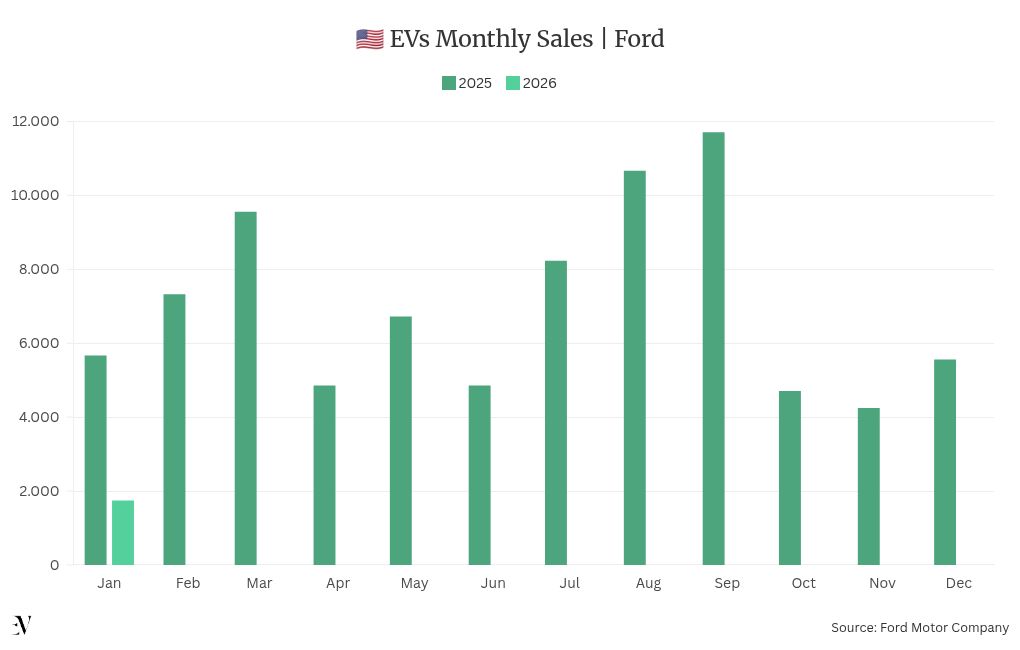

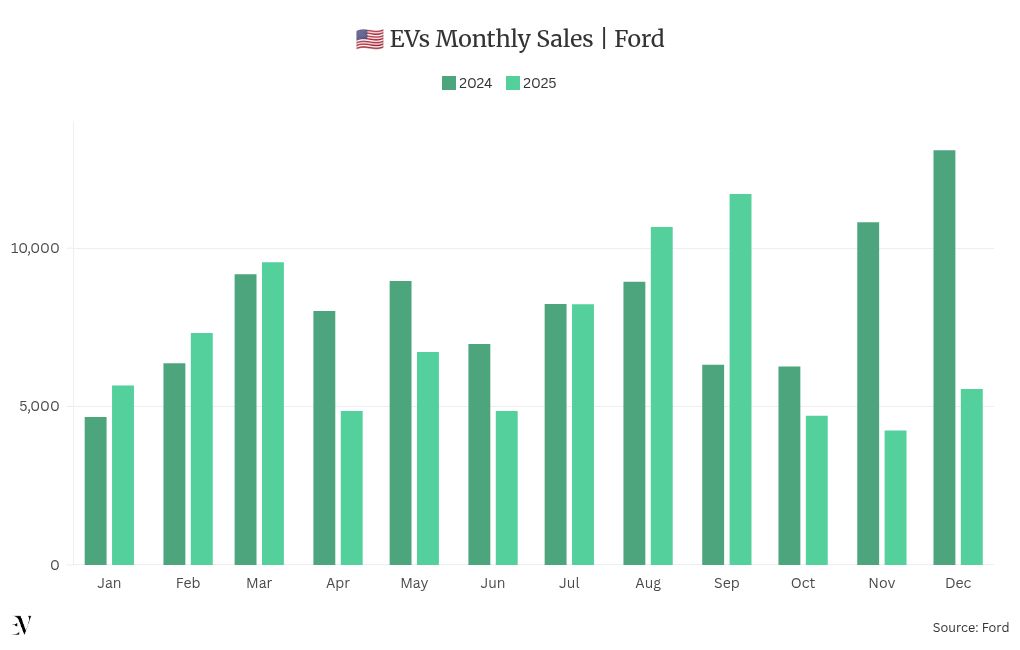

Detroit automaker Ford reported on Wednesday a 69% crash in electric vehicle sales, both year over year and sequentially.

In January, the company sold 1,743 electric vehicles in the United States, representing a 69.2% drop from the 5,666 units sold a year ago.

