In the U.S., interest in internal combustion engine (ICE) vehicles, hybrid electric vehicles (HEVs), and plug-in hybrids (PHEVs) is relatively flat, while battery EV interest is up slightly year-over-year (YoY), according to a recent Deloitte survey.

“The automotive industry is navigating one of the most transformative periods in its history amid shifting consumer expectations, advancing vehicle technologies, and new ownership dynamics,” a Deloitte press release states. “U.S. consumers are balancing affordability with the realities of charging access and everyday use as they consider future vehicle choices. Persistent concerns around range, charging time, and cost continue to temper BEV/PHEV adoption, signaling a cautious move toward electrification.”

Deloitte’s “2026 Global Automotive Consumer Study” is based on survey findings from over 28,000 consumers in 27 countries. The survey was conducted from October through November 2025. An interactive dashboard of the findings provides additional details and country-specific information.

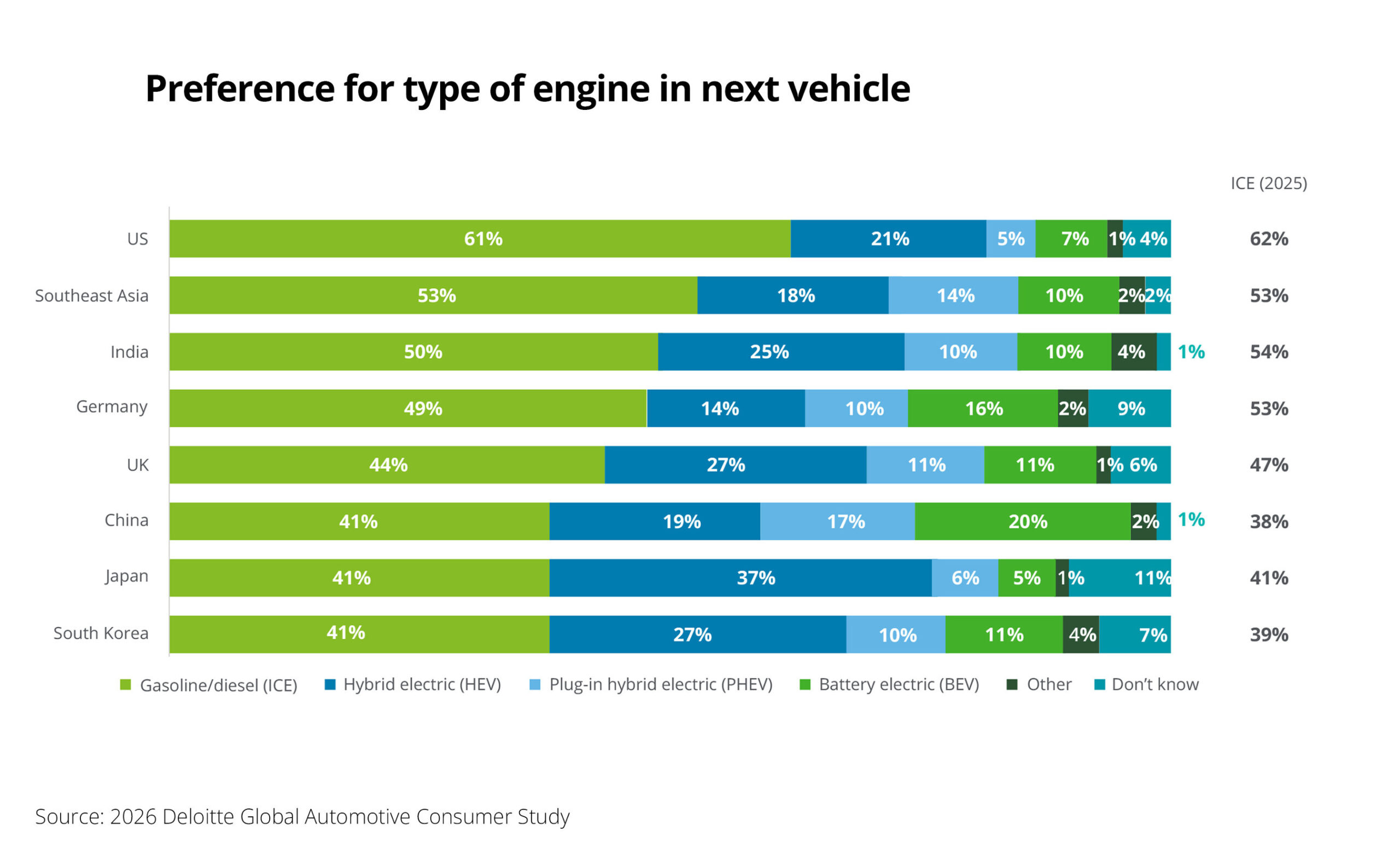

Among U.S. consumers surveyed, purchase intent for ICE vehicles (61%) and HEVs/PHEVs (26%) is flat YoY, while BEV purchase intent has seen a modest increase, rising 2 percentage points YoY to 7%.

Among global respondents, Deloitte found that BEV intention is highest among consumers in China (20%), along with hybrid intentions in Japan (43%), highlighting the difference in powertrain adoption across markets.

Lowering fuel costs remains the top reason (52%) that U.S. consumers surveyed say they would consider an EV for their next vehicle purchase, reinforcing a strong desire to mitigate longstanding concerns around total cost of ownership.

Driving range availability remains the top concern for survey respondents (47%), followed by charging time (44%) and overall cost (40%).

Seventy-seven percent of those considering buying an EV said they plan to charge their vehicles at home. Fifty-three percent said they don’t currently have access to a dedicated home charger, underscoring a potential source of concern regarding associated installation costs, Deloitte said.

Brand loyalty continues to wane, with 53% of U.S. respondents planning to choose a different brand for their next vehicle. Those who said they would choose a different brand said their motivation is primarily driven by product quality, performance, and price.

Most U.S. consumers surveyed said they prefer domestic brands over foreign brands, and 46% have no brand origin preference, as long as the vehicle meets their needs.

Product quality (58%), vehicle performance (51%), and price (46%) remain the top factors influencing U.S. respondents’ brand choice.

The most important parts of potential U.S. buyers’ purchase experiences center on getting a good deal (62%), transparent pricing (47%), and experiencing the vehicle in person (40%), reinforcing the role of dealership interactions in consumer purchasing experience, Deloitte said.

Vehicle service interactions also play an increasingly important role in shaping customer trust, with 57% of owners indicating they had their most recent service at a dealership, citing quality of work as the key driver. However, independent repair facilities represent 31% of service visits.

Quality of work remains the top driver of service provider choice for U.S. consumers at 20%.

Transparency around pricing and the work performed is the most important aspect of a vehicle service experience, according to 24% of respondents.

“The U.S. automotive sector is entering a critical phase defined by tightening affordability, evolving expectations around value, and a growing emphasis on longer-term ownership experiences,” said Lisa Walker, Deloitte’s vice chair and U.S. automotive sector leader, in the release. “As new vehicle demand levels off, deeper collaboration between OEMs and dealers, particularly around servicing and the post-purchase journey, will be important to strengthening loyalty and sustaining engagement in a market where traditional growth levers are becoming harder to pull.”

Software-defined vehicles (SDVs) generate mixed signals

As vehicles become more digitally enabled, U.S. consumers remain selective in the connected and software-defined features they value, according to Deloitte’s findings.

Safety-oriented applications generate the strongest interest, while enthusiasm for over-the-air (OTA) upgrades that extend vehicle lifecycles is tempered by consumer willingness to pay a premium for features that some expect to come standard.

Fifty-two percent said they would keep their vehicle longer with regular OTA updates. Of those, 26% said they would keep their vehicle for an additional two to three years. Deloitte says such updates open the door for OEMs to strengthen brand loyalty through frequent digital engagement while reducing their reliance on hardware redesigns.

Security-oriented connected features, such as anti-theft tracking, resonate most with those that were surveyed, while concerns about data sharing, particularly personally identifiable information, remain high.

“As the global industry advances toward software-defined vehicle platforms, continuous upgradability is becoming a powerful way to extend vehicle life and strengthen consumer loyalty,” said Jody Stidham, Deloitte’s global automotive managing director, in the release. “At the same time, it introduces a strategic dilemma: OTA updates enhance safety and performance and reduce warranty costs, yet they can also keep vehicles feeling newer for longer, potentially slowing future replacement cycles.

“In an environment marked by affordability pressures and limited willingness to pay for digital add-ons, automakers should consider how they deliver software-enabled value across the ownership lifecycle to support long-term growth.”

Among U.S. consumers surveyed, 62% are willing to pay above list price for OTA functionality. Twenty-eight percent said they’re only willing to pay up to 5% above the vehicle’s list price for automated updates that reduce shop visits, suggesting OTAs may be viewed as a baseline expectation rather than a premium feature, Deloitte said.

Thirty-eight percent said they aren’t willing to pay anything extra for enhanced OTA functionality.

U.S. consumers surveyed show the highest willingness to pay for safety and security-related connected features, including anti-theft tracking (61%), pedestrian/vehicle detection (59%), and emergency assistance (58%).

Data privacy within connected-vehicle systems remains a major concern for U.S. respondents, particularly regarding information from synced devices (62%), in-cabin camera data such as driver monitoring (58%), and vehicle location data (58%), underscoring rising sensitivities around PII.

Voice command support in local languages is considered a crucial functionality among respondents in China (80%), India (80%), and Japan (70%), compared to 43% of U.S. consumers.

Next-gen SDV and ADAS

Hyundai Mobis and Qualcomm Technologies announced Wednesday a comprehensive agreement to co-develop next-generation solutions for SDVs and advanced driver assistance systems (ADAS).

The memorandum of understanding (MOU) signing was held at the Consumer Electronics Show (CES).

Hyundai Mobis and Qualcomm plan to jointly develop integrated solutions tailored for emerging markets while pursuing broader global supply opportunities by leveraging the combination of Hyundai Mobis’s expertise in system integration, sensor fusion, and perception with Qualcomm’s leadership in system-on-chip (SoC) technology, according to a press release.

Co-development will start with advanced driving and parking solutions based on the Snapdragon Ride Flex SoC, initially targeting fast-growing markets including India.

For future SDV applications, the companies plan to work together on integrated solutions that combine Hyundai Mobis’s standardized software platform with Qualcomm Snapdragon automotive technologies to enhance performance, efficiency, and stability.

Images

Featured image credit: dikushin/iStock

Share This:

Related