Tesla (NasdaqGS:TSLA) has announced the discontinuation of its Model S and Model X vehicles in the past week. The Fremont factory is being transitioned from premium EV production to Optimus humanoid robot manufacturing. The company is concentrating on robotaxis, including Cybercab, as well as robotics and AI chip development. Discussions are underway about a potential merger involving Tesla, SpaceX, and xAI.

Tesla, traded as NasdaqGS:TSLA, is moving its center of gravity away from premium electric cars toward robotics, AI, and autonomous mobility services. For investors, this reflects a shift in how the company might generate revenue over time, from selling vehicles to potentially focusing more on software, services, and platforms linked to robotaxis and humanoid robots.

This change raises fresh questions about capital needs, execution risk, and how to compare Tesla with both carmakers and large tech companies. As the company reallocates resources into Optimus, Cybercab, and custom AI hardware, investors may want to reassess what drives the story for TSLA beyond the traditional EV narrative.

Stay updated on the most important news stories for Tesla by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Tesla.

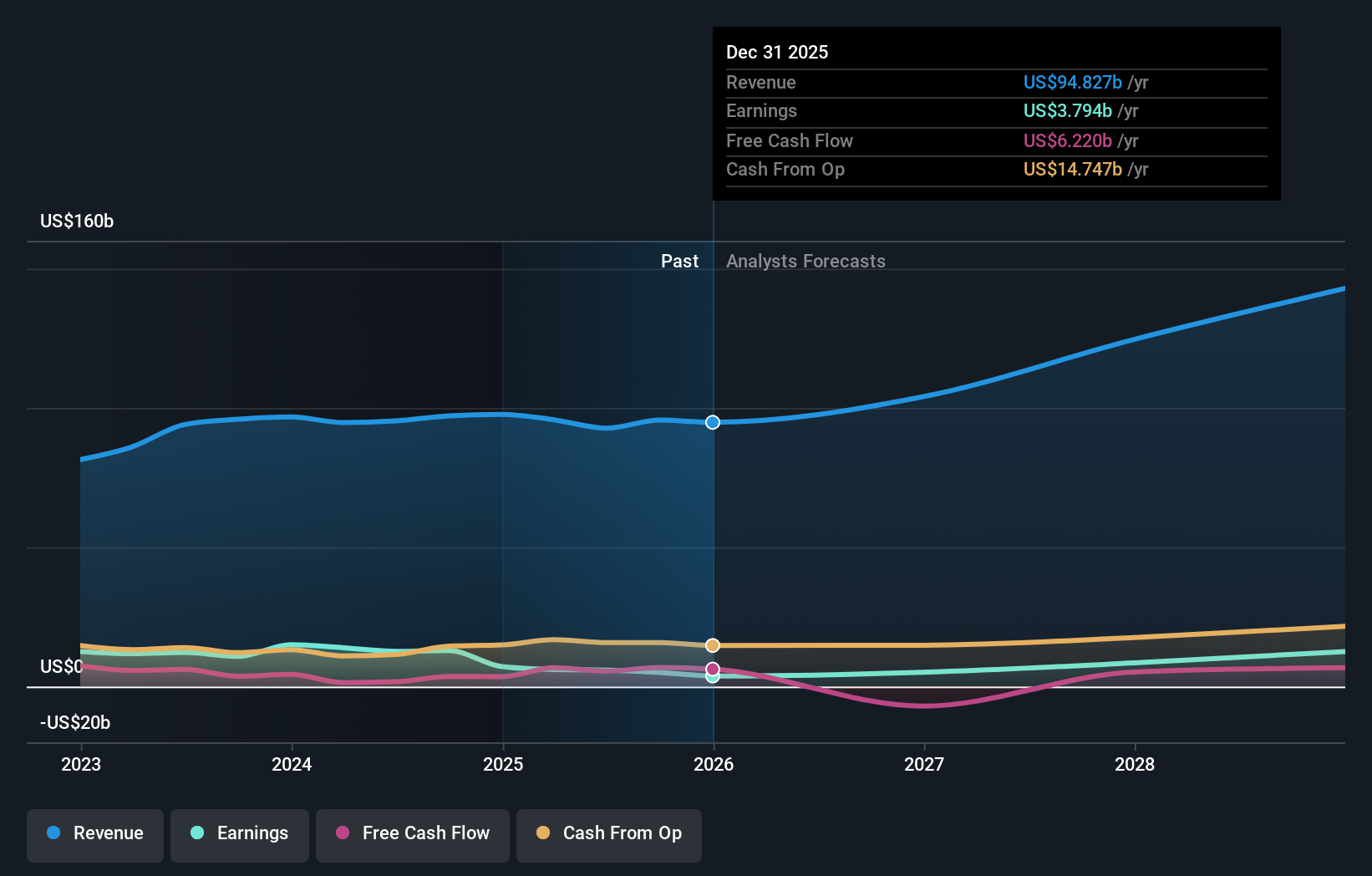

NasdaqGS:TSLA Earnings & Revenue Growth as at Feb 2026

NasdaqGS:TSLA Earnings & Revenue Growth as at Feb 2026

How Tesla stacks up against its biggest competitors

Quick Assessment ⚖️ Price vs Analyst Target: Tesla trades at about $421.91 versus a consensus target of roughly $418.81, so the price is within 1% of analyst expectations. ❌ Simply Wall St Valuation: Simply Wall St has Tesla trading at about 226% above its estimated fair value, which flags it as overvalued. ❌ Recent Momentum: The 30 day return of about 3.7% decline suggests recent pressure on the share price as the new direction beds in.

Check out Simply Wall St’s

in depth valuation analysis for Tesla.

Key Considerations 📊 The shift toward Optimus, Cybercab and AI chips moves the story further from traditional auto metrics and closer to a platform and services narrative. 📊 Watch how capital spending, R&D intensity, dilution, and any revenue disclosure for robotics and autonomy evolve against Tesla’s current P/E of about 417x and industry P/E of roughly 23.9x. ⚠️ Recent shareholder dilution, lower profit margin at 4% compared with 7.3% last year, and significant insider selling already sit alongside execution risk on robots, robotaxis and any merger structure. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Tesla analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com