Compared to the 5,557 electric vehicles sold in December, the automaker posted a 68.6% decline.

Ford recorded its fourth straight year-on-year decline in monthly battery-electric vehicle sales, following the end of the federal EV tax credit.

Late last year, the company announced it was restructuring its EV business, which included the production halt of the fully electric F-150 Lightning — a best-seller in its segment — and led to nearly $20 billion in charges.

According to CEO Jim Farley, “the very high-end EVs, the $50,000, $70,000, $80,000 vehicles, they just weren’t selling.”

Ford sold 84,113 fully electric vehicles in 2025, a 14.1% tumble from a year ago, when 97,865 units were registered.

As consumers rushed to purchase EVs before the tax deadline, sales more than doubled in July and exceeded 10,000 units in both August and September.

However, they were then cut in half.

Ford sold a total of 14,513 electric vehicles in the fourth quarter, halving from the 30,176 units registered a year ago.

EV Business Restructure

Ford established its EV unit in 2022.

Under the company’s latest plans, the ‘Model e’ division is expected to become profitable by 2029, recovering from a $19.5 billion impairment announced in December.

The automaker unveiled in August its ‘Universal EV Platform,’ in which a $30,000 pick-up truck will be built.

In the Summer, the company had also announced plans to invest in electric vehicle (EV) battery production, including a partnership with South Korean manufacturer SK On.

However, four months later, the company dropped its plans for battery production and will now focus on battery energy storage systems (BESS), leading to the termination of the partnership and the layoff of over 1,000 workers in the Kentucky plant alone.

Last month, Ford appointed Lisa Drake as the new President of Ford Energy, which will handle the battery storage business unit.

