Last week ended with the fireworks of:

Precious metals melting down

Three Mag 7 earnings reports: MSFT fell, META flew, and TSLA pivoted

A new Fed Chair nomination

President Trump threatening and sending a message to Iran

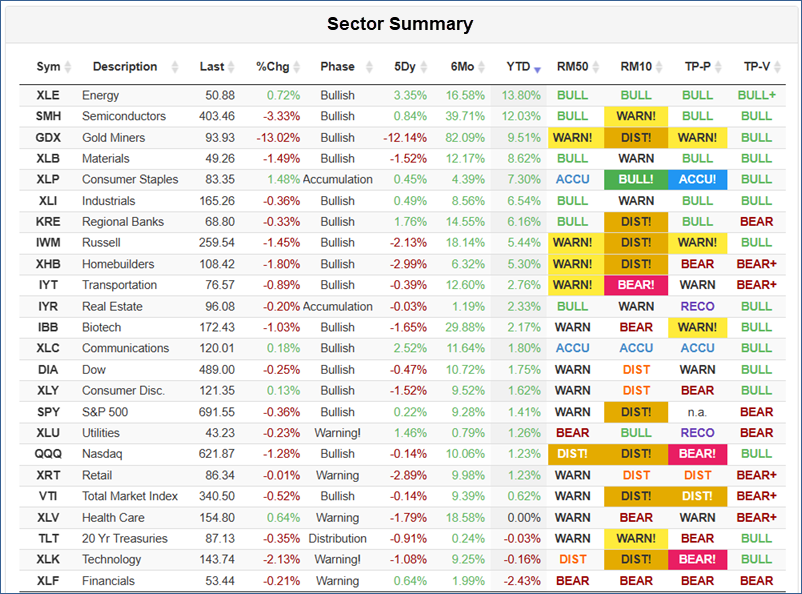

As you can see in the 5-day change column (5Dy) of the Big View Sector Summary table below, stock indexes and the long bonds took it all in stride. The and closed virtually unchanged.

The IWM, which started the week up over 7% for the year, gave back a modest 2%, and the long bond ETF () slipped less than 1%.

Why Is The Fed Nominee Such Bad News For Gold and Silver (and Fine For Stocks)?

The shiny metals melted down shortly after the news of President Trump’s nominee for Fed Governor, Kevin Warsh. Why?

How can he have such an impact on and without any impact on the stock indexes? This is just one of several contradictions the markets either presented or digested last week.

More importantly, will the meltdown in gold and silver of about 20% and over 30% respectively mark the top of a euphoric run or a second chance opportunity to buy a secular bull trend at a discount?

Another potentially confusing narrative was that both and beat earnings expectations last week, but one flew while the other flopped.

One reason this divergence can easily happen is that Wall Street’s speculative animal spirits are still alive and well. How else could announce that it is cutting back on the manufacturing of cars, from which it gets 70% of its revenue, and replacing it with the manufacturing of robots for which there is no demonstrable demand, and zero revenue?

In bull markets, high valuations are easily supported by animal spirits filled with optimism and FOMO, but, as gold and silver demonstrated, these animal spirits of support are also vulnerable to the other popular Wall St. saying: “easy come, easy go.”

Next week, roughly 20% of the companies will report earnings, and the market will get the monthly employment report.

Last week shed light on what to expect going forward.

What Was Really Behind The Precious Metal’s Meltdown?

Why Precious Metals Got Hit So Hard on the Kevin Warsh Nomination

There are some logical reasons for the precious metals to sell off with this nomination, but the size and speed of the violent correction were more of a function of market positioning.

Long-term structural trends are built on facts, but short and intermediate-term swings are often driven by market positioning and human emotions.

