Tesla reported 2025 revenue of $94.8 billion, down 3 percent year-on-year and marking the first annual revenue decline since the electric car maker began publishing financial results in 2010.

Quarterly revenue slipped to $24.9 billion, also down 3 percent year-on-year, even as the company narrowly beat analysts’ expectations.

Automotive revenue fell 11 percent to $17.7 billion in the quarter after Tesla delivered 418,227 cars in the final three months of 2025 – a 15.6 percent drop on the same period a year earlier. For the year as a whole, deliveries were down 8.6 percent, the second straight annual decline in units and the steepest Tesla has ever reported.

The slide comes as the EV market gets more crowded and less forgiving, with cheaper rivals such as China’s BYD pushing harder on price and volume. It has also arrived at an awkward moment politically, with Musk’s ties to Donald Trump sparking backlash among some customers and investors and muddying Tesla’s once carefully managed image.

Net income plunged 61 percent in the quarter to $840 million as operating expenses jumped 39 percent. For the year, profits fell 46 percent to $3.8 billion, Tesla’s weakest annual performance since the depths of the pandemic.

Musk used the earnings call to roll out a freshly polished mission statement built around “amazing abundance,” arguing that advances in AI and robotics will reshape society – and, in his telling, deliver “universal high income” rather than basic income.

The billionaire’s answer is to sideline the cars that helped build Tesla in the first place. Production of the Model S and X is to wind down next quarter, with their Fremont factory space handed over to Optimus. Musk described the move as “slightly sad,” while sketching a future where the site produces up to a million humanoid robots a year instead.

Autonomy remains the central obsession. Musk claims Tesla is now running paid robotaxi rides in Austin with “no safety monitor” and, more recently, “no chase car or anything like that,” insisting that vehicles are operating with no humans involved at all. Tesla expects to have fully autonomous vehicles operating across as much as half of the US by the end of the year, pending regulatory approval.

Musk also dusted off a long-running promise: that Tesla owners will one day be able to loan their cars to an autonomous fleet and make money while they’re not driving them. In the rosiest version of the math, he suggested, that income could even exceed the cost of a lease.

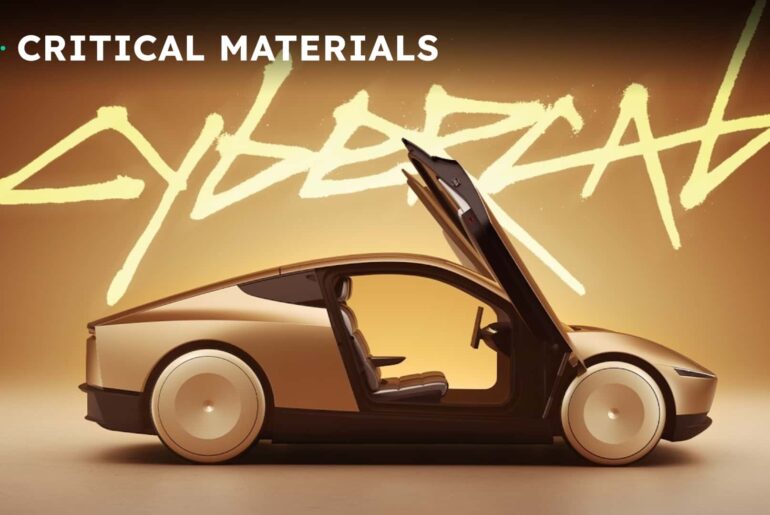

The purpose-built Cybercab is central to that plan. Designed without a steering wheel or pedals, it assumes autonomy will work all the time or not at all. Production is expected to begin in April, with Musk predicting that, over time, Tesla will make “far more Cybercabs than all of our other vehicles combined.”

All this will require cash that Tesla is no longer generating at the same rate. While capital spending fell 14 percent in the fourth quarter, the company warned that 2026 capex will exceed $20 billion as it funds new factories, expands battery production, builds AI compute infrastructure, and ramps up manufacturing for Cybercab, Semi, Megapack, and Optimus. Musk even floated the idea of Tesla building its own semiconductor “Terafab,” arguing it would be “crazy not to try” given looming chip shortages and geopolitical risk.

For Tesla, the warning lights are on. Revenue is shrinking, profits are under pressure, and the car business is losing momentum. Musk’s answer is to proclaim that “the future is autonomous,” and the market appears to have bought the story. ®