But Model Y was #1 US bestseller through Q3 before EV incentives ended. And Tesla’s hype machine works: TSLA trades at a P/E ratio of 300, other automakers at 10 to 20.

By Wolf Richter for WOLF STREET.

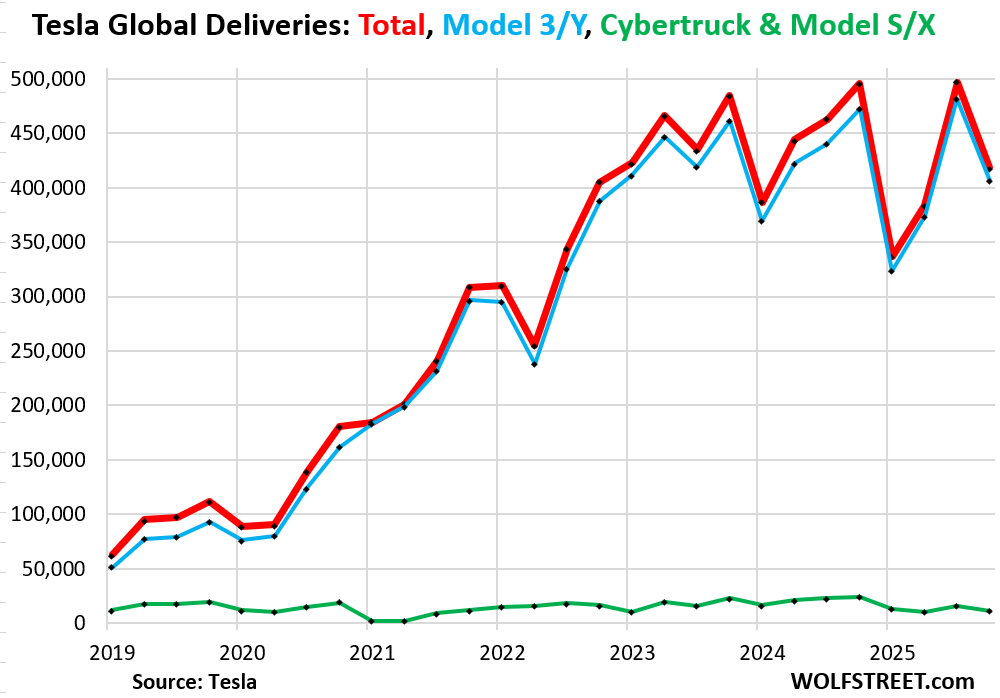

The total number of vehicles that Tesla delivered to customers around the globe in Q4 2025 plunged by 15.6% from a year ago, to 418,227 vehicles, the lowest Q4 since 2022 as the federal EV incentives in the US ended on September 30, as other EV brands around the globe ate Tesla’s lunch, and as the Cybertruck has failed (red in the chart).

Deliveries of the Model 3 and Model Y plunged by 13.8% from a year ago, to 406,585 vehicles, also the lowest Q4 since 2022 (blue).

