In 2025, the chapter of the global automotive industry history was completely rewritten.

International mainstream media such as CNN and BBC rushed to report that BYD, a Chinese brand that had long led the global new – energy vehicle sales, for the first time surpassed Tesla in the annual sales of pure – electric vehicles. With 2.257 million pure – electric vehicle sales in 2025, BYD crowned the global champion, with a year – on – year increase of 27.86%.

US media CNN reported: The world welcomes a new king of electric vehicles, not Tesla.

In contrast, Tesla’s global deliveries in 2025 were only 1.636 million, a year – on – year decline of 8.6%. And its deliveries in the fourth quarter were only 418,000, a sharp drop of 16% compared with the same period of the previous year.

This is not just a simple change in sales rankings. It also means that a competition that has lasted for more than a decade around technical routes, industrial models, and market strategies has reached a stage judgment.

If Tesla is the initiator of the intelligent electric vehicle revolution, then BYD has become the leader in spreading this revolution globally.

The power structure of the global automotive industry is undergoing a profound restructuring. In the era of electrification and intelligence, the Chinese automotive industry has proven its competitiveness in the global automotive market with its mature vertical integration system, excellent cost – control ability, rapid technology iteration efficiency, and penetration power in diverse markets.

01. BYD Overtakes Tesla, and the Global Pure – Electric Sales Champion Changes Hands

In the 2025 automotive market report card, BYD once again became the focus. The total sales of its new – energy vehicles reached 4.602 million, which is equivalent to selling about 13,000 vehicles per day on average. Its position as the world’s largest new – energy vehicle manufacturer is unshakable.

An even more strategically significant breakthrough is in the pure – electric vehicle segment. BYD has left Tesla behind in annual sales.

Moreover, this is the fifth consecutive quarter that BYD has exceeded Tesla in pure – electric vehicle sales, indicating that its lead is not accidental but a normal state based on a solid market foundation.

This historical overtaking inevitably reminds people of the dramatic change in Tesla CEO Elon Musk’s attitude towards BYD in recent years.

In 2011, Musk publicly declared that “he didn’t think BYD was a competitor.” However, in 2023, when netizens brought up the old matter again, he candidly replied, “That was a long time ago. Their cars are very competitive now.”

Musk’s Attitude Towards BYD Reversed

Behind the change in attitude is the continuous narrowing of the gap in pure – electric vehicle sales between the two sides.

