The Australian motor industry is experiencing a seismic change. The cost of Electric Vehicles (EVs) was a serious impediment to the ordinary commuter in terms of high initial cost. Nevertheless, an ideal combination of government action, tax reform and evolving consumer behavior has inverted the script. Nowadays it is possible to drive a new Tesla, BYD, or Polestar at the cost of a regular petrol and diesel model thanks to groundbreaking federal laws.

The key to these savings is a certain financial scheme: Novated Lease for electric cars. As an Australian employee, you should not view the functioning of this structure only as a matter of being green anymore but of making a smart financial choice, which may cost you thousands of dollars annually.

The Game Changer: Electric Vehicle Discount Policy.

Later, in late 2022, the Australian Government has proposed the Treasury Laws Amendment (Electric Car Discount) Bill. It was not a slight incentive; this was a complete shake up of the car leasing market. The policy was effective in eliminating the Fringe Benefits Tax (FBT) on qualified plug-in hybrid and battery electric vehicles which have a fuel-efficient vehicle value below Luxury Car Tax (LCT).

In order to put this in perspective, FBT is typically a 47 percent tax that is imposed on benefits received by employees instead of salary. In the case of a typical petrol driven car, FBT may impose a huge invisible cost to a lease. The government has done this by being removing to EVs, in essence, offering a free tax-free ride to the electric car drivers in terms of their running expenses and lease fees. By enlisting the services of an expert such as Novated Choice, you will be able to visualize the way these exemptions change your after-tax earnings.

The operation of a Novated Lease in EVs.

A novated lease involves a three-way contract between yourself, employer and a finance company. Your house companies are paying your lease and running expenses on your wages. Although it is easy to say this, the magic occurs in the pre-tax nature of the payments.

Due to the FBT exemption, you can now afford to make 100 percent of your EV lease payments, insurance and registration, tires and even charge through your gross (pre-tax) salary. Under a traditional petrol car lease, some of these payments would need to be done using the post tax money to cover FBT. In the case of an EV, that need disappears. This implies that your taxable income is cut down by a lot hence more money in your pocket at the end of every month.

The “Sticker Price” vs. The “Real Cost”

Among the greatest myths in Australia is that EVs are too expensive. It is however true that the cost of the purchase of an EV will be approximately $10,000 or more expensive than the purchase of a similar internal combustion engine (ICE) car, but the Novated Lease of an electric car equalizes the playing field.

The lease rates on an EV with a price of $65,000 are in fact in many occasions cheaper monthly than the lease rates of an EV of $45,000 petrol SUV. This is because:

GST Savings: You save on the GST on the cost of purchasing the car (saving you up to $6,191).

Running Costs: You do not pay GST on electric charge/charging, tires or maintenance.

FBT Exemption: You save thousands of dollars every year to the Australian Taxation Office (ATO).

Why Now is the Time to Switch

These enormous savings are now under a broad open window, but it will not last long. The mission of the government is to promote the adoption of gas guzzlers in order to achieve the climate objectives. These generous tax subsidies can be retuned eventually as EVs become the new reality and not the exception.

In addition, the secondary market on EVs in Australia is starting to develop. Your current opportunity is to get a modern car with an advanced battery system at the highest point with the financial incentives plus the opportunity to get a car under leasing at the low costs.

Beyond the Dollars: The Real-world Advantages of Electricity.

Although the financial case surrounding a Novated Lease of electric cars is too tempting, the lifestyle advantages also cannot be disregarded.

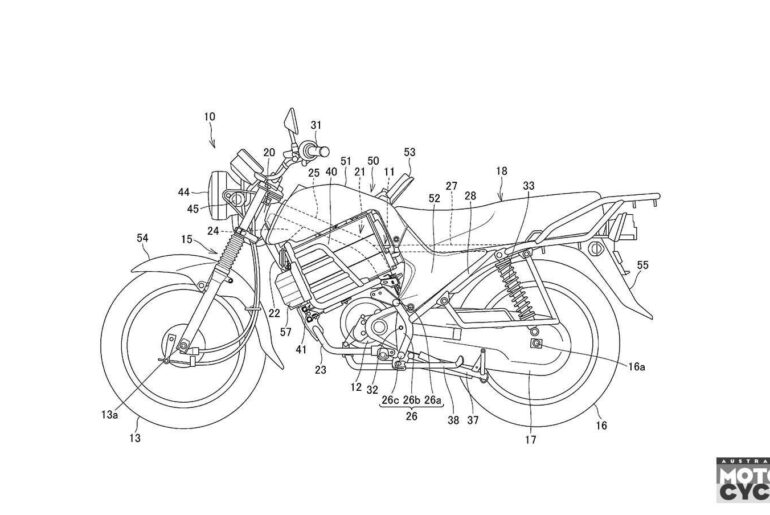

Minimal Maintenance

Electric motors contain a low percentage of moving parts as compared to petrol engines. There are no spark plugs to replace, no oil to spill and no timing belts to burst. This reduces the cost of servicing and time wastage in the mechanic.

Superior Performance

The instant torque is something to revel in in case you have not driven an EV yet. EVs offer a quiet and quick acceleration that is smooth, which makes urban driving and getting into highways hassle-free.

Charging Convenience

The days of going to a smelly petrol station are gone when one has home charging. All you do is plug in at night, just like your smartphone, and get up with a full tank each day. To commuters, the Australian charging system is growing at a rate that is very high along major highways and in shopping malls.

Choosing the Right Partner: Novated Choice.

The process of negotiating salary packaging may seem like a nightmare in tax and spreadsheet. This is the reason why it is important to select a transparent and independent provider. Novated Choice is the company that is oriented at empowering its employees to learn the practical effects of their lease.

In contrast to other providers which conceal their charges or attempt to push certain brands, a personalized advisor may assist you in evaluating the varying models of the EVs, including the widely used Tesla Model 3 and Model Y, with the more affordable BYD Atto 3, to discover the one that will provide the most benefits to your tax position.

Summary of the Financial Win

In short, an Australian worker with an annual income of $100,000 may qualify to save between $4,000 to $6,000 a year by taking an EV instead of a petrol-powered vehicle on a novated lease. In a five-year lease contract, that is a $20,000-$30,000 difference in cumulative wealth.

Once you reflect on the fact that you are also contributing to Australia reducing its carbon footprint, and having a more technologically advanced car, then it would be a no-brainer.

Conclusion

The days of the costly electric vehicle are gone in Australia so long as you utilize the appropriate financial instruments. The effect of a Federal Government FBT exemption plus the amount of savings in tax savings inherent in a salary packaging scheme has made EVs the most affordable means to place oneself behind the wheel of a new car.

In case you want to upgrade your car, do not be afraid of the sticker price. Look into a Novated Lease on electric cars and do the figures. With the support of the team at Novated Choice, you will leave behind the days of electric cars, and begin your journey to driving electrically without any worry about losing more of your hard-earned pay as you roll into a greener and more sustainable future.

Do You Want to Know More?