Polestar is Swedish but owned by one of China’s largest carmakers, manufactures its cars in China but does not sell them there, and only makes electric cars even though the world seems to be moving back to petrol. Then there is the small matter of being heavily lossmaking.

And yet its new German boss thinks it will thrive and outsell BMW and Mercedes.

“It’s simple,” said Michael Lohscheller, as he tucked into his tofu lunch on a visit to London last month. “We offer the best European design, the best Chinese battery technology, the best driving performance and we take sustainability more seriously than others. A new generation will love us.”

It’s early days, but the 57-year-old from North Rhine-Westphalia might be on to something — starting in Britain. After Abba and Ikea, UK consumers are becoming fans of the latest Swedish import. “Britain is our biggest market by a big margin,” Lohscheller said.

The figures don’t lie. Sales here have doubled in the past 12 months, albeit from a low base, and now account for 28 per cent of Polestar’s total global sales. “We are the fastest-growing premium brand in the UK and have 50,000 cars on the road.”

Why do Brits like Polestars? “You appreciate good design, great driving performance and fantastic technology. You also don’t want to have a car that everybody else drives.”

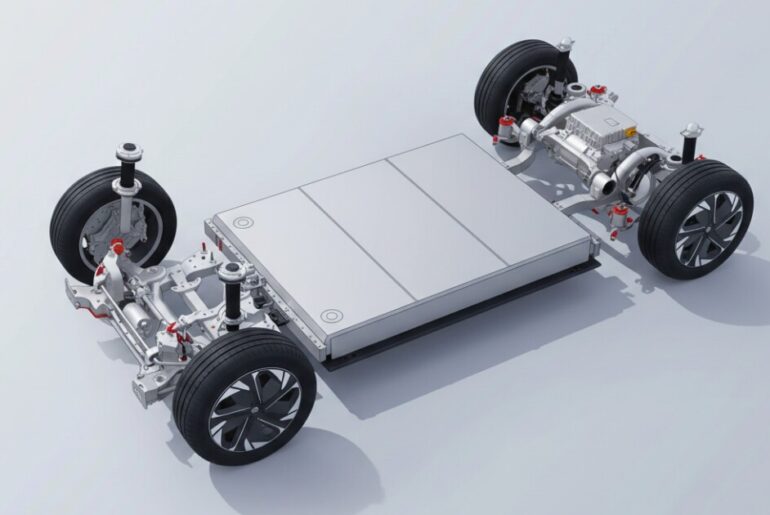

With their “chuck out the chintz” Scandi-chic design, Polestars look distinctive and cooler than American Teslas, Chinese BYDs and many upscale German marques. They have a range of up to 400 miles on a single charge, handle like sports cars, and have a 0-60mph time of less than three seconds.

They also have one of the lowest CO2 emissions per car in the industry — about 21 tonnes of CO2 is expended to make each car.

• Has the big drive to electric cars run out of energy in the UK?

For these reasons, Polestar is growing across Europe as a whole. The Continent accounted for 80 per cent of global sales in the first half of 2025.

A new model, the Polestar 5, a four-door luxury grand tourer, will help boost sales when it hits the streets next year. One critic recently described it as “the car Apple couldn’t make”. Lohscheller goes further. “It’s the best premium EV in the world for everyday use.”

His hyperbole is not the usual car salesman schtick. Polestar now outsells Porsche when it comes to EVs “despite all those Porsche dealers, its heritage and brand strength,” Lohscheller says proudly.

All the German brands have struggled to make inroads in the luxury EV market because “the Germans try to defend the past, rather than invest in the future,” he argues. The Germans have an ally in the EU, which last month pushed back the ban on the sale of new internal combustion engine cars in the bloc beyond 2035.

The EU also imposes a tariff of 28.8 per cent on imports of Polestars made in China, which is why Lohscheller is opening a factory in Slovakia in 2028. The new Polestar 7, a small SUV, which will be made there will not attract EU import duties.

Tariffs on Chinese-made cars and on car parts from Mexico, which Polestar uses in its US factory in South Carolina, make the American market “difficult”. As the price of its models has risen in the US, Polestar’s sales have fallen — down by 40 per cent in the first nine months of last year.

The impact will be felt across the EV sector. Research from Benchmark Mineral Intelligence shows EV sales will rise 13 per cent to 24 million in 2026, down from a 22 per cent increase last year.

But Lohscheller is convinced the market will rebound. Imports of models from a new factory in South Korea will circumvent tariffs, reducing on-the-road prices in the US. The same cannot be said of the world’s largest EV market, however. Chinese consumers now favour home-grown brands, prompting Polestar to pull out of China.

Polestar has its headquarters in Gothenburg, where its sister company, Volvo, is based, and it is keen to present itself as a European brand. Like Volvo, and troubled British marque Lotus, it is majority-owned by entities of Chinese autogiant Geely and its chairman Li Shufu.

Lohscheller replaced Polestar’s founder, Thomas Ingenlath, 18 months ago and he credits his fellow German with “setting this up right, with the right design, the right brand.” But he points out that while Ingenlath, 61, was a designer — he was Volvo’s styling chief before moving to Polestar — he is an accountant who knows how to drive sales.

He has dialled down Ingenlath’s “direct to consumer” internet-based sales system in favour of a traditional bricks-and-mortar dealer network in partnership with Volvo. “Customers need to go to the dealer, get a quote, get a test drive, get an explanation because people don’t want to admit they don’t understand certain technologies.”

There are 160 Polestar dealers worldwide — 15 in the UK with more on the way — and Polestars are serviced by Volvo’s 1,100-strong dealer network.

Lohscheller is more ruthless than Ingenlath. He has axed 15 per cent of Polestar’s workforce, 450 jobs, and closed its UK research and development arms in Coventry and Nuneaton. Meanwhile, Ingenlath’s favourite model, the Polestar 6, a snazzy roadster, has been put on hold and the Polestar 7 prioritised because “we need volume sales.”

Globally, Polestar sales increased by 36 per cent in the first nine months of last year and revenue was $2.2 billion, up 48.8 per cent on the same period in 2024. Lohscheller predicts those numbers will increase as Polestar’s charging network expands beyond the one million charge points across Europe.

The former Opel, VW and Mercedes Benz executive talks a good game but the firm’s latest financials show that, like other edgy EV start-ups, notably US-based Rivian, Polestar is starting from very modest beginnings. It sold only 44,500 cars in the first nine months of last year. Tesla shifted more than 1.6 million cars last year and mass market Chinese manufacturer BYD sold 2.26 million EVs. Sales revenues may be rising but the firm is heavily lossmaking, burning through $110 million a month.

Overall, it has lost almost $1 billion for each year of its short life — it is only nine years old. Its corporate loan book is more than $4.4 billion and its share price has tanked by more than 95 per cent since it floated on the Nasdaq in 2022.

Polestar shares even briefly dipped below the $1 required to trade, prompting some creative accounting, known as a reverse stock split, which boosts the share price.

There are new roadblocks ahead. Consumers are turning away from premium EVs because they tend to be more expensive than their fossil-fuel powered rivals. Porsche, Mercedes, Bentley, GM and Ford have all scaled back production of high-end EVs. The Polestar 5 starts at £90,000.

Lohscheller dismisses price concerns. “We will not be the cheapest in town. We don’t want to be the cheapest in town. We have a premium positioning.” He adds that the Polestar 7 is likely to cost a more affordable £40,000.

When I suggest that Polestar hedge its bets in the short term and diversify into hybrids, he chokes on his tofu. He believes one of the biggest reasons why German automakers have failed to take on Tesla is that they have too many different power options. “It’s a problem when you try to do everything.”

He urges the EU and the Conservative opposition here in Britain to stop pushing back the date when sales of new petrol and diesel cars will be banned. Tory leader Kemi Badenoch has pledged to scrap Britain’s 2030 ban. Politicians “should stay the course and stop confusing everybody”.

When it comes to staying the course, the big question for Lohscheller is: does he have the backing of Geely?

If Polestar’s financial performance does not soon match its cars’ performance, some analysts predict the Chinese will pull the plug and concentrate on Volvo. Geely is not afraid to wield the axe. It fired 550 people at Lotus’s north Norfolk plant last year — almost half the UK workforce — and fears persist that Geely will end all UK Lotus production and expand in China.

Lohscheller insists he will prove the naysayers wrong. “We have total backing from Geely. They and we are in it for the long haul.”

He points out that it took Tesla more than a decade to break through. It launched in 2008 when it sold a few hundred cars a year and it was not until 2017 that sales exceeded 100,000.

He chooses a personal analogy. “I’m a marathon runner. I’ve run 126. When I started in 1987, everybody thought it was a really uncool thing. Now, everybody thinks it’s the coolest thing. EVs are the same. EVs will grow. This is not a two-year project. It’s a marathon. You don’t stop after five miles, you go strong and long.”