Support CleanTechnica’s work through a Substack subscription or on Stripe.

There were over 2 million plugin vehicles registered in November, with BEVs (+12% YoY) rising and PHEVs (-1% YoY) falling.

With the USA EV market still in hangover mode and China slowing down, it was up to the Rest of the World (+37% YoY) to pick up the pace, pulling plugins to a 7% growth rate in November.

There were over 2 million registrations, the second best result ever, only behind the 2.1 million score of last September. Will December reach 2.3 million units? One thing is certain, September’s record will surely be beaten in the last month of the year…. BEVs grew 12% YoY to 1.3 million units, while plugin hybrids were dragged down by the Chinese market and ended the month falling by 1%, to around 700,000 units.

In the end, BEVs represented 20% share of the overall auto market (and plugins represented 29% if we add PHEVs to the tally), pulling the YTD numbers to 17% BEV share (26% PHEV+BEV).

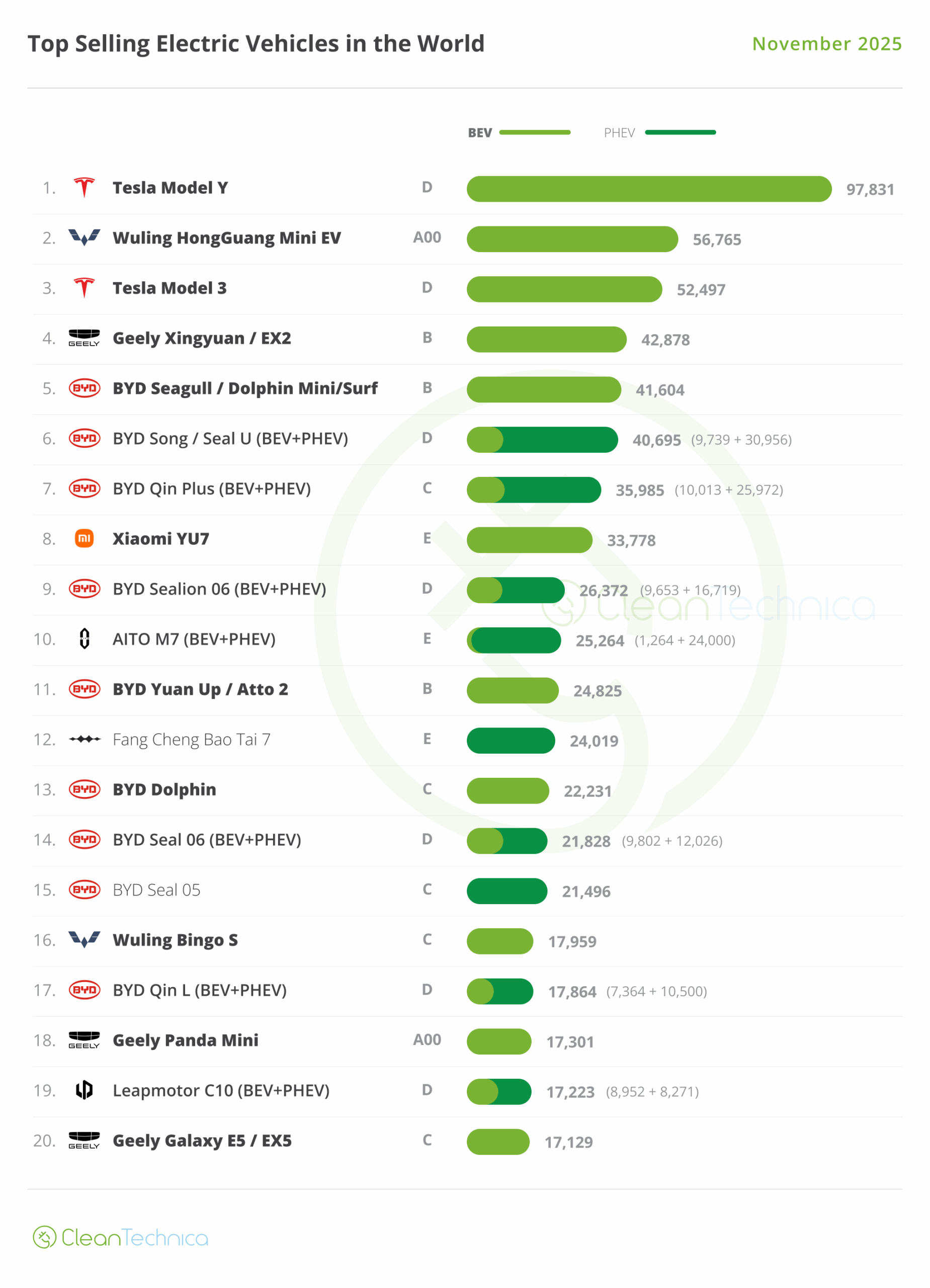

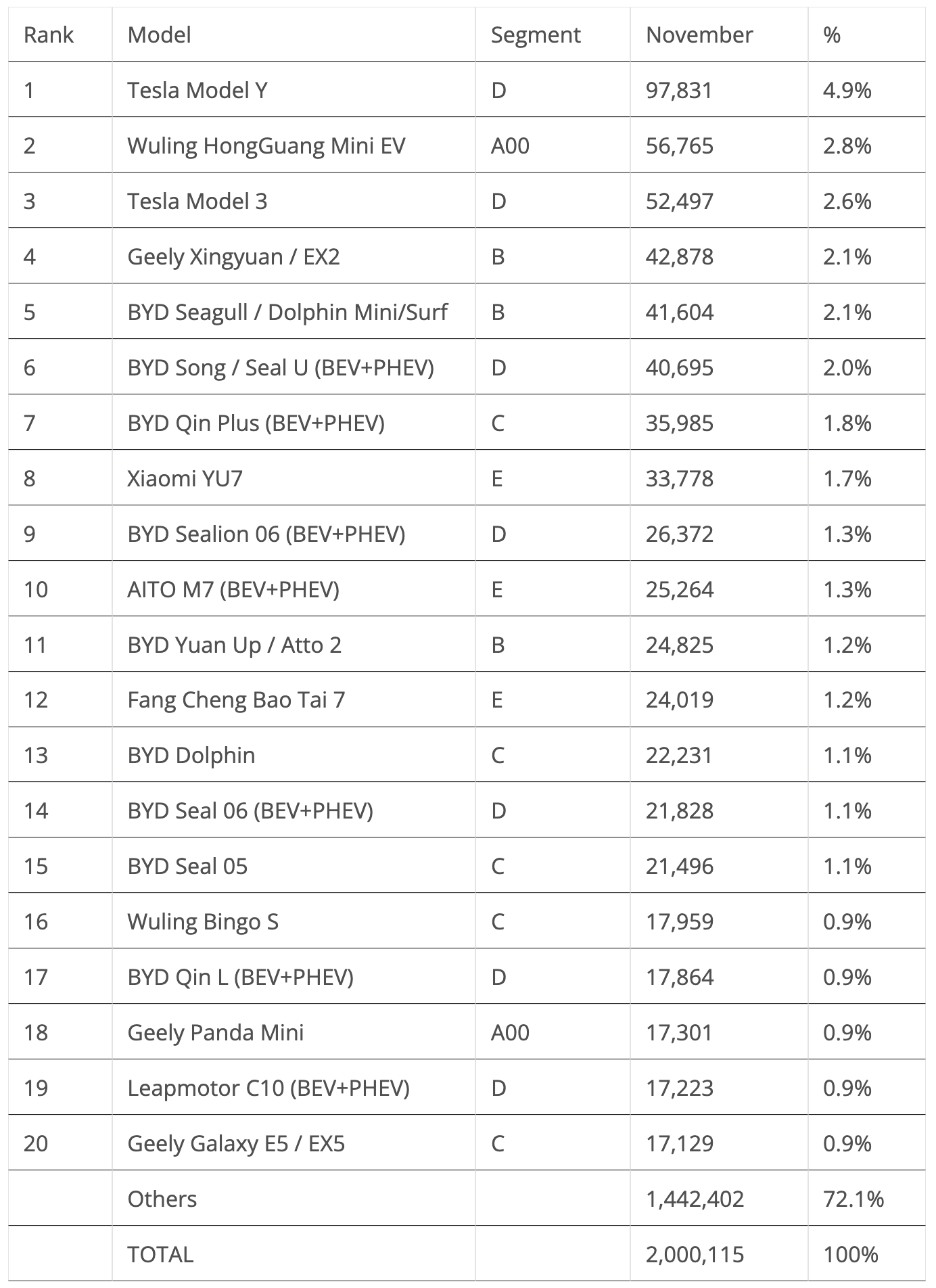

20 Best Selling EV Models in the World in November — Tesla Model Y recovers the #1 spot, Tesla Model 3 returns to the podium

Regarding November’s best sellers, the big news is that Tesla partly recovered from the hangover on the US market and saw its best sellers return to more normal positions, with the Model Y (97,831 units, down 8% YoY) recovering the best seller title, while the Model 3 (52,497 units, down 7% YoY) was up from 14th in October to 3rd. Still, expect both models to continue in the red for the next couple of quarters globally.