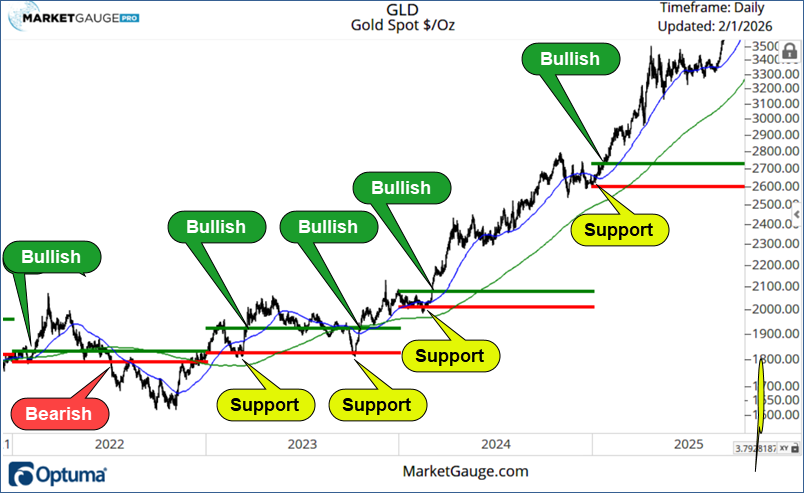

The extended bullish trend in both gold and silver had recently entered a parabolic condition. This condition, like its alter ego – the capitulation collapse, both tend to reverse in ways that are similar to their initial move.

The media was quick to point out that silver dropped $40 in two days, but was less interested in the fact that it was at the same level it had traded just two weeks ago. Friday’s close in gold is the same level it traded at just 6 days ago.

The volatile price action on Thursday suggested that the market was susceptible to a fearful liquidation driven by profit-taking and risk-reducing traders even without a bearish catalyst.

Kevin Warsh, however, is a bearish catalyst.

He has been openly critical of quantitative easing and repeatedly described the Fed’s balance sheet as bloated and distortionary.

He also has a history of pushing for lower inflation

He would also favor faster quantitative tightening even with a simultaneous lowering of short-term rates.

As a result, his nomination provided the catalyst that accelerated an overdue period of profit-taking, leading to a crowded trade lacking the liquidity needed for an orderly correction.

How To Trade The Metals Now

These markets are global, and the long-term structural demand for them will not be changed by this nomination.

However, the violent nature of the move is the type of pattern that can indicate or create a real reduction in speculative demand for some time. This can be measured using Market Phases determined by the 50 and 200-day moving averages and the January calendar ranges, which we speak about extensively here.

The short answer is that a market in a bullish phase and positioned above the January calendar range can be traded with a bullish bias in a risk-managed way.

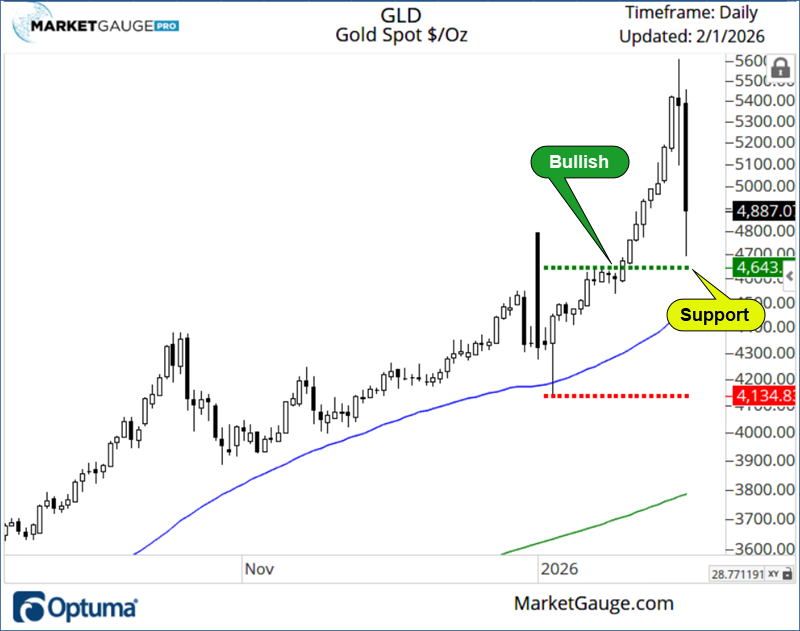

It is not surprising that Gold’s collapse bounced from the top of its calendar range. See the chart below.

As you can see in the chart below, the 50 (blue) and 200 (green) DMAs and Market Phases, and the January Calendar Range high (green) and low (red) have provided very reliable levels for anticipating the right market bias for gold.

One simple approach would be “neutral” under the Calendar Range high and bearish under the low. Until then, the long-term trends remain bullish, the short-term volatility needs more short-term tactics.

MSFT Falls, META Flies, and TSLA Pivots

Last week, in our trading room mentoring sessions, I said I was waiting for the market to tell us its bias through its response to the MSFT and META earnings.

It was very clearly a split decision, and the market’s response was equally mixed.

Microsoft delivered strong fundamentals but triggered an AI reality check: more spending, slower near-term payoff, tighter margins.

Meta delivered strong fundamentals and a clean monetization narrative: AI spend is big, but the ad machine funds it—and AI is already paying rent.

Tesla reinforced the third message: the market is increasingly valuing “AI” as a long-dated option—and TSLA is leaning into that by pivoting away from being primarily an auto story and toward robotaxis + humanoid robots.

Why MSFT Fell: “Great quarter” wasn’t the point—the AI narrative was

Microsoft’s drop wasn’t about collapsing demand. It was about expectations and the “AI hyper-growth, low-risk” story hitting a speed bump.

What spooked investors:

Capex shock / margin optics. Microsoft’s AI infrastructure spending jumped sharply and was framed as necessary to build capacity—exactly the kind of “cash now, payoff later” cycle that compresses multiples when a stock is priced for perfection.

Cloud growth not accelerating fast enough. Even small decelerations matter when the market is paying a premium for “unstoppable” growth.

Concentration / platform dependence concerns. Reporting around Microsoft’s cloud backlog being meaningfully tied to OpenAI amplified the question: Is this diversified platform economics—or concentrated, capital-heavy utility buildout?

Microsoft didn’t have bad numbers; it had a disappointing narrative.

Why META Flew: AI spend looked “expensive” but productive.

Meta delivered what the market wanted: proof that AI isn’t just a cost center.

The key difference vs. Microsoft wasn’t the existence of capex—it was the framing:

A strong ad engine + AI leverage. Meta’s results reinforced that AI improvements are directly lifting ad performance, and the core business can fund the buildout.

Guidance that pulled demand forward. Q1 revenue guidance came in stronger than expected, signaling momentum—not just a backward-looking beat.

“Yes, capex is huge—but the story is credible.” Meta’s 2026 capex outlook (up to $135B) would normally scare markets, but investors treated it as controlled—a deliberate, ROI-driven land grab, not an open-ended burn.

So META ran higher because it gave the market a clean message: AI can expand the profit pool, even during peak spend. This will likely continue if market sentiment continues to be optimistic.

TSLA’s Pivot Shows Off The Bulls’ Persistence

Tesla’s earnings reinforced a strategic shift that investors have been debating for years, but now Tesla is making it explicit: robotaxis + Optimus + AI infrastructure are the centerpiece.

From the reporting last week:

Tesla is winding down Model S/X and reallocating capacity toward robotics, including Optimus production ambitions.

Capex expectations rise materially, with commentary pointing to $20B+ as Tesla tries to fund factories, autonomy, AI compute, and robotics.

Robotaxi progress is positioned as moving from concept to rollout (starting with Austin and expanding), which matters because it shifts the debate from “promise” to execution and regulation.

The market implication: TSLA is increasingly priced like an AI/robotics option. That widens the outcome distribution:

If robotaxis + Optimus work, the upside is enormous.

If timelines slip (again), the market focuses back on autos—where growth and margins are tougher. Some would even say terrible.

Few CEO’s can pivot like Elon, but this pivot clearly shows the bulls still believe in the enormous promises of AI.

As we move through earnings season, almost every company will be judged based on how tied its future is to the AI trends, and for those that are heavily influenced, investors should be evaluating what kind of investors are in control of the trend.

AI skeptics looking for improving productivity, immediate profits, and expanding margins, or…

AI evangelist looking for market share, vision, and revenue potential.

Summary: Markets remain risk-on but weakening, with bullish phases intact across indexes and supportive seasonality into mid-February, even as momentum fades, leadership narrows, and value continues to outperform lagging growth. Risk is rising, with deteriorating market internals, mixed breadth and volume, warning phases in tech and growth, a volatility uptick, and renewed pressure from macro cross-currents like the dollar, commodities, and crypto.

