Tesla dealership with cars in lot by Jetcityimage via iStock

Tesla Inc. (TSLA) Q4 earnings, released on Jan. 28, were strong, but its near-term put options still have high yields. An investor who sells short 1-month puts at $400.00 and $395.00 can make an immediate 2.50% average investment yield. That’s attractive to value investors.

TSLA is at $419.213 in midday trading on Feb. 3, down over 13% from its peak of $489.88 on Dec. 16, 2025. But that’s up from a recent dip of $416.26 on Jan. 29, right after its shareholder deck release the night before. TSLA hit a three-month low of $391.09 on Nov. 21, 2025.

TSLA stock – Last 3 months – Barchart – Feb. 3, 2026

This provides a good income opportunity for investors who sell short one-month put options. I discussed this in several recent Barchart articles, including on Jan. 23 (“Tesla Inc Put Options Still Look Attractive to Short-Sellers Before Earnings Next Week“) and Jan. 4 (“Tesla Stock Has Been Flat For 2 Months – How to Make a 3.2% Yield in One-Month Puts.”)

In both of these articles, I suggested selling short the $410.00 put option contract expiring this Friday, Feb. 6. So far, that has worked out, as the put option price has fallen.

It makes sense now to consider rolling this contract over to a lower out-of-the-money (OTM) strike price. Before describing this, let’s review the Tesla results.

Strong Results, Including FCF Margins

Tesla reported slightly lower revenue in Q4 (-3.13%), and on a full-year basis, it was down 2.93%. However, it fell by less than 1% (-0.84%) compared to Q3 revenue on a trailing 12-month basis (TTM), according to Stock Analysis.

Free cash flow (FCF) fell 30% to $1.42 billion, and its FCF margins were lower in Q4, but still stayed relatively strong on a long-term basis.

For example, FCF represented 5.75% of Q4 revenue, vs. just 7.91% last year, according to Stock Analysis.

However, on a full-year basis, its $6.22 billion in 2025 FCF represented 6.56% of its $94.827 billion in 2025 revenue, vs. 3.67% in 2024. In addition, this was down slightly from 7.15% in Q3 on a TTM basis, according to Stock Analysis.

The bottom line is that Tesla had a difficult quarter, but its FCF and FCF margins stayed relatively strong.

Price Target for TSLA Stock

Analysts are still projecting higher revenue this year and next. For example, Seeking Alpha reports that 40 analysts have an average revenue forecast of $103.53 billion for 2026 and $123.13 billion for 2027. This represents a gain of 9.2% for 2026 over $94.827 billion in 2025, and almost 30% for 2027.

So, if Tesla can make an average revenue gain of 19.5% to $113.33 billion over the next 12 months (NTM) and if it maintains a 6.6% FCF margin, FCF could rise to almost$7.5 billion:

$113.3 billion NTM revenue x 0.066 = $7.48 billion FCF

That is over 20% higher than last year’s $6.22 billion in FCF.

Moreover, using a 0.4% FCF yield, its market cap could rise to $1.875 trillion:

$7.5 billion NTM FCF / 0.004 = $1,875 billion mkt cap

That is +19.2% higher than today’s market value of $1.573 billion, according to Yahoo! Finance. In other words, TSLA stock could be worth $500 per share:

$419.50 x 1.192 = $500.00 target price (TP)

That makes it attractive to short-sellers of out-of-the-money (OTM) put options.

Shorting OTM TSLA Puts

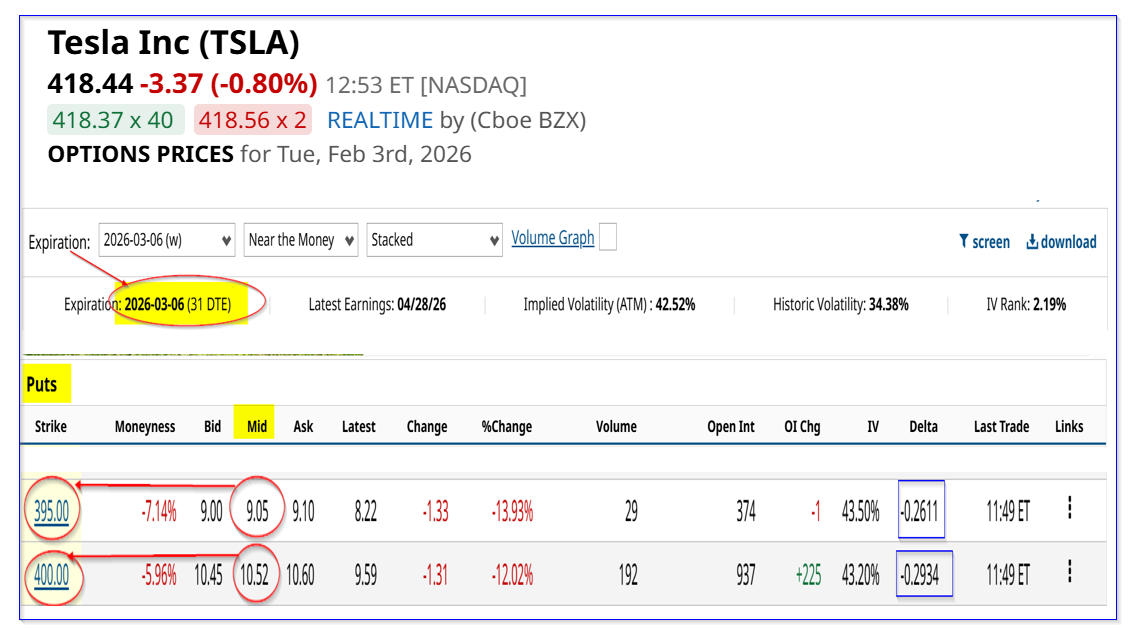

For example, look at the March 6, 2026, expiry period. It shows that the $400.00 strike price put option has a midpoint premium of $10.52. That represents 2.63% income yield (i.e., $10.52/$400.00) to a short-seller of this put contract.

TSLA puts expiring March 6, 2026 – Barchart – As of Feb. 3, 2026

This strike price is 4.58% below today’s price of $419.21. However, just to be conservative, shorting the $395 strike price (i.e., 5.8% lower than today’s price) still has an attractive yield of 2.29% (i.e., $9.05/$395.00) over the next month.

So, on average, if an investor can afford to short both of these puts, they can obtain an average yield of about 2.5% (i.e., 2.46%) over the next month.

Moreover, the delta ratios are low, implying less than a 30% chance that TSLA could fall to these strike prices. But even if that happens, the investor would still have low breakeven points:

$400.00 – $10.52 = $389.48 B/E (-6.9% lower than today)

$395.00- $9.05 = $385.95 B/E (-7.76%)

That implies that doing both of these short put plays will give an investor an average potential buy-in point of $387.72, or 7.34% below today’s price.

Combined with the 2.5% one month yield, this makes shorting these puts very attractive to value investors in TSLA stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.