Looking at the rest of the competition, the highlight is the tiny Wuling Mini EV (56,765 units), which got in the way of both Teslas and won the silver medal.

Off the podium, we have the Geely Xingyuan in 4th, registering close to 43,000 units, while the usual BYD armada was less dominant than before, with only four representatives in the top 10. Besides the aforementioned Teslas, Wuling Mini EV, and Geely Xingyuan, the other outsider was the Xiaomi YU7, with the production ramp-up allowing it to be 8th with close to 34,000 registrations.

Still on the first half of the table, we have the new-generation AITO M7, with the Huawei-backed startup placing its latest land yacht in 10th, with 25,264 registrations, its best score in almost two years.

As for the second half of the table, we have a few new models breaking records and a return. Starting with the return, the Geely Galaxy E5 (EX5 in export markets) joined the table at #20 thanks to a year-best score of 17,129 registrations. That was much thanks to increasing export volumes, with the biggest surprises being Mexico (1,019 registrations) and Australia (412 registrations).

Adding the tiny #18 Geely Panda Mini and the value-for-money king #4 Geely Xingyuan, we have three Geely models in the top 20 for the first time ever. Sure, it is still far from reaching the 9 BYDs present on the table, but it makes Geely the second most represented OEM on the table.

Speaking of BYD, its new Seal 05 compact sedan jumped to #15 with a record 21,496 registrations, while the premium brand Fang Cheng Bao placed its new Tai 7 SUV in 12th with a record 24,019 registrations. And that’s in only its third month on the market. In 16th, SAIC’s Wuling got its new Bingo S, a BYD Dolphin fighter, into the top 20 with a record 17,959 registrations.

Off the table, the highlights were the continued ramp-up of the Geely Galaxy M9 land yacht, with the big SUV now reaching 10,639 registrations; and NIO’s ES8 large SUV scoring 10,714 registrations. The ES8’s production ramp-up apparently continues, and a big December month is expected from NIO’s full size SUV.

Still in China, SAIC’s MG 4 continues on a roll, with the compact hatchback scoring a record 16,829 registrations. Meanwhile, Great Wall’s WEY Gaoshan large MPV is now leading the category, thanks to a record 10,416 registrations.

Outside of China, a reference goes out to the Renault 5 & Alpine A290 twins, with the French EVs reaching a record 11,282 units, while in Vietnam, the new Vinfast Limo Green 7-seater has gotten off to a great start, with the ride-hailing friendly EV reaching close to 10,000 registrations (9,642, to be more precise) in only its 3rd month on the market. Is this the model that will give the Vietnamese automaker the success story it needs?

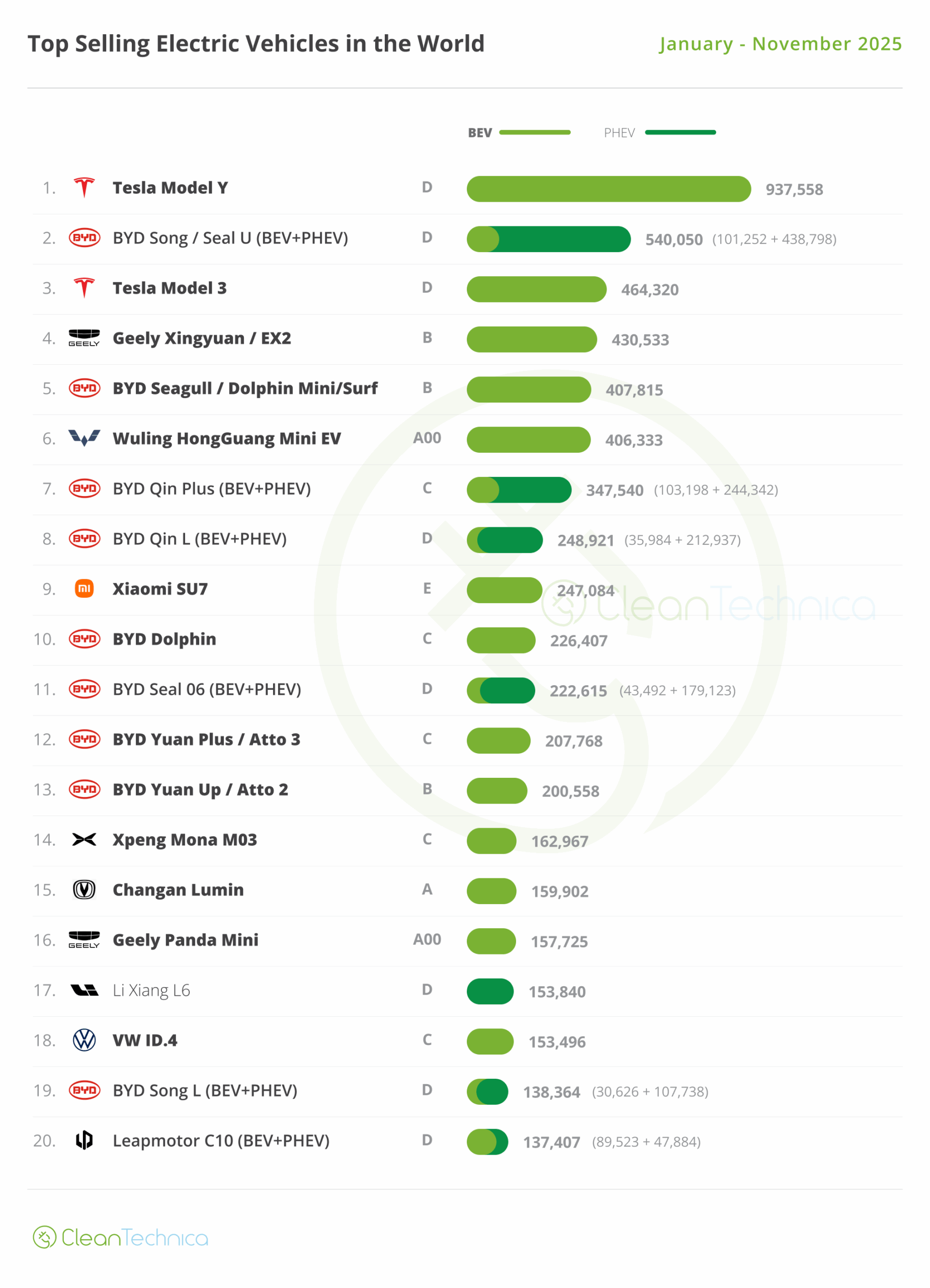

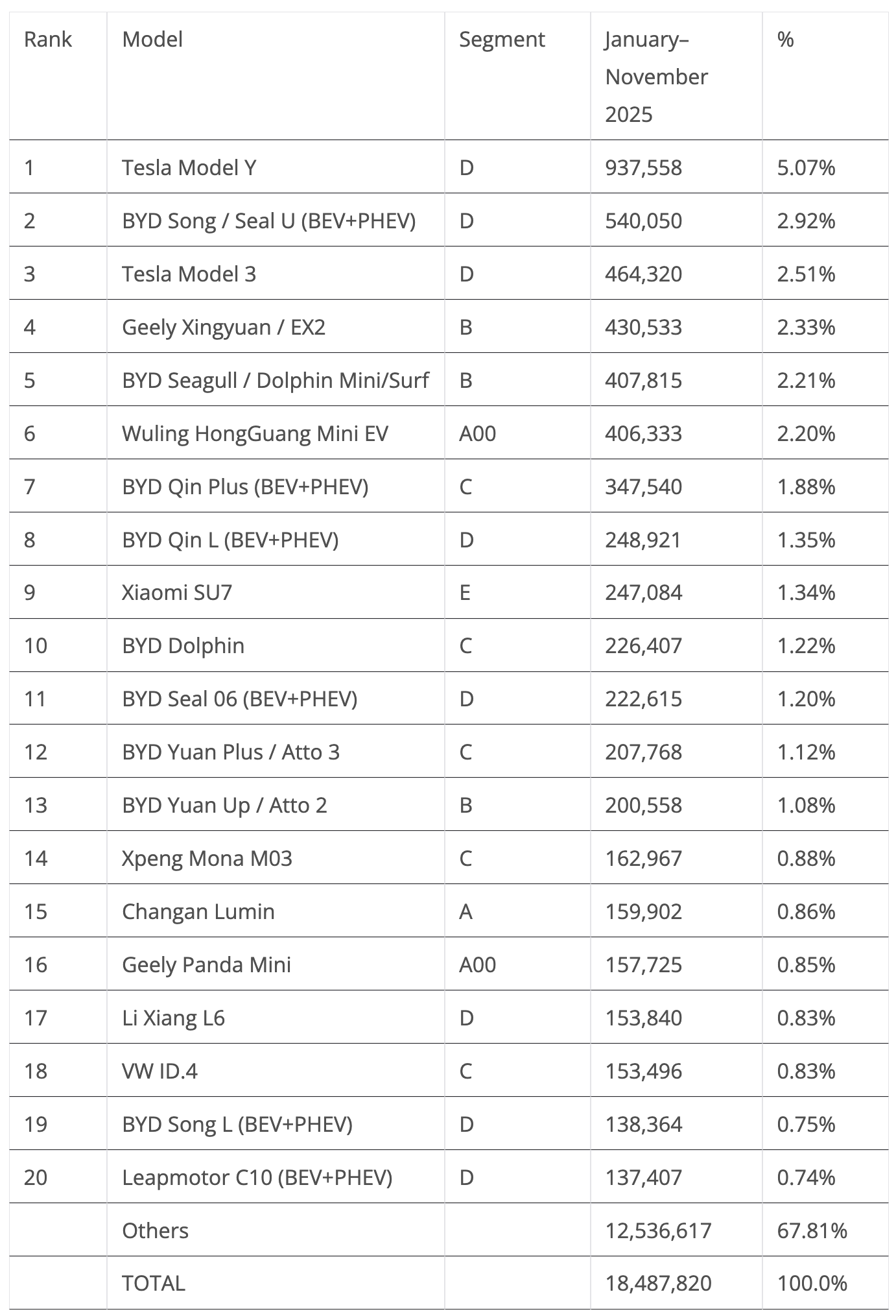

Top 20 EV Models YTD — Geely Xingyuan Climbs Closer to the Model 3’s Bronze Medal

On the year-to-date (YTD) table, with the podium positions already decided, and in the same positions as in the past three years (boooring!….), we’ve got the Tesla Model Y leading, followed by the BYD Song and the Tesla Model 3. It is time to look at the positions immediately below them.

The Geely Xingyuan seems safe in the 4th position, but the #5 BYD Seagull and #6 Wuling Mini EV are separated by just 500 units, so anything can happen between these two. (Although, looking at the sales trends of the past few months, I would say that the tiny Wuling will surpass the BYD hatchback and end the year in 5th.)

For 2026, though, big changes are expected to happen at the top. While the Model Y should continue leading for yet another year, despite dwindling sales, behind it, it is pretty much open for discussion. The incumbents, #2 BYD Song (down 43% YoY in November) is expected to jump into that big charging station in the sky, and the #3 Tesla Model 3 will continue to see falling sales.

On the other hand, the tiny Wuling Mini EV is expected to continue posting 50,000-plus monthly performances, while the Geely Xingyuan will start exporting in large volumes next year, adding critical volume to its sales.

