Elon Musk and SpaceX are exploring a possible merger involving Tesla (NasdaqGS:TSLA) or xAI, with early talks focused on combining electric vehicles, robotics, aerospace, satellites, and advanced AI. The discussions signal a potential reshaping of how Musk’s companies are organized, with implications for ownership, governance, and long term business priorities. A combined structure could influence how capital, talent, and technology are allocated across Tesla, SpaceX, and xAI if any deal moves ahead.

Tesla, listed as NasdaqGS:TSLA, is known for electric vehicles, energy storage, and increasingly for robotics and software. SpaceX operates in launch services and satellite networks, while xAI focuses on advanced artificial intelligence research. For you as an investor, the idea of these businesses coming closer together raises questions about how different revenue streams and risk profiles could sit under a more unified setup.

These talks are still at an early stage, so there is a wide range of ways any merger or realignment could be structured. As news develops, you may want to pay attention to how Tesla’s board responds, what regulators signal, and whether any proposal changes Tesla’s role in Musk’s wider group of companies.

Stay updated on the most important news stories for Tesla by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Tesla.

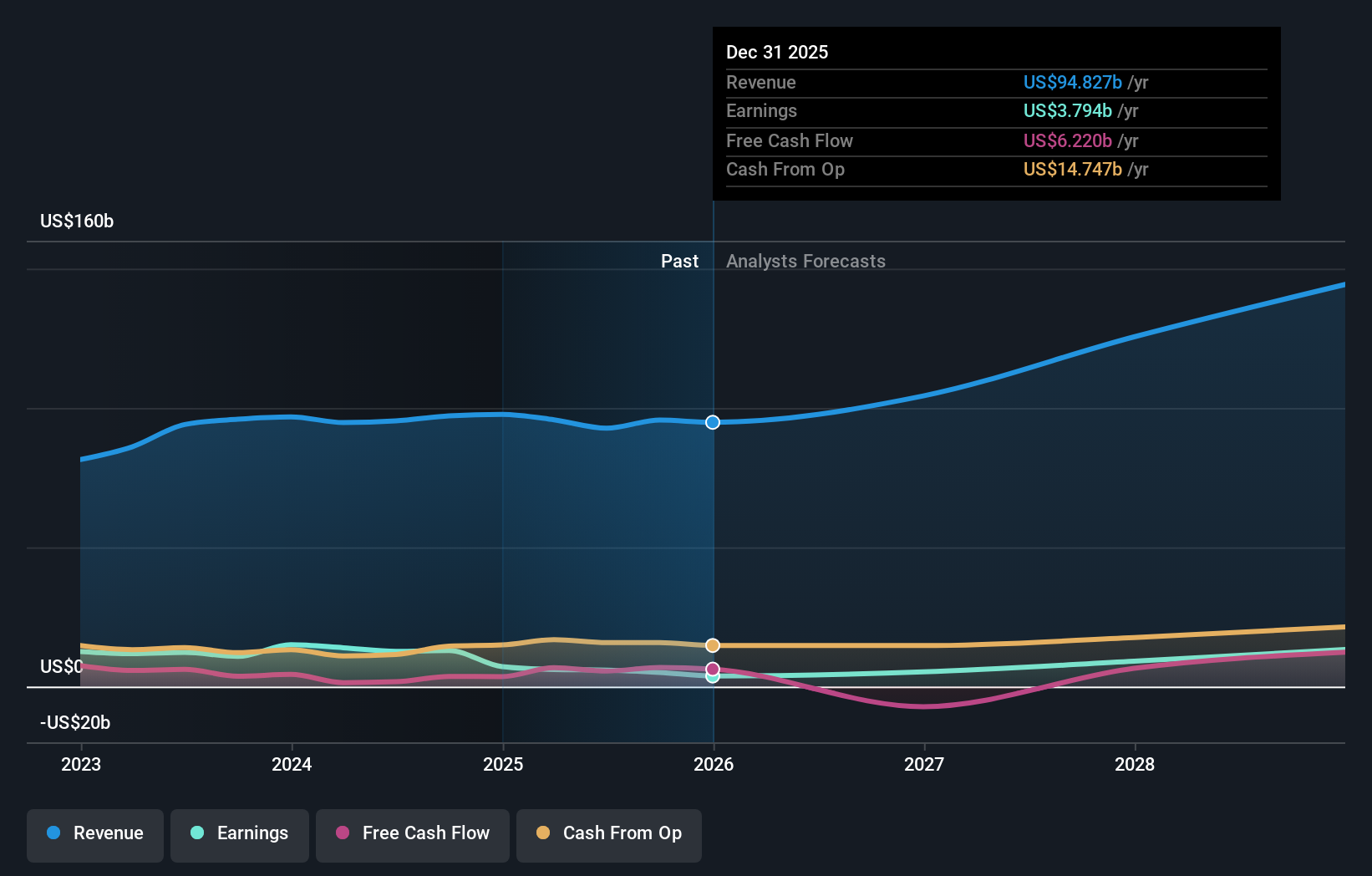

NasdaqGS:TSLA Earnings & Revenue Growth as at Feb 2026

NasdaqGS:TSLA Earnings & Revenue Growth as at Feb 2026

How Tesla stacks up against its biggest competitors

Quick Assessment ❌ Price vs Analyst Target: At US$430.41, Tesla trades about 3.5% above the US$415.87 analyst target, slightly above consensus expectations. ❌ Simply Wall St Valuation: Simply Wall St flags the shares as trading about 200.2% above its estimated fair value. ❌ Recent Momentum: The 30 day return of roughly 1.7% decline suggests recent softness in the share price.

Check out Simply Wall St’s

in depth valuation analysis for Tesla.

Key Considerations 📊 A potential merger that ties Tesla closer to SpaceX and xAI could change how you think about its mix of auto, robotics, satellite and AI exposure. 📊 Watch any details on deal structure, governance, and capital allocation, as well as how analysts update targets from the current US$415.87 level. ⚠️ With the stock flagged as overvalued and recent shareholder dilution already identified as a risk, any merger funded with new equity is important to scrutinize. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Tesla analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com