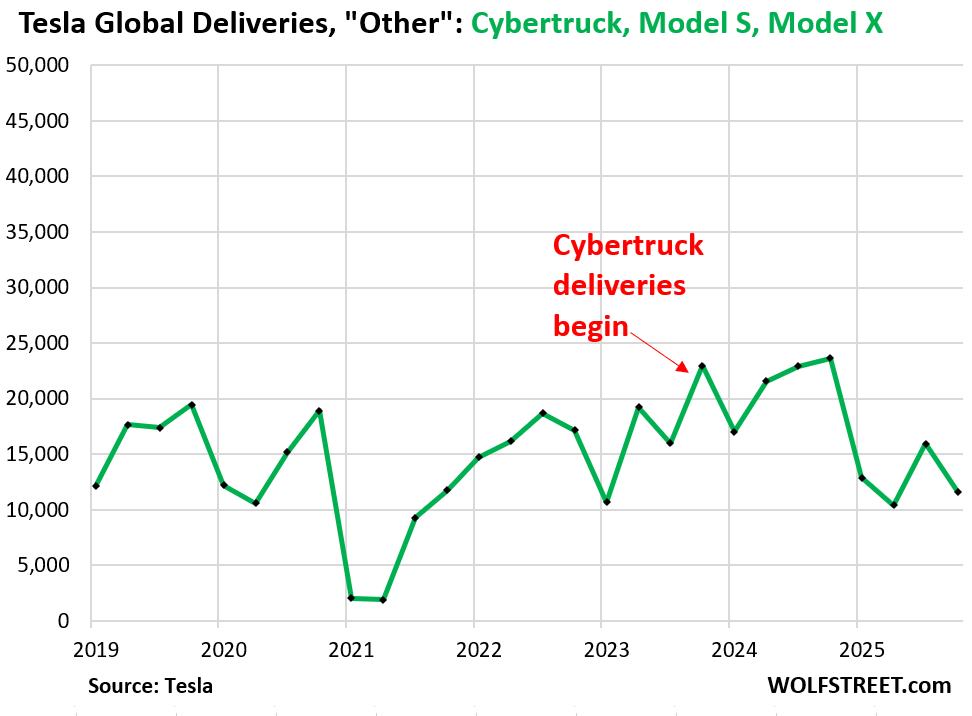

Deliveries of what Tesla calls “other” models – Cybertruck, Model S, and Model X all combined, the green line at the bottom of the chart – collapsed by 50.8% year-over-year to just 11,642 vehicles in Q4, the lowest Q4 since Adam and Eve (or at least since 2014). Sales of the Model S have been dying for years, the Model X never took off, and the Cybertruck is now a failed model.

The Semi, Tesla’s most promised and delayed vehicle ever, is now ramping up mass production at its new Nevada factory. The few prior Semis were essentially handmade prototypes under a pilot program that companies like PepsiCo tested. So that model is still in the hype-and-hope department.

But the Model Y remains an immensely successful model in the US: In 2025 through Q3, it was the #1 bestseller by registrations in the US, with a share of 3.0% of all vehicles sold, ahead of the Toyota RAV4 (2.9%), and the Ford F-150 pickup (2.8%), according to Experian’s quarterly report on vehicle registrations. That performance was helped by frontrunning in Q3 ahead of the end of the federal EV incentives of $7,500.

Experian’s Q4 report on registrations, when it comes out in March, will show that in Q4, Model Y registrations plunged as the federal EV incentives had ended, and that it likely lost its #1 spot in the US to the RAV4 and the F-150, but that it remained one of the bestsellers in the US.

Cybertruck woes. Tesla said in 2023 that it expects to be able to ramp production of the Cybertruck to 250,000 units in 2025. But now in the reality of the whole year 2025, deliveries of “other” models – Cybertruck, Model S, and Model X all combined – have collapsed by 40% to 50,850 units for the full year.

Cybertruck is now a failed model. It was immensely expensive to develop, took years longer to get to production due to the technical challenges and innovations its design pushed, and now faces a cold reception from consumers and the media.

Here we’re looking at the “other” models – Cybertruck, Model S, and Model X all combined – under the magnifying glass

For the whole year, global deliveries of all models dropped 8.6% to 1.636 million vehicles; compared to the peak year of 2024, they dropped by 9.5%:

Why are we even looking at this? Tesla’s crazy share price. Tesla’s stock-market fan club has turned their eyes away from the mundane stuff an automaker makes, including its failed super-hyped models, and now it’s all about future robotaxis, where Tesla is about two years behind Waymo, humanoid robots for every household or whatever, AI, and other promises, and to heck with the prior failed promises, such as the Cybertruck.

Tesla’s shares, currently at around $445, are near their all-time high of mid-December and trade at a P/E ratio of 300, when automakers listed in the US usually trade in the 10-20 range, including Toyota (P/E ratio of 10), GM (P/E ratio of 16), and Ford (P/E ratio of 11). I know, I know, Tesla is not an automaker, it’s a hype machine and the TSLA fan club loves that and thrives on it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

WOLF STREET FEATURE: Daily Market Insights by Chris Vermeulen, Chief Investment Officer, TheTechnicalTraders.com.

![‘[They] knew or should have known’ '[They] knew or should have known'](https://www.evshift.com/wp-content/uploads/2026/01/tesla-Depositphotos_318693426_XL-770x515.jpg)