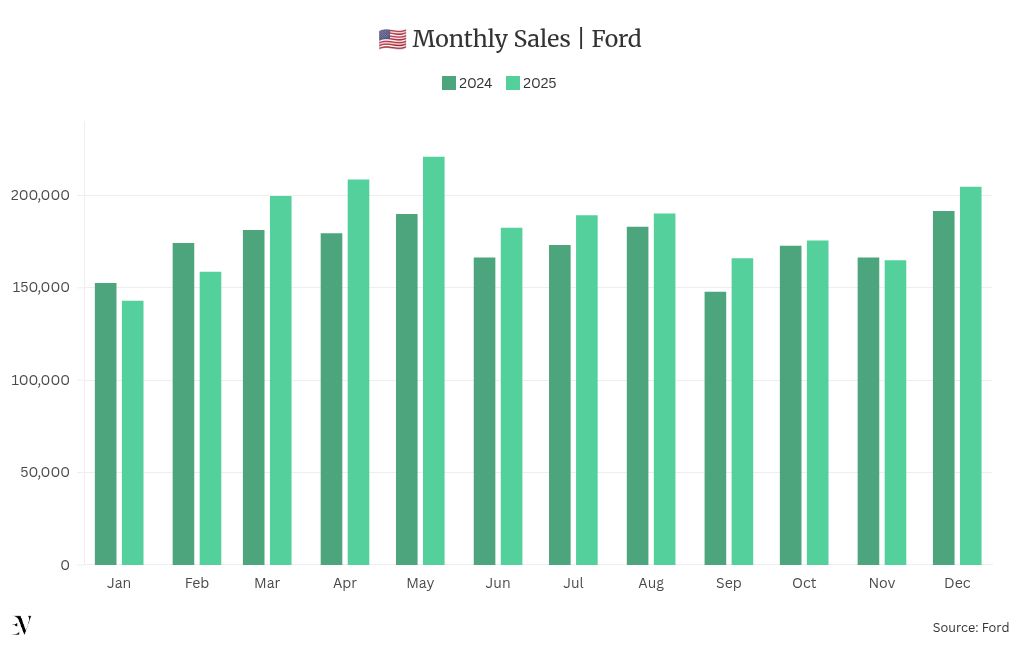

Overall Sales

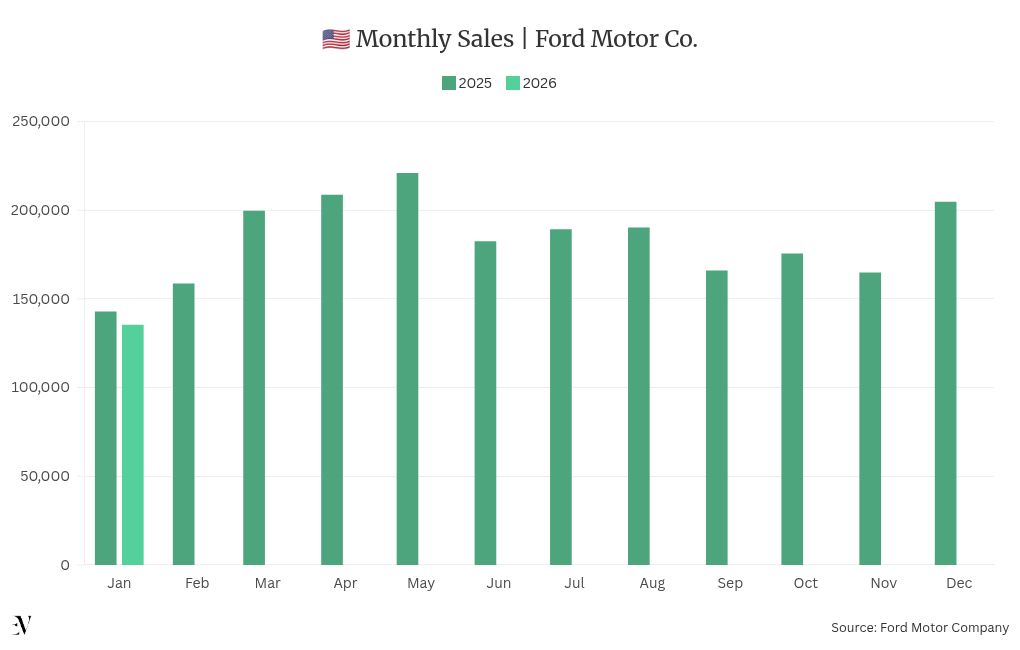

Despite policy changes and the late-2025 slump in EV sales, Ford kept overall monthly vehicle sales positive up until December, supported by strong hybrid and internal combustion engine (ICE) sales.

Only February and November registered results below the same period a year prior, with the latter representing a deviation of just 1,000 units.

Still, the only period in which Ford recorded a year-over-year decline in overall sales was from January to March, which is typically the weakest sales period for the auto industry.

Ford sold 2.2 million vehicles in the United States in 2025, a 6.0% increase from 2024, and grew its domestic market share by 0.6 percentage points to 13.2%.

However, this January, the automaker’s vehicle registrations across the United States tumbled 5% to 135,362 units from 142,944 cars a year before.

General Motors‘ Chevrolet registered 123,621 units last month, and Cadillac accounted for 9,203 units, according to data estimates published by Motor Intelligence on Tuesday.

Chevrolet sales increased year over year from 121,324 units, while Cadillac‘s registrations declined by around 4,000 units.

Truck-focused GMC sold 44,661 vehicles in January, around 1,000 up from the same period a year ago despite the 20,000-unit drop from December.

The total figures from the Mary Barra-led Detroit automaker show a 0.19% increase year over year, to 177,485 units from 177,147 a year ago.

GM only reports quarterly auto data sales.

EV Sales in the US

J.D. Power analysts predicted a decline in EV and PHEV sales in the US, driven by larger incentives for gasoline-powered vehicles, ongoing profit pressure from tariffs, and the continued slowdown in EV sales after the tax credit deadline.

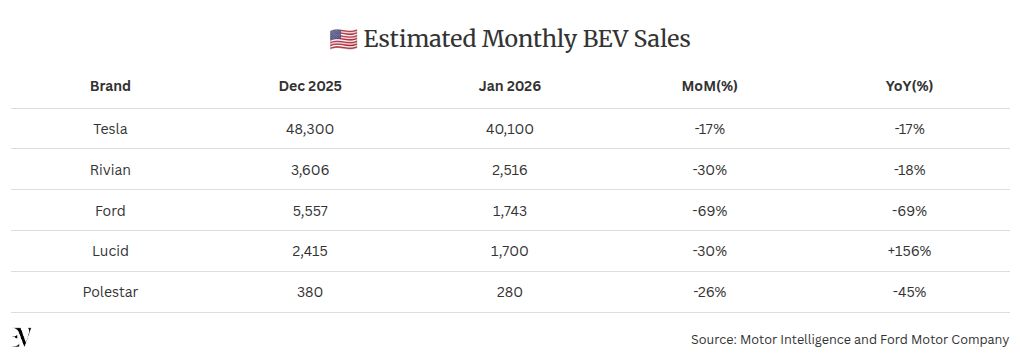

Motor Intelligence estimates show that Tesla led January EV sales with an estimated 40,100 vehicles sold in January, down 17% from December.

Rivian sold 2,516 vehicles in the United States last month, representing a 17.8% decline from the same period a year ago and a record low since the first few months of 2023.

Lucid Motors, on the other hand, posted 1,700 registrations, more than doubling its year-ago figure on a 156% year-over-year surge.

Geely-backed Polestar saw its sales decline year over year for the seventh straight month, with 280 vehicles registered.