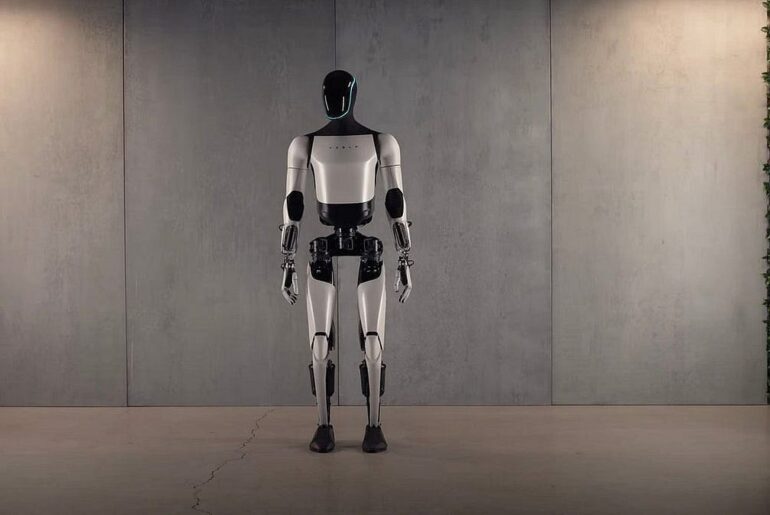

The timeline leading to this moment was defined by the “Bridge Year” of 2025. With the high-volume $25,000 “Project Redwood” vehicle delayed until late 2026, CEO Elon Musk spent much of the year refocusing the narrative on the Tesla Network and the “Cybercab.” In January 2026, just weeks before the earnings report, Tesla achieved a major milestone by removing safety drivers from its autonomous pilot program in Austin, Texas. This move served as a critical proof-of-concept for shareholders, signaling that the company’s transition into a “Physical AI” entity was finally entering the execution phase.

Initial market reactions to the earnings were mixed but leaned toward the optimistic. While bears pointed to the shrinking delivery numbers as evidence of a “broken growth story,” the stock rallied nearly 6% in the days following the call. This rally was largely driven by the announcement that volume production for the Cybercab is scheduled to begin in April 2026, alongside news that the company’s energy storage arm deployed a record 46.7 GWh in 2025. Stakeholders are now looking at a company that is successfully diversifying its revenue streams away from pure hardware sales and toward higher-margin recurring software and energy services.

The Global EV Landscape: Winners, Losers, and Rivals

As Tesla pivots, the competitive landscape has been irrevocably altered. The primary winner of 2025 was BYD Company Limited (HKG: 1211), which officially dethroned Tesla as the world’s largest battery-electric vehicle (BEV) manufacturer. Delivering 2.25 million BEVs in 2025, BYD’s vertical integration and dominance in the sub-$30,000 segment have made it the undisputed leader in mass-market electrification. While Tesla seeks higher margins through AI, BYD has won the battle for global scale, particularly in Europe and Southeast Asia.

On the other side of the spectrum, legacy U.S. automakers are facing a harsh reality. Ford Motor Company (NYSE: F) has spent much of the last year retreating from its ambitious EV targets, shifting its focus toward hybrids and its profitable “Ford Pro” commercial division. Similarly, General Motors Company (NYSE: GM) has adopted a more conservative “balanced portfolio” approach, relying on high-margin internal combustion engine (ICE) trucks to subsidize its slower-than-expected Ultium platform ramp-up. For these companies, 2025 was a year of retrenchment as they struggled to match the cost efficiencies of both Tesla and the Chinese titans.

The “AI arms race” has also created secondary winners. NVIDIA Corporation (NASDAQ: NVDA) continues to benefit from Tesla’s massive $20 billion capital expenditure into AI training clusters. As Tesla scales its FSD (Full Self-Driving) capabilities, the demand for high-performance compute remains a tailwind for the semiconductor industry. Conversely, pure-play EV startups that lacked Tesla’s capital or BYD’s scale have largely faded from the spotlight, further consolidating the market into a few high-tech powerhouses and a legacy guard struggling to keep pace.

A Fundamental Shift in Industry Trends and Policy

Tesla’s current trajectory reflects a broader industrial trend: the decoupling of vehicle hardware from software-driven value. The industry is moving toward a “software-defined vehicle” model where the profit is realized over the life of the car through subscriptions and autonomous services. Tesla’s success in logging over 700,000 paid autonomous miles in its pilot programs by February 2026 has set a historical precedent, forcing regulators to move faster on autonomous driving frameworks.

However, this transition is fraught with regulatory hurdles. The potential expiration of various EV tax credits and changing political landscapes in both the U.S. and the EU have created a volatile environment for consumer adoption. Tesla’s move toward the “Cybercab” is, in part, a strategic hedge against a world where private car ownership might decline in favor of autonomous ride-hailing fleets. This mirrors historical shifts in transportation, such as the move from horses to automobiles, where the primary value shifted from the “engine” to the “utility” provided by the new technology.

The ripple effects on competitors are profound. As Tesla pushes the envelope on “Physical AI,” other automakers are being forced to decide whether to develop their own autonomous stacks—an incredibly expensive endeavor—or license FSD from Tesla. Musk’s willingness to license Tesla’s AI technology could potentially turn competitors into customers, further blurring the lines of the traditional competitive landscape and cementing Tesla as a foundational platform for the entire industry.

The Road Ahead: 2026 and the Year of Execution

The coming months will be the most critical for Tesla since the “production hell” of the Model 3 in 2018. The short-term focus is squarely on the April 2026 launch of the Cybercab. If Tesla can successfully transition from pilot programs to volume production of a vehicle without a steering wheel, it will likely silence valuation skeptics and justify its premium P/E ratio. However, any delays in production or “edge-case” accidents in the autonomous fleet could lead to a sharp correction in the stock price.

Looking toward the end of 2026, the arrival of the $25,000 next-gen vehicle will determine if Tesla can reclaim its crown as the volume leader from BYD. This “iPhone moment” for EVs is intended to use a revolutionary manufacturing process to halve production costs. The strategic pivot required here is immense; Tesla must simultaneously scale a low-cost manufacturing marvel while perfecting a world-class AI software suite. The dual-track strategy of mass-market hardware and high-margin AI software represents a “high-risk, high-reward” scenario that will likely define the company’s market cap for the next decade.

Final Assessment for the Modern Investor

Tesla’s recent performance suggests a company that has successfully navigated the “trough of disillusionment” for electric vehicles by evolving into something entirely different. The key takeaway for investors is that Tesla is no longer a play on the transition to electric engines; it is a bet on the future of autonomous labor and transport. The recovery of margins in the face of declining sales demonstrates a maturing financial discipline that provides a floor for the stock, while the AI roadmap provides the ceiling.

As we move deeper into 2026, the market will likely remain divided. Bulls will continue to view Tesla as an undervalued AI leader with a multi-trillion-dollar future, while bears will point to the fundamental disconnect between current earnings and a $400+ share price. Investors should closely watch for three things: the Cybercab production ramp in April, regulatory approval for FSD in major metropolitan areas beyond Texas and California, and the first “unboxed” production prototypes of the $25,000 model. In the “Year of Execution,” the time for promises has passed—Tesla must now deliver on the vision that its valuation has already priced in.

This content is intended for informational purposes only and is not financial advice.