Key Points

The electric vehicle industry continues to grow well (at least outside of the United States).

The industry, however, needs to begin mass-producing its solution to one key challenge weighing on the entire business.

The problem is, most of the major names are working on the same solution as this pure-play company.

Recent marketwide weakness notwithstanding, electric vehicles (EVs) remain a solid growth opportunity for investors. Worldwide sales of EVs grew 20% last year, in fact, according to Benchmark Mineral Intelligence.

The next EV frontier investors need to know about? The lithium-based batteries that power them. They can be improved, mostly by becoming more durable with a greater driving range.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Enter QuantumScape(NASDAQ: QS). Since 2010, it’s been working on so-called solid-state lithium batteries that will do both. And, after the usual post-IPO rise and fall, its stock started to soar in the latter half of last year after the company announced a crucial battery production process had been perfected.

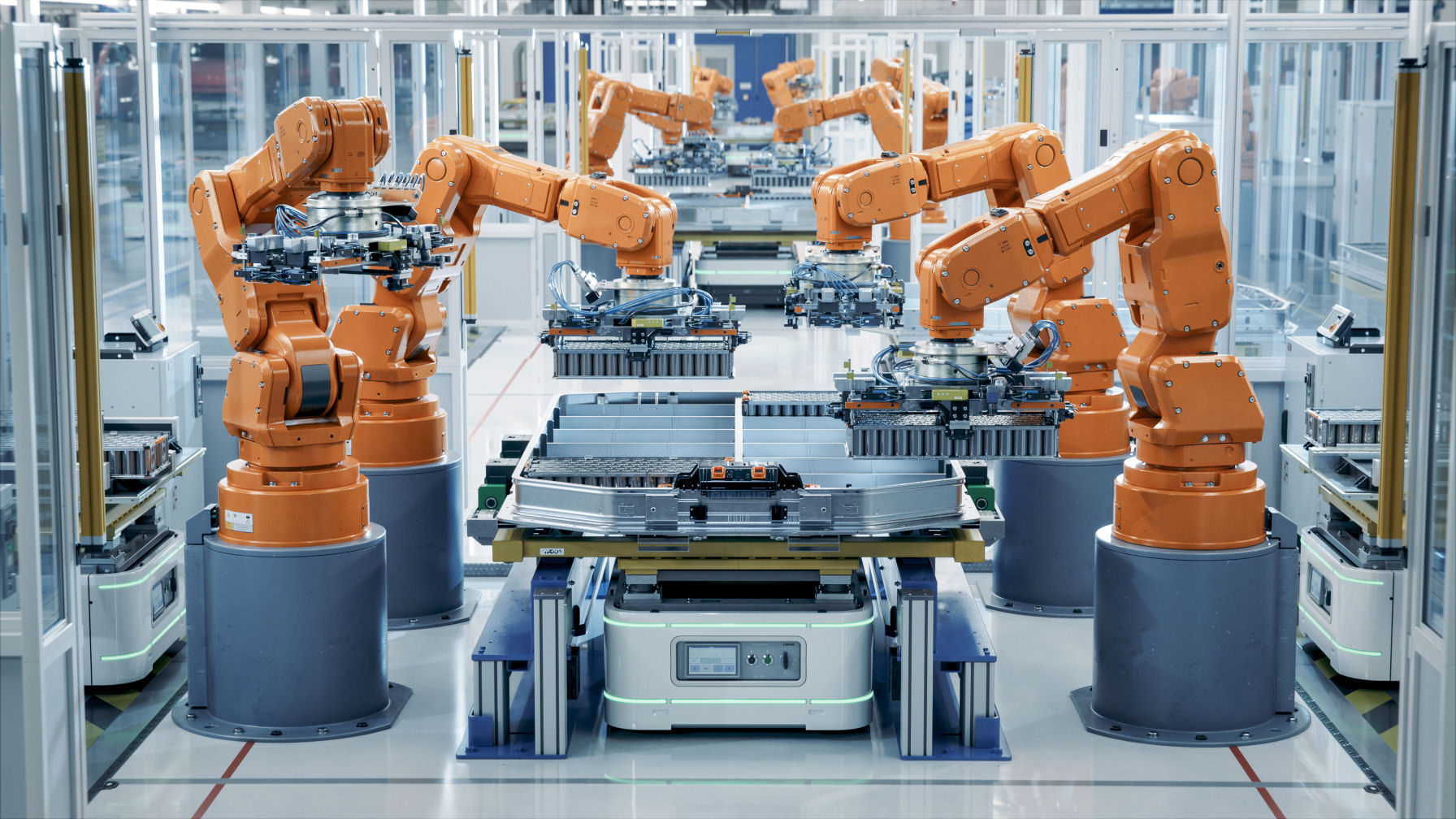

Image source: Getty Images.

Although it’s still only shipping prototypes to its developmental partner PowerCo — a subsidiary of Volkswagen — it was a sign that the company would probably be able to begin large-scale commercial production sometime in 2027. It almost seemed as if it would be the first to enter the solid-state lithium EV battery business, in fact. Straits Research expects this sector to grow at an annualized pace of 36.4% between now and 2033.

Is QuantumScape getting leapfrogged?

Much has changed since then, however. Namely, a shocking number of rivals have unveiled their own solid-state lithium EV battery development efforts, suggesting time frames for commercialization that are at least as short as QuantumScape’s.

Take China’s BYD(OTC: BYDDY) as an example. Without nearly as much fanfare as QuantumScape’s mid-2025 announcement that it was able to begin utilizing its newly developed production process, around that same time, BYD began testing its own solid-state battery packs capable of being driven 900 miles on a single charge. Given BYD’s much bigger size and scale, it’s in a much better position to expand its output once the technology is perfected.

Toyota Motor decisively entered the race in the meantime, too, committing in October of last year to bring its own solid-state batteries to the market by 2027, and install them in its own EVs no later than 2028. Then just last month, China’s Geely (parent to Volvo) said its first fully integrated solid-state lithium battery will be completed this year, with testing in its own electric vehicles to begin shortly thereafter.

And these are just a few of the electric vehicle manufacturers working on this next-generation battery tech.

QuantumScape is poorly positioned

None of this is to suggest QuantumScape won’t be able to make a marketable product capable of competing with alternatives. It’s simply to point out that most of the major electric automobile manufacturers are coming up with their own solid-state lithium battery solutions. They won’t need QuantumScape’s. Indeed, BYD and its battery development partner CATL already make battery packs for other EV companies. This isn’t apt to change once solid-state batteries become the norm, particularly if the duo launches their third-party solution first.

It matters to investors interested in QuantumScape simply because — despite the fact that it’s got the right idea — this underfunded $5 billion pure-play company that’s years away from turning a profit just isn’t likely to be able to stand toe-to-toe with bigger, deeper-pocketed rivals.

More to the point, no, QuantumScape stock isn’t a growth stock worth buying to start 2026. At least for now, there are far more promising growth prospects out there than this one, relegating QS to your long-term watch list.

Should you buy stock in QuantumScape right now?

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends BYD Company and Volkswagen Ag. The Motley Fool has a disclosure policy.