Mexico Electric Two-Wheeler Market: A Market on the Move

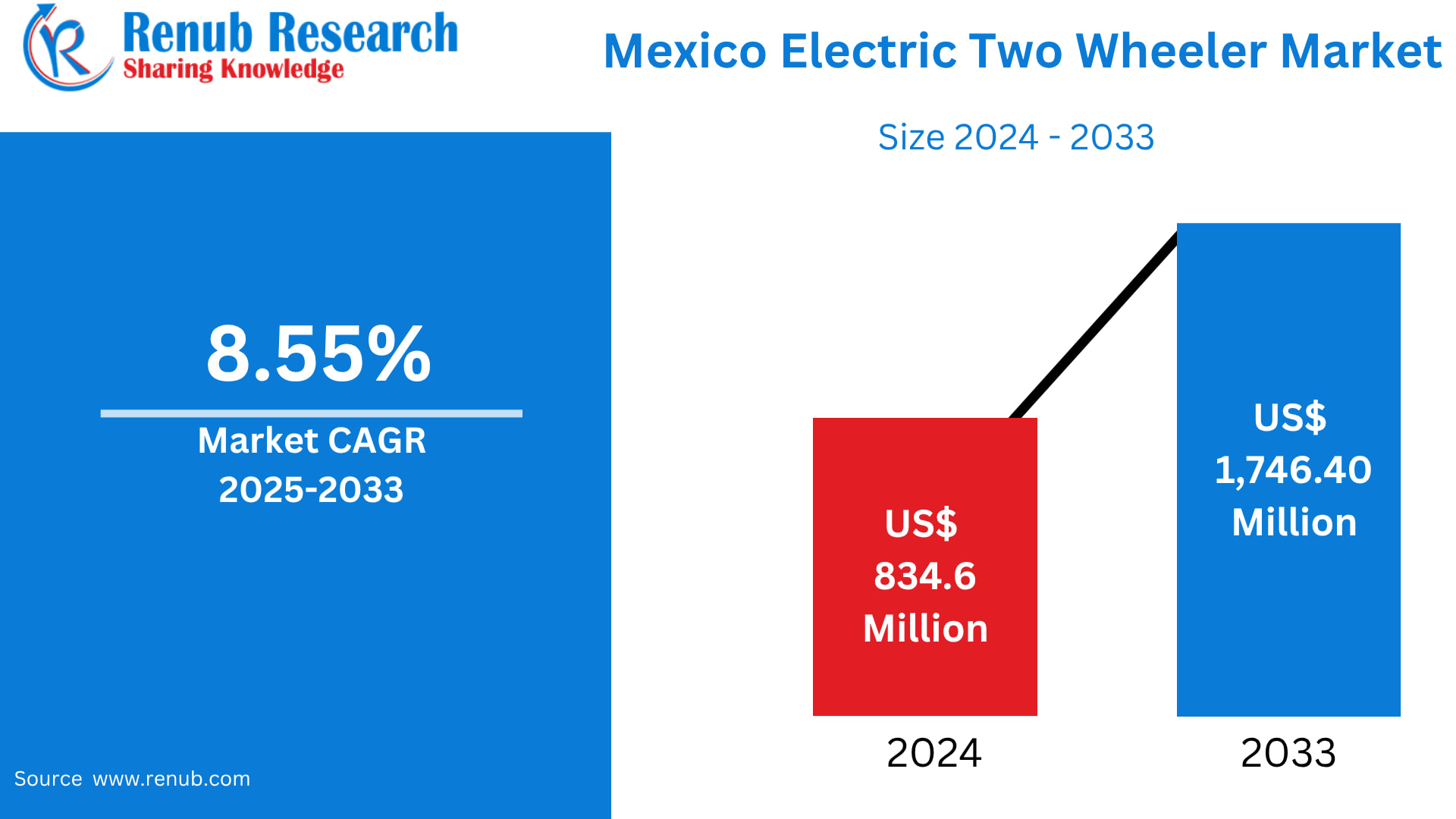

Mexico’s transportation landscape is undergoing a powerful transformation as electric mobility reshapes how people commute, deliver goods, and reduce environmental impact. According to Renub Research, the Mexico Electric Two-Wheeler Market is projected to reach US$ 1,746.40 million by 2033, up from US$ 834.6 million in 2024, growing at a CAGR of 8.55% between 2025 and 2033. This growth is being fueled by rising fuel prices, expanding urban populations, supportive government policies, and increasing awareness of sustainable transport alternatives.

