Key Takeaways

Used hybrid and EV prices fell more than other vehicles did in December, signaling a broader reset rather than a routine year-end dip.

With clean-vehicle tax incentives ending in late 2025, demand cooled quickly, leaving dealers with less pricing power at year-end.

As incentive-driven demand has dried up and inventory is hitting lots, used hybrids and EVs could stay more competitively priced in 2026.

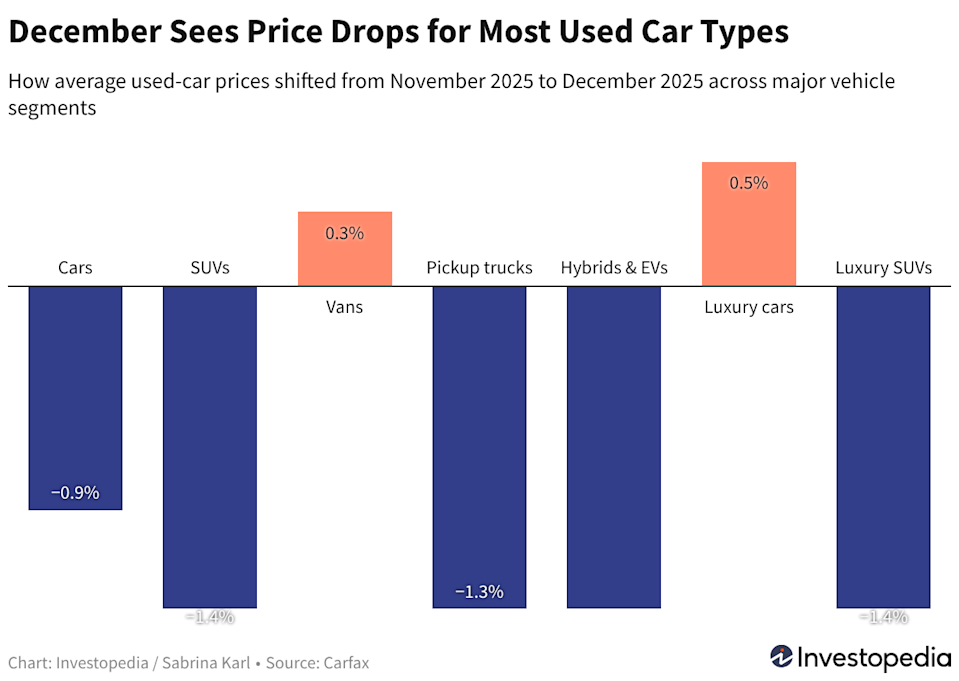

As we start out 2026, used car pricing is showing anticipated seasonal movement, with one important twist. According to the December 2025 release of the Used Car Price Trends report from Carfax, year-end shifts are once again giving buyers more negotiating leverage. This time, however, the most meaningful changes are happening in hybrids and electric vehicles (EVs).

Late-year moves from 2025 are offering early signals about where prices may go next. While some vehicle categories are holding relatively steady, hybrids and EVs are showing signs of a reset. It’s less driven by seasonality and more by changes in demand, incentives, and supply dynamics that could continue shaping prices in the months ahead.

Why This Matters

From a 2026 standpoint, the December 2025 data offers more than a snapshot—it provides early clues about where used hybrid and EV pricing may be headed next. With incentive-driven demand tapped out and supply arriving, the segment appears to be entering a more competitive—and potentially more negotiable—phase than it has seen in recent years, giving buyers more room to shop, compare, and push for better deals.

Why Used Car Prices Often Shift at Year-End

December has long been one of the most volatile months for used car pricing. Dealers operate on calendar-driven sales goals, and as the year winds down, inventory management becomes just as important as maximizing price. Vehicles that linger on car lots for too long, especially as new models have made their way to the showroom floor, often become harder to justify holding into January.

That dynamic doesn’t guarantee price drops though. Instead, year-end typically brings increased flexibility when it comes to negotiations, such as stronger trade-in offers, modest price adjustments, or more favorable financing options. As a result, some segments tend to see more of a price shift, depending on how supply and demand are lining up at that moment.

Hybrids and EVs Saw the Biggest Price Drop Among Used Vehicles

Among all used vehicle categories tracked in December, hybrids and electric vehicles experienced the most pronounced price declines.

For buyers who have been watching the hybrid and EV market, December marked a notable change. Rather than routine seasonal easing alone, the size and timing of the decline suggest a broader adjustment in market conditions.

What’s Behind the Late-2025 Shift in Used Hybrid and EV Prices

The most immediate driver for this shift appears to be policy-related. After September 30, 2025, tax incentives for new and used clean vehicles were no longer available. Buyers motivated by credits or rebates likely acted earlier in the year, reducing demand in the fourth quarter.

That shift in buyer urgency left dealers with less pricing power heading into December. With fewer motivated buyers at year-end, demand softened quickly. Rather than a gradual cooling, the market experienced something closer to a sudden demand reset, where interest dropped off more abruptly than in prior years.

Note

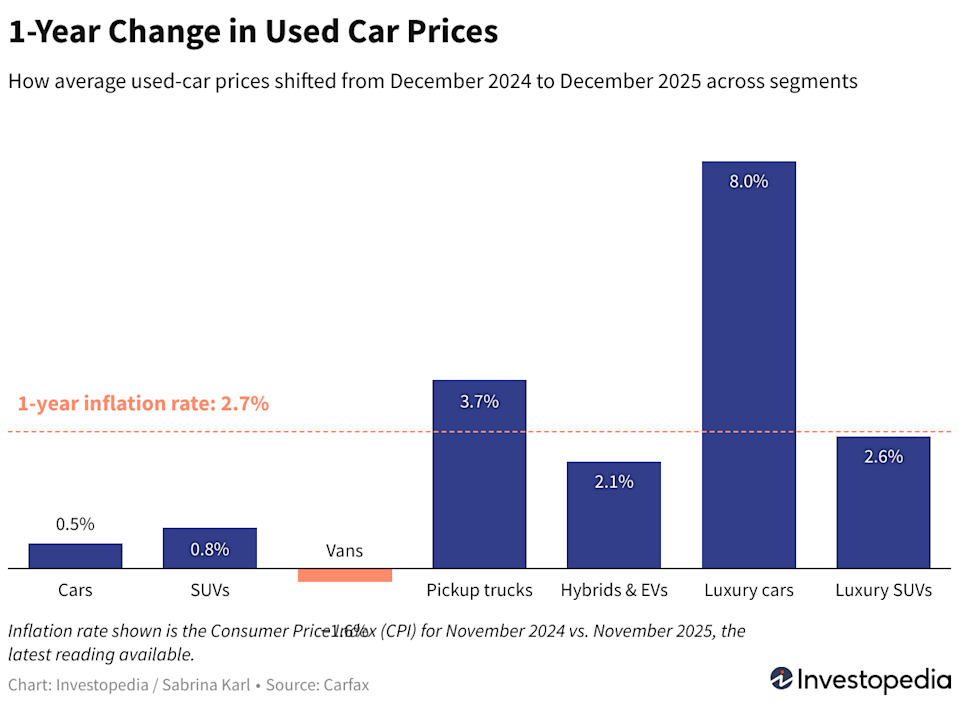

Despite December’s decline, used hybrid and EV prices were still up 2.1% year-over-year. However, that increase lagged overall inflation, which ran at about 2.7% in 2025. In real terms, used hybrid and EV prices actually lost ground relative to inflation over the course of the year.

This positioning matters as we are now in 2026. With incentives gone and supply continuing to arrive on lots, pricing pressure in the used hybrid and EV segment may persist. Whether that pressure results in stabilization or further declines as we head into spring and summer remains uncertain.

Read the original article on Investopedia