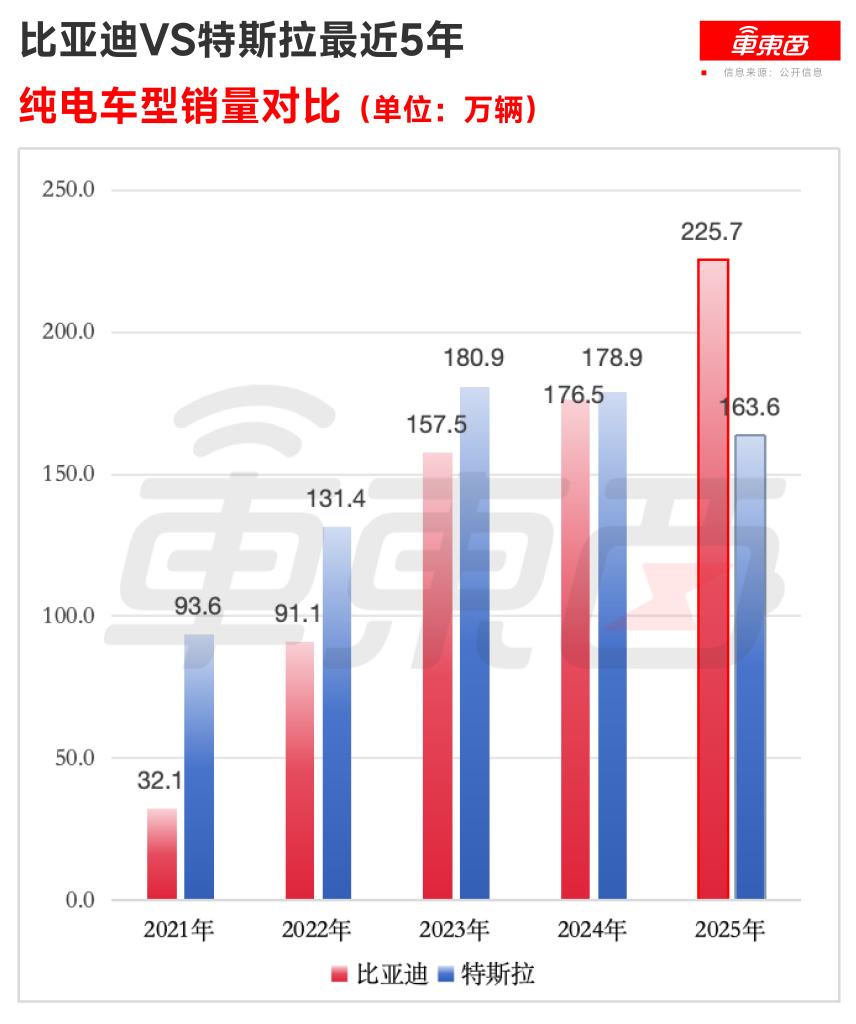

In 2021, BYD’s pure – electric vehicle sales exceeded 320,000, about one – third of Tesla’s. In 2023, BYD’s pure – electric vehicle sales exceeded 1.57 million, and the gap with Tesla narrowed to about 230,000.

Comparison of BYD and Tesla’s Pure – Electric Vehicle Sales in the Past Five Years

In the fourth quarter of 2024, BYD’s single – quarter pure – electric vehicle sales exceeded Tesla’s for the first time. In 2025, BYD topped the global pure – electric vehicle sales list with a significant advantage of 621,000 vehicles over Tesla, completing the transformation from a chaser to a leader.

Behind Tesla’s being overtaken in sales is BYD’s victory in the competition in terms of technical routes and product layout.

In terms of technical routes, compared with Tesla, which focuses more on the exploration of cutting – edge technologies, BYD’s vertical integration model (self – research and self – production of batteries, motors, and electronic controls) brings significant cost advantages and supply – chain autonomy. This allows it to be more calm in the fierce industry competition and to apply cutting – edge technologies such as ultra – fast charging and intelligent assisted driving to mainstream models at a faster speed, achieving technology popularization.

In the current situation of new – energy vehicle popularization, BYD’s technical route will be more explosive in seizing market share.

In terms of product matrix, Tesla pursues a popular – model and streamlined strategy, mainly relying on the Model 3 and Model Y to dominate the market.

BYD, on the other hand, has built a complete product matrix covering brands such as Dynasty, Ocean, Denza, Fang Cheng Bao, and Yangwang, covering a price range from 50,000 to over 1 million. It can meet the diverse needs of consumers at different levels in different countries, with stronger risk – resistance ability and deeper market penetration.

Thanks to these factors, BYD had a great comeback in 2025 and won a broader market base.

02. Overseas Sales Account for Over 20%, and the Global Strategy of BYD is Dissected

The value revealed in BYD’s sales annual report is far more than just topping the pure – electric vehicle sales list. One of the most strategically significant signals is the explosive growth of BYD’s sales in the overseas market.

In 2025, its overseas sales of new – energy vehicles exceeded 1 million, accounting for more than 20% and doubling year – on – year. This means that BYD’s globalization has entered the “deep – water area,” which is based on decades of in – depth localization efforts.

Dissecting its global strategy simply, this victory is based on three levels:

Firstly, the product strength has been globally recognized.

In Europe, the Song PLUS won the sales championship of plug – in hybrid models in Germany in November 2025, becoming the first Chinese – brand model to top the mainstream segment in Germany. The Seagull was selected as one of the “Best Inventions of the Year” by the US magazine Time.

The Seagull was Selected as One of the “Best Inventions of the Year” by Time

In Japan, with models such as the Seal and Sea Lion 07EV, BYD won the core awards issued by the “Automobile Researchers and Journalists Conference” (RJC) of a Japanese NPO for two consecutive years.

