Support CleanTechnica’s work through a Substack subscription or on Stripe.

Or support our Kickstarter campaign!

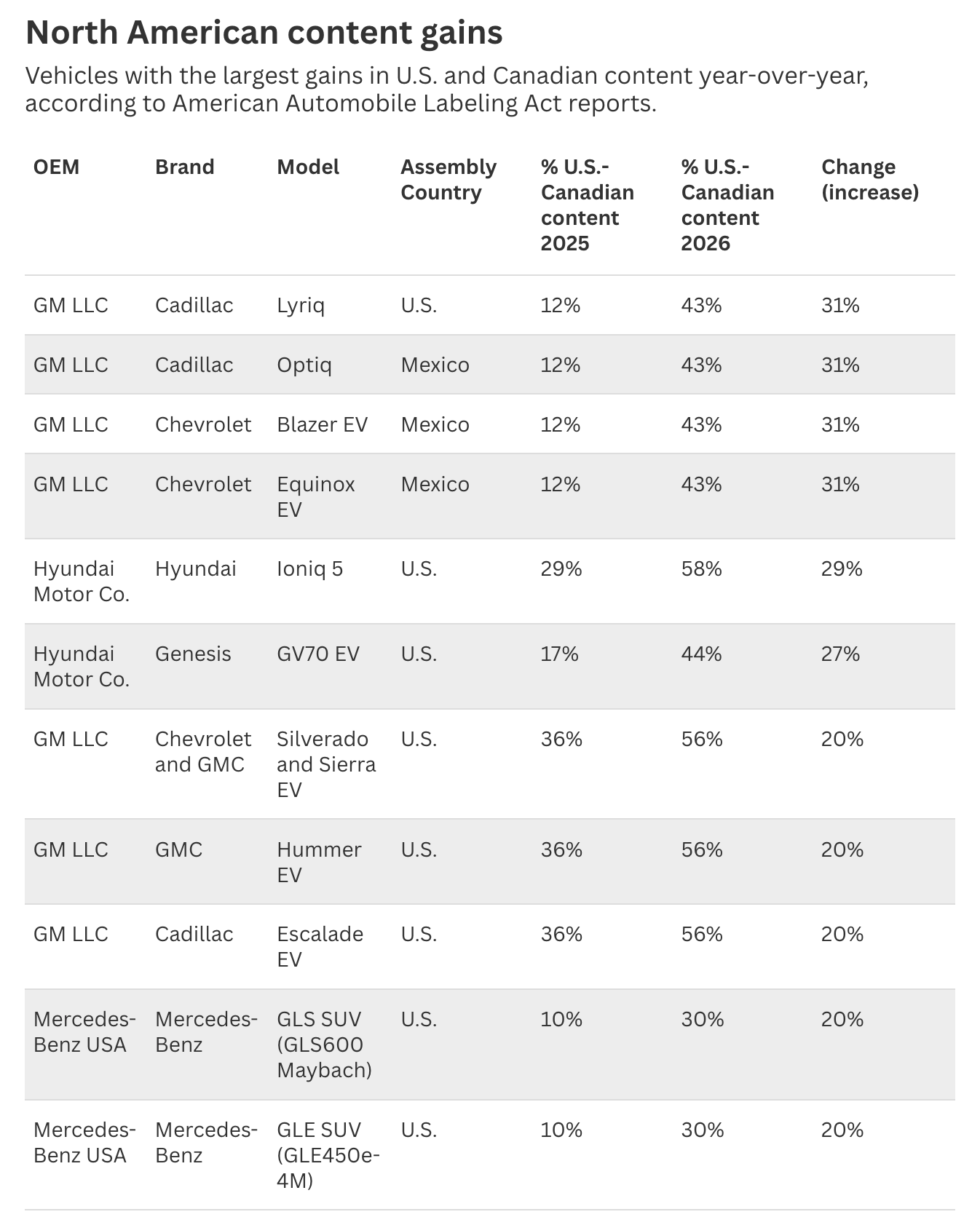

American Automobile Labeling Act reports show that the 2026 vehicle models with the biggest gains in domestic content — US and Canadian content, that is — are electric vehicle models.

Experts indicate that is most likely due to policies put in place during the Biden presidency. Subsidies were implemented as part of the Inflation Reduction Act of 2022 that strongly encouraged more domestic content use, and the Biden administration also put in place significant tariffs on Chinese made EVs and EV components.

GM EVs led the charge — no pun intended — in terms of this increase in US & Canadian content, the Detroit News reports. “The all-electric Cadillac Lyriq and Optiq as well as the Chevrolet Blazer EV and Equinox EV saw the largest increases in U.S. and Canadian content of 31 percentage points, according to a Detroit News analysis of American Automobile Labeling Act reports published by the National Highway Traffic Safety Administration. Other EVs like the Genesis GV70EV, Chevrolet Silverado/GMC Sierra EV, GMC Hummer EV and Cadillac Escalade EV also had significant increases.”

It’s largely about the batteries. And in addition to strong rules with regard to consumer-side subsidies, the Biden administration and Democrats in Congress enacted huge subsidies for US battery pack production, US battery cell production, and US battery mineral mining and refining.

Of course, Republicans killed the consumer subsidy for electric vehicles, so there’s no longer an incentive on that side of things to make sure your EV is using components from North America rather than the US. However, the various battery production subsidies are still in place.

Here’s a table from the the Detroit News on the vehicle models that saw the biggest gains in domestic content:

US policy on EVs, and tariffs, have been so up and down, so unpredictable, and so inconsistent that it’s really quite hard to guess how these things will change in the future. Overall, though, it seems automakers have had enough signals that there will be benefits and priorities to EVs and EV components produced at home that they will continue this trend toward using more domestic content. But we’ll see. If the US EV market isn’t big enough, scaling domestic content production isn’t very practical when Chinese demand and production are exponentially larger. But hopefully the US EV market is going to be large enough to support an EV supply chain and ecosystem more and more in the years to come, US government incentives or not.

Support CleanTechnica via Kickstarter

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Advertisement

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy