Tesla is now one of the largest publicly traded companies on the stock market.

Electric carmaker and robotaxi company Tesla (TSLA +2.20%) is one of the largest companies in the stock market, led by CEO Elon Musk, one of the most prolific tech founders of our time.

Tesla is the first company to widely commercialize electric vehicles, which are viewed as a critical innovation in helping to wean the planet off of fossil fuels that have greatly contributed to global warming. While Tesla’s core EV business has struggled due to rising competition and fewer government incentives, investors are now more focused and extremely excited about Tesla’s autonomous ride-hailing fleet, full self-driving technology, and Optimus humanoid robots.

Image source: Tesla.

This explains why the stock now trades at a massive valuation of around 200 times forward earnings. Investors believe Tesla is on the groundbreaking level of new industries with massive markets, and that Tesla will be able to gobble up market share with its first-mover advantage.

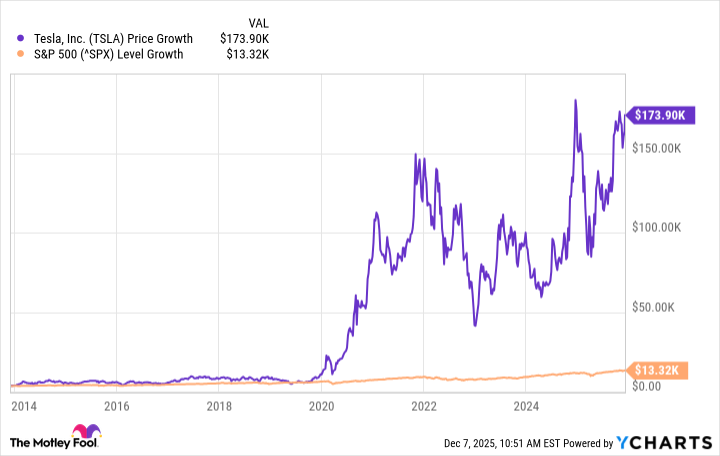

The bulls have been right so far

Tesla remains one of the most disputed battleground stocks on Wall Street. And while many, including myself, are skeptical about continuing to buy the stock at such a rich valuation, the bulls have prevailed so far.

As you can see in the chart, $3,500 invested in Tesla at the end of 2013 is now worth nearly $174,000 for a total return of 4,869%. Meanwhile, the same $3,500 invested in the broader benchmark S&P 500 (^GSPC +0.04%) is only worth $13,320, which is still a strong return.

While Tesla’s future is uncertain, the bulls have now been right for many years.

Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.