Ford Motor (F) is in the spotlight after announcing a US$19.5b special charge linked to its electric vehicle reset, as the automaker leans into hybrids and extended range models, and explores battery storage opportunities.

See our latest analysis for Ford Motor.

Ford’s reset on electric vehicles, analyst upgrades and a recent 52 week high have come alongside a 90 day share price return of 21.89% and a 1 year total shareholder return of 57.08%, suggesting momentum has strengthened over both shorter and longer horizons.

If Ford’s pivot has you rethinking the auto space, it could be a good moment to scan other auto manufacturers that match your view on electrification and hybrids.

After a 57.08% 1 year total return and a recent analyst upgrade, Ford now trades slightly above the average analyst price target and at an intrinsic premium. This raises the question: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 13.5% Overvalued

Ford Motor’s most followed narrative puts fair value at US$12.52 per share, compared with the last close of US$14.20, framing current pricing as rich.

The analysts have a consensus price target of $10.8 for Ford Motor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $8.0.

Curious what justifies paying up for a company with flat revenue assumptions yet materially higher margins and earnings five years out? The key is how profit mix, recurring software style revenue and a lower future earnings multiple all interact. If you want to see exactly how those pieces are stitched together, the full narrative lays out the numbers in detail.

Result: Fair Value of $12.52 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent EV division losses, along with pressure from tariffs and input costs, could still unsettle margins and challenge the case for paying a premium today.

Find out about the key risks to this Ford Motor narrative.

Another View: Earnings Multiple Sends a Different Signal

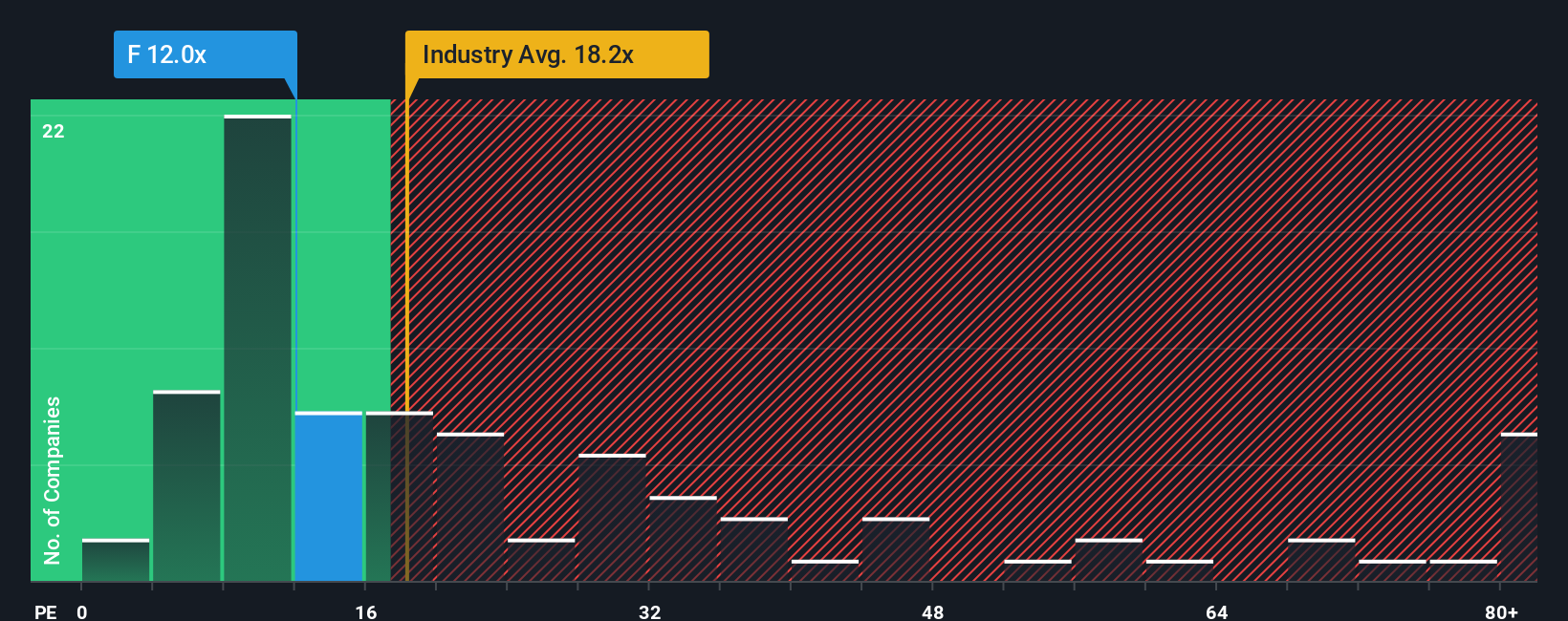

If you step away from fair value models and just look at earnings, Ford trades on a P/E of 12x versus 18.6x for the global auto group, 24.1x for peers and a fair ratio of 28.7x. That gap points to valuation risk running the other way. The question is which story you trust more.

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:F P/E Ratio as at Jan 2026 Build Your Own Ford Motor Narrative

NYSE:F P/E Ratio as at Jan 2026 Build Your Own Ford Motor Narrative

If you see Ford’s story differently or simply want to stress test these assumptions against your own view, it only takes a few minutes to build your version: Do it your way.

A great starting point for your Ford Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ford has sharpened your focus on where capital goes next, do not stop here. Broaden your watchlist with ideas that fit your own risk and return preferences.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com