With both models expected to surpass the half a million units mark in 2026, along with the BYD Seagull, these three small Chinese EVs will probably kick the Tesla Model 3 off the podium, which would be a first for the Tesla sedan, which has been in the top three positions since 2018…. The Xiaomi YU7 could also show up as a possible dark horse in the race.

The first position change on this chart saw the BYD Qin L switch positions with the Xiaomi SU7, with the sporty sedan dropping to 9th, and the BYD sedan climbing to 8th. With a refresh coming in a few months to the SU7, Xiaomi wants to make sure that its sedan does not age. And the SU7 is not even two years old…. That’s China speed.

On the lower half of the table, the Geely Panda Mini jumped two positions, to 16th, thanks to lower than average performances from the #17 Li Xiang L6 and #18 VW ID.4.

And in 20th, we have a new model on the table, with the Leapmotor C10 joining the top 20 for the first time. With export markets having an increasingly important role in the midsize SUV career, as one can see by the volumes sold in markets like Germany (1,659 units so far this year), Poland (1,387), Spain (1,084), UK (1,622), Israel (1,035), or Nepal (1,059).

Although, it is not certain that the startup model will end the year on the table, as the #21 BYD Sealion 06 (126,000) could have a strong enough last month of the year, to be able to remove the Leapmotor model from #20. To be continued…

Stay tuned for our next article on the top selling EV brands and auto groups in the world.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Advertisement

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy