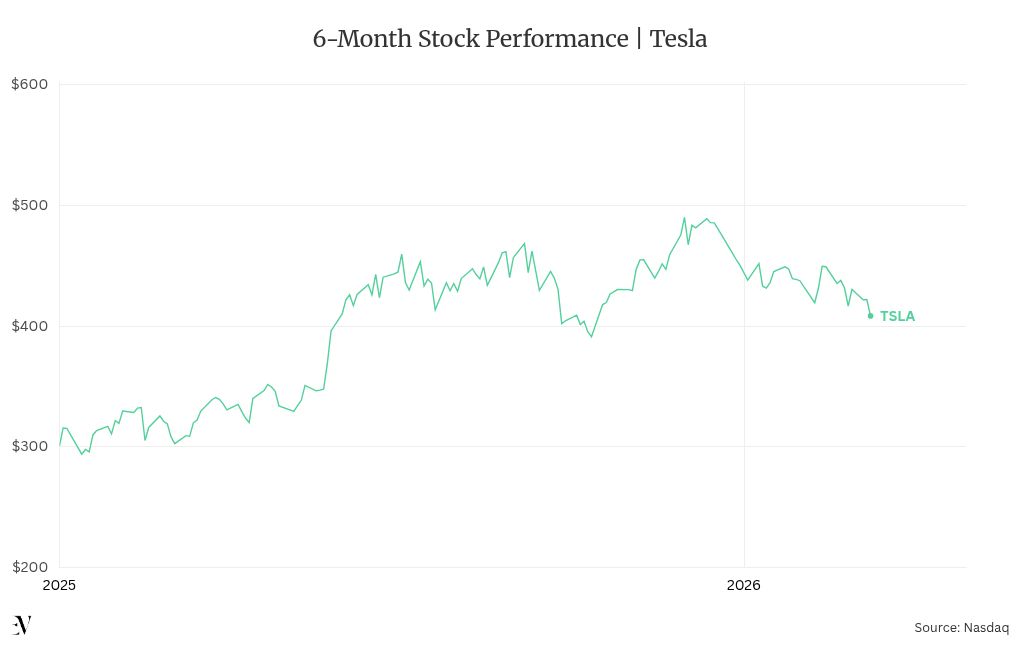

Tesla shares fell by more than 4% on Wednesday morning, hours after January sales figures from the US, China, and the UK were released.

The stock dropped more than 4% in the opening hours of the session to $403.69, extending a decline that has taken shares down roughly 19% from their December 22 all-time closing high of $489.88.

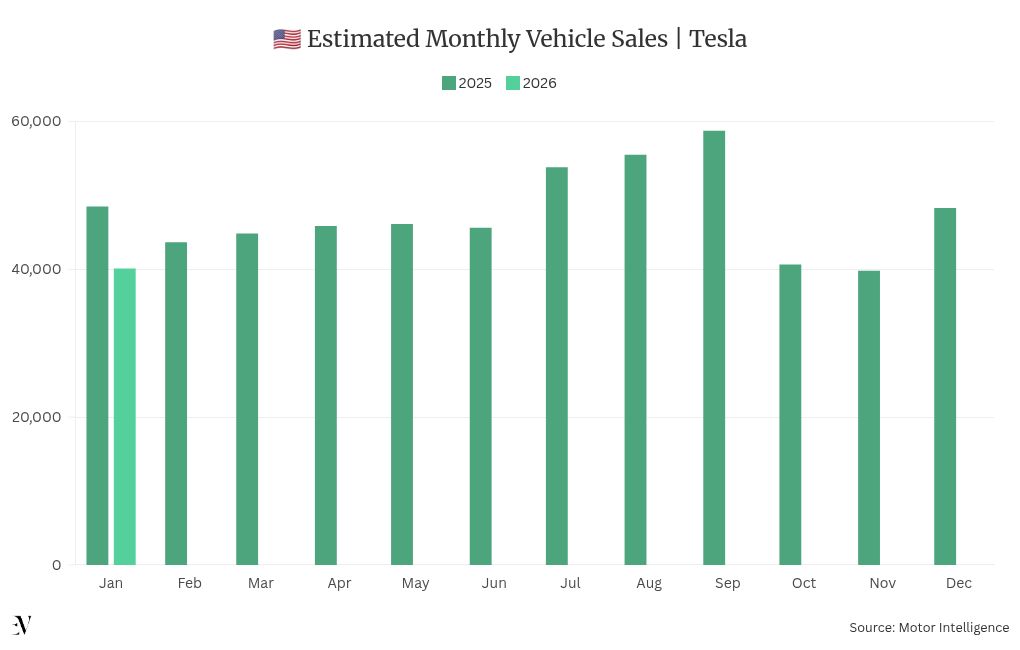

On Tuesday, Motor Intelligence published estimated US registration figures showing a 17% year-over-year decline in January — the fourth consecutive month of falling domestic sales.

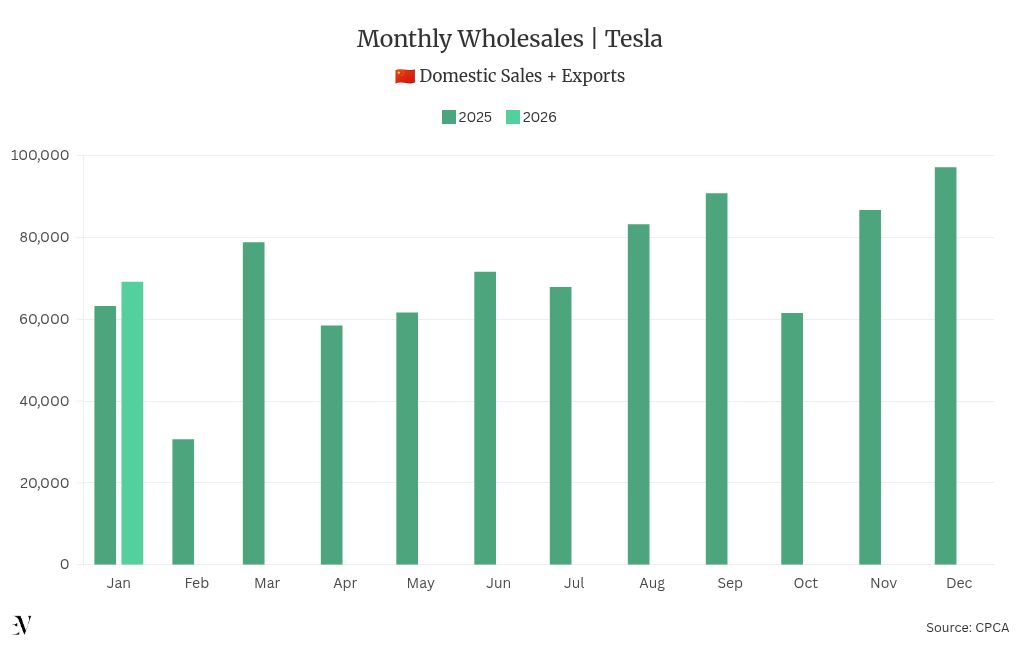

Hours later, the CPCA’s Wednesday morning report announced that China wholesale volumes rose 9.3% annually.

Additionally, data from the research group New Automotive showed on Wednesday that Tesla sales have more than halved in January to 647 units.

The company has recently started deliveries of its cheaper Model Y and Model 3 in the UK.

“The variant was previously marketed as the ‘Standard’ trim, while the previous sole version was named ‘Premium’.

Tesla dropped the Standard designation this week when it unveiled a new all-wheel-drive (AWD) version in the United States and Puerto Rico.

United States: The Deeper Problem

Tesla sold an estimated 40,100 vehicles in the United States in January, down 17% from the 48,500 units registered in January 2025, according to Motor Intelligence data published Tuesday.

The decline marked the fourth consecutive month of falling year-over-year registrations and extended a pattern that now covers nine of the past twelve months.

Only July, August, and September 2025 produced year-over-year gains — a burst widely attributed to consumers rushing to purchase vehicles before the expiration of the $7,500 EV tax credit on September 30, 2025.

October registrations dropped to 40,650, November fell further to 39,800 — the lowest month of the year — before a partial recovery to 48,300 in December.

China

Wholesale deliveries of Model 3 and Model Y vehicles produced at Tesla‘s Shanghai factory rose 9.3% year over year to 69,129 units in January, according to CPCA data released Wednesday.

The gain extended a streak that began in November 2025, when Tesla reversed eight months of annual declines in China.

The January figure was down 28.9% from December’s 97,171 units — a seasonal drop amplified by the expiration of China’s NEV purchase tax exemption at the end of 2025. The new 5% purchase tax, combined with reduced trade-in subsidies, dampened consumer demand across the market.

China’s total new energy passenger vehicle wholesale volume was estimated at approximately 900,000 units in January, up just 1% year over year — a deceleration from the 25% growth the market delivered across 2025.

BYD, China’s dominant NEV manufacturer, reported a 30% year-over-year decline in January sales.

In the United States, Tesla shifted FSD to a subscription-only model in mid-February, eliminating the $8,000 one-time purchase option.

The company reported approximately 1.1 million paid FSD customers globally as of its fourth-quarter earnings call on January 29.

As of press time, the stock was falling 3.6%.