All these show that BYD’s models have successfully passed the strict tests of mature markets, breaking the stereotype overseas that “Chinese cars rely on low prices.” It also proves that Chinese automotive brands have reached the global top level in terms of design, safety, and quality.

Secondly, the production capacity and supply chain are deeply localized.

When the competition enters the deep – water area, a single product lead is no longer sufficient to maintain the advantage in the overseas market. BYD’s global layout of localized production capacity and supply chain has become the core engine for its sales explosion.

Currently, BYD has built three passenger – car production bases in Thailand, Uzbekistan, and Brazil, and is planning more overseas production bases and production capacity. This will further improve the response speed in the overseas market, reduce trade and logistics risks, promote local employment, and reshape the regional automotive industry ecosystem.

Thirdly, an independently controllable logistics “lifeline” has been established.

BYD has put 8 self – owned large – scale car carriers into operation and formed an independently controllable ocean – going transportation fleet. This “maritime lifeline” not only solves the problem of transport capacity but also firmly holds the logistics lifeline in its hands, ensuring a stable delivery rhythm and strengthening its initiative in the global supply chain, laying the foundation for continuous overseas expansion.

BYD’s Large – Scale Car Carriers

The above overseas layout has directly translated into market dominance. In 2025, BYD ranked first in new – energy vehicle sales in many countries and regions such as Turkey, Italy, Brazil, Spain, Singapore, and Hong Kong, China. With the dual support of technology and market, BYD is establishing a long – term and stable competitive barrier.

03. BYD Stands at a New Starting Point, and There is No Shortcut in the Automotive Industry

Topping the pure – electric vehicle sales list and exceeding 1 million in overseas market sales, BYD’s success provides a model for the development of the Chinese and even the global automotive industry.

For the Chinese automotive industry, BYD’s rise is the result of the concentrated explosion of the systematic advantages of the Chinese automotive industry in the fields of three – electric technologies and intelligence.

It directly proves that China has a fertile ground for cultivating world – class automotive brands, which will greatly boost the confidence of Chinese automotive brands going overseas and may lead to a new wave of collective overseas expansion by automotive enterprises and supply – chain enterprises. The global influence of the Chinese automotive industry will be further enhanced.

For the global competition pattern, BYD’s victory announces that in the stage of large – scale popularization of electrification, the competition dimension of the global automotive industry has shifted from a single product or technical highlight to a competition of system efficiency covering the entire chain of R & D, manufacturing, and market.

This forces all participants, whether traditional automotive giants or new forces, to re – examine their R & D and manufacturing systems. The wave of electrification is irreversible, and slowing down may mean falling behind.

For BYD itself, topping the pure – electric vehicle sales list is not the end but the beginning of a new round of competition. BYD has also started a new journey: continuously enhancing its global influence in terms of brand, technology, and ecosystem.

To this end, BYD announced a major investment at the beginning of the year. It has formed an assisted – driving team of over 5,000 people and plans to invest 100 billion in in – depth exploration of intelligence. This is a key first move for BYD to win this in – depth competition.

BYD’s Engineer Team

In the automotive industry, which has a long cycle and heavy assets, there is no shortcut. Continuous investment in technology R & D is the only certain bargaining chip to deal with all industry fluctuations. This is the most rational adventure.

04. Conclusion: Chinese Automotive Enterprises Reshape the Global Automotive Competition Pattern

BYD’s exceeding Tesla in pure – electric vehicle sales in 2025 is a significant historical milestone in modern automotive history.

It records the tenacious counter – attack of a Chinese automotive enterprise and also symbolizes that the competition in the global electric vehicle industry has gone beyond the technical competition of a single enterprise and gradually evolved into a comprehensive competition of the complete automotive industry ecosystem at the national level.

Chinese automotive brands represented by BYD are redefining the rules of the global automotive industry game with their early layout in the entire electrification industry chain, agile response to market demand, and firm determination for globalization.

The power center of the global automotive industry is irreversibly tilting towards the East. The reshaping of the global automotive competition pattern has entered the “Chinese Time.”

This article is from the WeChat official account “Che Dongxi.” The author is Guo Yue, and the editor is Zhi Hao. It is published by 36Kr with authorization.