Market Overview: What Is an Electric Two-Wheeler?

An electric two-wheeler is a battery-powered vehicle designed for personal or commercial use, including electric scooters, mopeds, and motorcycles. These vehicles operate on rechargeable lithium-ion or lead-acid batteries and are known for their quiet performance, low maintenance, and eco-friendly operation.

Compared to conventional gasoline-powered motorcycles, electric two-wheelers deliver significant cost savings over time, eliminating fuel expenses and reducing servicing needs. Many models also feature advanced technologies such as digital dashboards, GPS connectivity, mobile app integration, and regenerative braking. In Mexico, these benefits are gaining strong traction among students, office commuters, delivery workers, and environmentally conscious consumers.

The increasing popularity of electric two-wheelers reflects broader shifts toward cleaner energy, cost efficiency, and smarter urban mobility. As infrastructure improves and technology advances, these vehicles are expected to become a mainstream mode of transport across Mexican cities.

Key Growth Drivers in the Mexico Electric Two-Wheeler Market

1. Rising Fuel Prices and Urban Congestion

Escalating fuel prices in Mexico are making electric two-wheelers an economically attractive alternative for daily commuters. Major urban centers such as Mexico City, Guadalajara, and Monterrey face heavy traffic congestion, encouraging the adoption of compact, agile vehicles that can navigate crowded streets efficiently.

Electric two-wheelers offer lower operating and maintenance costs compared to internal combustion engine (ICE) vehicles. This makes them particularly appealing to office workers, students, and last-mile delivery riders who rely on frequent, short-distance travel. As urbanization continues and traffic density rises, electric two-wheelers are becoming a practical solution for cost-effective mobility.

2. Government Policies and Environmental Incentives

The Mexican government has committed to reducing greenhouse gas emissions in line with international climate goals, including the Paris Agreement. As part of this initiative, authorities are promoting electric mobility through a range of supportive measures, such as tax incentives, reduced import duties, and investments in EV infrastructure.

Several cities have introduced low-emission zones and regulations that encourage the use of electric vehicles. Municipal governments are also working to expand charging networks and support pilot projects for clean transportation. These policies are creating a favorable environment for manufacturers, investors, and consumers, accelerating the adoption of electric two-wheelers across both urban and semi-urban regions.

3. E-Commerce Growth and Delivery Services

The rapid expansion of Mexico’s e-commerce, food delivery, and ride-hailing sectors is a major catalyst for electric two-wheeler adoption. Companies such as DiDi, Uber Eats, and Rappi are increasingly integrating electric vehicles into their delivery fleets to reduce operating costs and meet sustainability targets.

In January 2024, DiDi announced its membership in the Electric Mobility Association (EMA) and launched a major initiative to deploy 100,000 electric vehicles in Mexico by 2030, backed by a MX$1 billion investment. This move positions DiDi as a leader in electric mobility across Latin America and demonstrates the growing commercial demand for electric two-wheelers.

For delivery companies, electric scooters and motorcycles offer a compelling combination of affordability, reliability, and environmental responsibility. As businesses prioritize ESG goals and cost efficiency, fleet electrification is expected to remain a powerful growth engine for the market.

Challenges Facing the Market

Limited Charging Infrastructure

Despite rising demand, the lack of widespread charging infrastructure remains one of the most significant barriers to market expansion. Public charging stations are concentrated in major cities, leaving rural and semi-urban regions underserved. This creates range anxiety among potential users and restricts broader adoption.

Additionally, many households lack private parking spaces with access to home charging facilities. Without accelerated investment in fast-charging stations and residential charging solutions, infrastructure gaps could limit long-term growth.

High Initial Purchase Costs

Although electric two-wheelers offer substantial long-term savings, their upfront costs remain higher than those of traditional gasoline-powered models. Advanced lithium-ion batteries and smart features increase initial prices, making affordability a challenge for price-sensitive consumers.

Limited financing options and a lack of awareness about total cost of ownership further hinder adoption, particularly among lower-income groups and in non-metropolitan regions. Addressing these barriers through subsidies, installment financing, and consumer education will be critical to unlocking mass-market growth.

