After a long and frustrating transitional period, three catalysts suggest that Tesla (TSLA) has turned the corner and is ready to have a strong 2026, including:

Tesla Unsupervised FSD is Becoming Reality

Alphabet’s (GOOGL) ‘Waymo’ service is off to a wide lead in the battle for robotaxi supremacy. Earlier this week, Waymo announced that it is far ahead of its robotaxi competition and that the company has completed over 14 million paid robotaxi trips in 2025, and that it is on pace to reach the one million rides per week milestone by the end of 2026. Nevertheless, with Waymo currently operating in only five major cities, the battle for robotaxi supremacy is in its infancy.

Meanwhile, Tesla’s robotaxi program has only debuted in two cities (Austin, Texas & San Francisco, California). Nevertheless, Tesla has two critical advantages that will allow it to catch up to and even surpass Waymo rapidly – scalability and cost. Waymo robotaxis rely on expensive lidar technology that can cost ~$10-$12k. Conversely, Tesla robotaxis rely on camera and vision technology that costs ~$400 per vehicle.

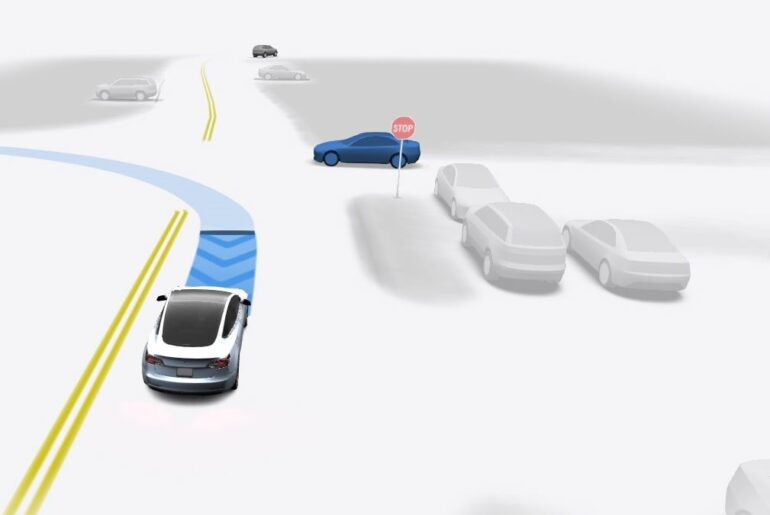

Until now, Tesla’s robotaxi roadblock has been the long wait to achieve full self-driving (FSD) and to deliver robotaxis without a safety rider. However, data sourced from the betting market Kalshi suggests the wait may be over. According to Kalshi, there is a 77% chance that Tesla will launch unsupervised FSD before 2026.

Image Source: Kalshi

Tesla CEO Elon Musk recently exhibited high confidence in his company’s robotaxi future, posting on X that “Waymo never really had a chance against Tesla. This will be obvious in hindsight.” Meanwhile, in another interview, Elon Musk said that unsupervised FSD is “pretty much solved at this point.” In related news, rideshare giants Lyft (LYFT) and Uber Technologies (UBER) sold off hard on Wednesday on above-average volume turnover.

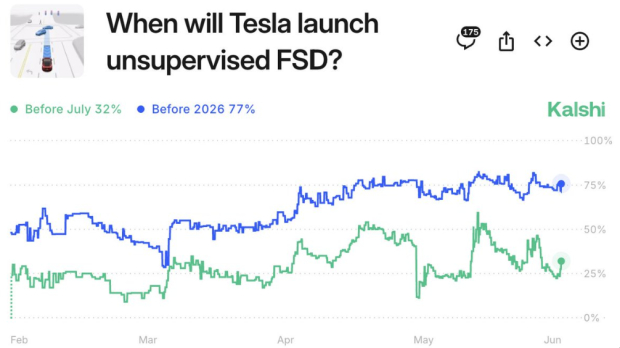

Tesla Brand Reputation Has Healed

In early 2025, Elon Musk stepped away from his numerous businesses (including Tesla) to become a “special government employee” and spearhead the “Department of Government Efficiency” (DOGE) under the Trump Administration. However, Musk’s decision to tackle government waste, fraud, and abuse backfired significantly for his own businesses. Tesla cars and dealerships across the country were vandalized as sales plunged.

That said, data from predictive insight firmHundredX suggests that enough time has passed and that the Tesla brand has healed. The data shows that Tesla’s net purchase intent (NPI) and brand value/trust have fully recovered after plunging in early 2025.

Image Source: HundredX

Tesla China has Turned the Corner

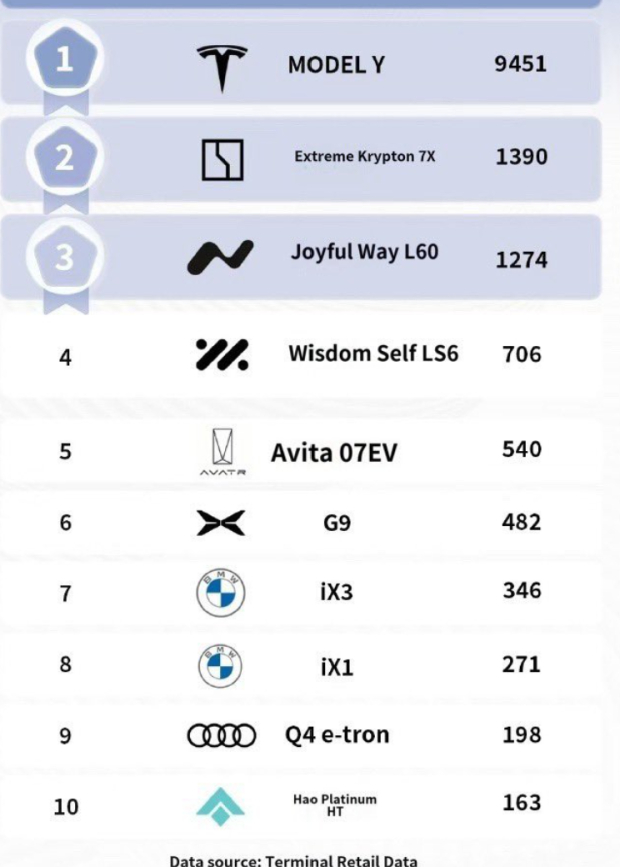

Amid a weak economy and cutthroat competition from automakers such as BYD (BYDDF), Nio (NIO), and Xpeng (XPEV), Tesla has experienced stagnant sales in its second-largest market, China. That said, fresh data suggests Tesla China has turned the corner. Last week, the Model Y was the top-selling vehicle in China.

Image Source: Terminal Retail Data

Meanwhile, the Tesla Model S is completely sold out in China.

Bottom Line

After a turbulent stretch, the pieces are finally aligning for Tesla. With unsupervised FSD nearing launch, brand trust recovering, and renewed Chinese demand, Tesla enters 2026 with momentum.

Zacks Naming Top 10 Stocks for 2026

Want to be tipped off early to our 10 top picks for the entirety of 2026? History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2026. Don’t miss your chance to get in on these stocks when they’re released on January 5.

Be First to New Top 10 Stocks >>

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.