In late January and early February 2026, Ford Motor Company outlined a sharp pullback from fully electric vehicles, flagging about US$19.50 billion in EV-related charges, discontinuing the pure electric F-150 Lightning, and reaffirming a first-quarter dividend of 15 cents per share payable on March 2, 2026.

At the same time, Ford is reshaping its business mix by pivoting toward hybrids, extended-range EVs, and a new battery energy storage unit aimed at utilities and AI data centers.

We’ll examine how Ford’s large EV write-down and pivot toward hybrids and energy storage reshapes its investment narrative for shareholders.

Capitalize on the AI infrastructure supercycle with our selection of the 33 best ‘picks and shovels’ of the AI gold rush converting record-breaking demand into massive cash flow.

For Ford to make sense in a portfolio right now, you have to believe the company can pivot from an aggressive EV bet to a more balanced mix of hybrids, extended-range EVs and profitable truck and commercial franchises without losing its identity or financial discipline. The roughly US$19.50 billion in EV-related charges and the discontinuation of the pure electric F-150 Lightning are big enough to reshape near-term catalysts around the upcoming Q4 2025 results, as investors refocus on how quickly capital can be redeployed into higher-margin programs like Ford Pro and the new Ford Energy unit. Lisa Drake’s appointment to lead battery energy storage, along with the reaffirmed US$0.15 dividend, signals management’s intent to stabilize cash returns while leaning into storage and multi-energy vehicles, even as recall and quality issues remain a key overhang.

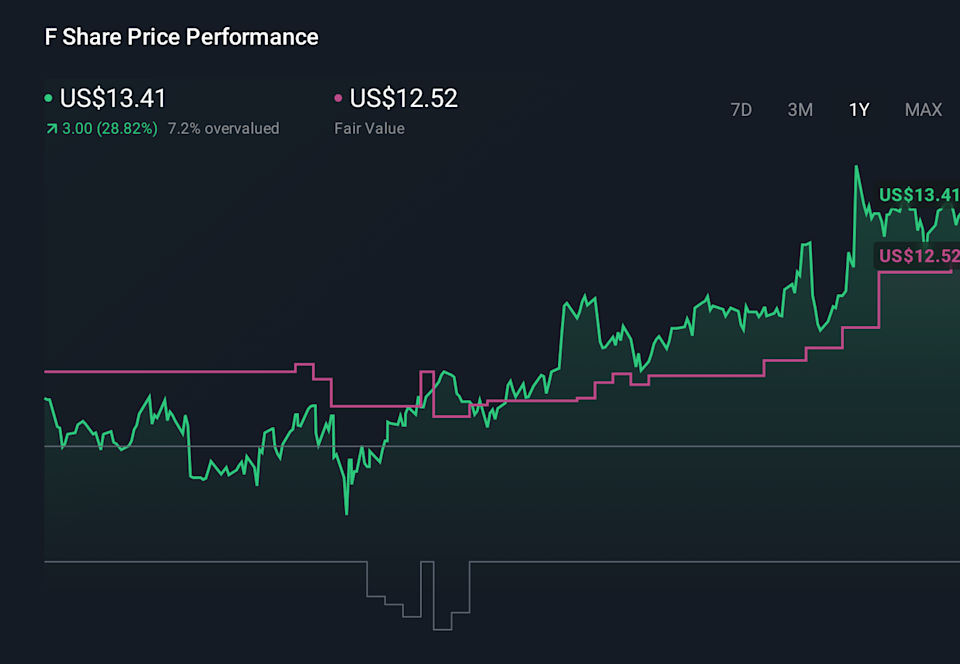

However, these quality and recall concerns could still weigh heavily on the story, and investors should be aware of them. Ford Motor’s share price has been on the slide but might be up to 39% below fair value. Find out if it’s a bargain.

Eleven fair value views from the Simply Wall St Community span roughly US$9.90 to US$15.67 per share, underlining how differently people weigh Ford’s EV retrenchment, recall overhangs and the emerging Ford Energy catalyst. You can use these contrasting opinions to stress test your own expectations about how this pivot might affect Ford’s future performance.

Explore 11 other fair value estimates on Ford Motor – why the stock might be worth 28% less than the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include F.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com