Risk On

With the exception of the Russell, which gave back some of its recent gains, the indexes were mixed to flat on the week. Market phases are still bullish across the board, however, momentum as measured by real motion is clearly waning on daily charts and on a positive note weekly charts are still intact. A weakening but still risk-on reading for the markets. (+)

The color charts (moving average of stocks above key moving averages) for IWM is still broadly positive across all time frames despite this week’s sell off. (+)

Retail lost its bull phase, though the rest of the modern family remains strong across the board. (+)

Seasonal patterns for equities remain strong through mid-February. (+)

Neutral

Volume patterns are a weak neutral and only the NASDAQ 100 is showing an equal number of accumulation vs distribution days over the last two weeks. (=)

Geopolitical stress and some severe weather conditions drove energy up on the week. (=)

Gold, gold miners, silver, all got hit extremely hard on Friday, a bit of a mixed signal on geopolitical stress. (=)

The color charts (moving average of stocks above key moving averages) is showing very mixed readings in the QQQs across all time frames. (=)

Risk gauges improved to neutral with the strength in high yield debt vs US treasuries. (=)

Volatility is showing some short-term strength, potentially breaking out of a base. (=)

Value stocks put in a new high while growth continues to lag and is now trading under its 50-Day Moving Average in a warning phase. (=)

Gold has a big down day Friday (over -10%), giving back the last half of January’s gains. (=)

The dollar put in new recent lows this week, though it popped a little on Friday. (=)

Rates continue to trade in a wide range. (=)

Risk Off

More sectors were down on the week. Energy and utilities led the sectors higher, while retail, tech, and healthcare were weak. The technology sector moved into a warning phase on Friday’s close. (-)

Market internals took a decisive negative turn in the McClellan Oscillator, Up/down volume ratio, and advance declines for both Nasdaq and S&P. (-)

New high new low ratio flipped negative. (-)

Bitcoin is currently trading below important support ….. its November lows. (-)

Actionable Trading Plan

Maintain a measured risk-on posture, but recognize that the market is transitioning into a more fragile phase as momentum wanes and market internals weaken. While longer-term market phases remain bullish and seasonal trends are supportive through mid-February, the deterioration in breadth, leadership, and growth momentum argues for more selective positioning and tighter risk control rather than broad exposure.

Equity positioning should favor relative strength and defensive leadership. Continue to overweight areas showing resilience such as value-oriented exposures, energy, and utilities, which are benefiting from macro uncertainty and shifting leadership. Avoid adding exposure to technology, growth, retail, and healthcare, particularly where warning phases and poor internals are already evident. Any rallies in these weaker groups should be treated as counter-trend or tactical unless internal indicators materially improve.

Risk management should be proactive, not reactive. Position sizes should be reduced from aggressive levels, stops should be tightened, and portfolios should be reviewed with the assumption that volatility may expand. If volatility continues to break out or market internals deteriorate further (breadth, advance-decline, up/down volume), exposure should be reduced promptly rather than waiting for index-level breakdowns.

Remain flexible across asset classes. Commodities and precious metals experienced sharp downside reversals and should be approached cautiously until price and momentum stabilize. Rising geopolitical uncertainty and weather-driven energy moves argue for tactical exposure rather than long-term conviction trades. Bitcoin’s failure to hold recent support reinforces the need to keep speculative assets underweight until risk appetite improves.

Cash remains a valid allocation. With mixed signals across equities, rates, currencies, and commodities, maintaining dry powder allows portfolios to respond quickly to either renewed risk-on confirmation or a broader risk-off transition. Re-engage more aggressively only if market internals stabilize and leadership broadens back toward growth and technology.

![Online shopping sales hit record 24.29 trillion won in December on Tesla sales surge Tesla Korea's Shinsa store in Gangnam District, southern Seoul [TESLA]](https://www.evshift.com/wp-content/uploads/2026/02/1770029087_0a1f17b2-339f-4ab7-b217-4c36362b5192-770x515.jpg)