Market Segmentation Insights

Electric Motorcycles: Gaining Momentum

Electric motorcycles are rapidly gaining popularity in Mexico due to their superior speed, range, and load capacity compared to scooters. Urban commuters and delivery personnel increasingly prefer electric motorcycles for their performance and durability. Manufacturers are introducing more affordable and stylish models, broadening consumer appeal. With ongoing improvements in battery efficiency and government incentives, electric motorcycles are expected to capture a growing share of the two-wheeler market.

Lithium-Ion Battery Dominance

Lithium-ion batteries lead the Mexican electric two-wheeler market due to their higher energy density, longer lifespan, and faster charging compared to lead-acid alternatives. While initially more expensive, declining global battery prices and improved local supply chains are making lithium-ion solutions more accessible. Innovations in battery management systems and battery-swapping technology are expected to further enhance convenience and adoption.

Hub Drive Motor Preference

Hub drive motors dominate the market because of their simplicity, reliability, and cost-effectiveness. Positioned directly within the wheel, hub motors reduce mechanical complexity and maintenance requirements. These features make them ideal for entry-level scooters and motorcycles used for daily commuting and delivery. Given Mexico’s largely flat urban geography, hub drive systems remain highly practical for both consumer and commercial applications.

Voltage-Based Segmentation

36V Electric Two-Wheelers: Designed for short-distance travel, 36V models are lightweight, affordable, and popular among students, seniors, and first-time EV users. Though limited in speed and range, they play a crucial role in introducing electric mobility to mass consumers.

72V Electric Two-Wheelers: Offering higher power, speed, and extended range, 72V models cater to commercial users and long-distance commuters. While more expensive, their superior performance and durability make them attractive for delivery services and professional riders. This segment is expected to grow significantly as fleet electrification expands.

Regional Outlook

Northern Mexico

States such as Nuevo León and Chihuahua are emerging as key adoption hubs due to industrial development, young demographics, and proximity to the U.S. market. Monterrey, in particular, is leading infrastructure development and green transport initiatives. Cross-border logistics and manufacturing activities are further boosting demand for electric two-wheelers in last-mile delivery.

Central Mexico

Central Mexico, including Mexico City and surrounding regions, represents the largest and most dynamic market. High population density, traffic congestion, and strict emissions regulations are accelerating the transition to electric mobility. Government-backed infrastructure projects, EV startups, and pilot programs are strengthening adoption, making the region a cornerstone of Mexico’s clean transportation strategy.

Southern Mexico

Southern Mexico remains an underpenetrated but promising market. While economic constraints and limited infrastructure have slowed uptake, government programs promoting sustainable rural mobility and eco-tourism are opening new opportunities. NGOs and social enterprises are also introducing low-cost electric vehicles for farming and local transport. As battery prices fall and off-grid charging solutions expand, southern states are expected to witness steady growth.

Recent Market Developments

May 2024: DiDi announced a MX$1 billion investment to introduce 100,000 electric vehicles by 2030, reinforcing its leadership in electric mobility across Latin America.

September 2024: Yadea unveiled its high-performance electric motorcycle Kemper at the SIMM Exhibition in Mexico City, featuring a top speed of 160 km/h and ultra-fast CATL battery charging.

2022: Strategic industry developments involving Specialized Bicycle Components and Denk Engineering highlighted growing innovation and investment in electric mobility technologies.

Competitive Landscape

Major players shaping the Mexico Electric Two-Wheeler Market include:

BMW AG

GOVECS AG

Hero Electric Vehicles Pvt. Ltd.

Mahindra GenZe

Terra Motors Corporation

Vmoto Limited

Zero Motorcycles Inc.

These companies are focusing on product innovation, affordability, and strategic partnerships to expand market share. Their activities are strengthening Mexico’s position as a growing hub for electric two-wheeler adoption in Latin America.

Final Thoughts: A Clean Mobility Future for Mexico

Mexico’s electric two-wheeler market is entering a decisive growth phase. Driven by rising fuel costs, urban congestion, government incentives, and the rapid expansion of delivery services, electric two-wheelers are becoming a vital component of the country’s transportation ecosystem.

While challenges such as charging infrastructure gaps and high upfront costs remain, ongoing policy support, technological innovation, and falling battery prices are steadily removing barriers to adoption. From busy metropolitan centers to emerging rural markets, electric two-wheelers are redefining how Mexicans move—efficiently, affordably, and sustainably.

As Renub Research forecasts the market’s value to surpass US$ 1.74 billion by 2033, the message is clear: electric two-wheelers are not just an alternative—they are the future of urban mobility in Mexico.