Report Overview

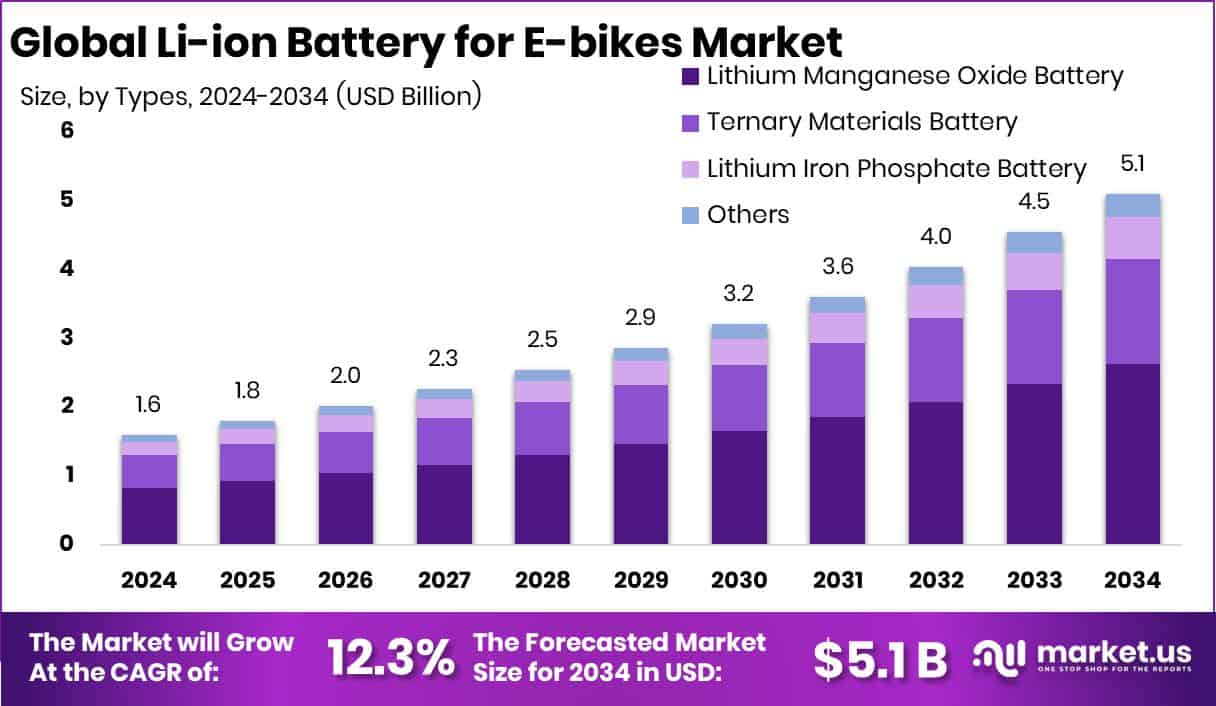

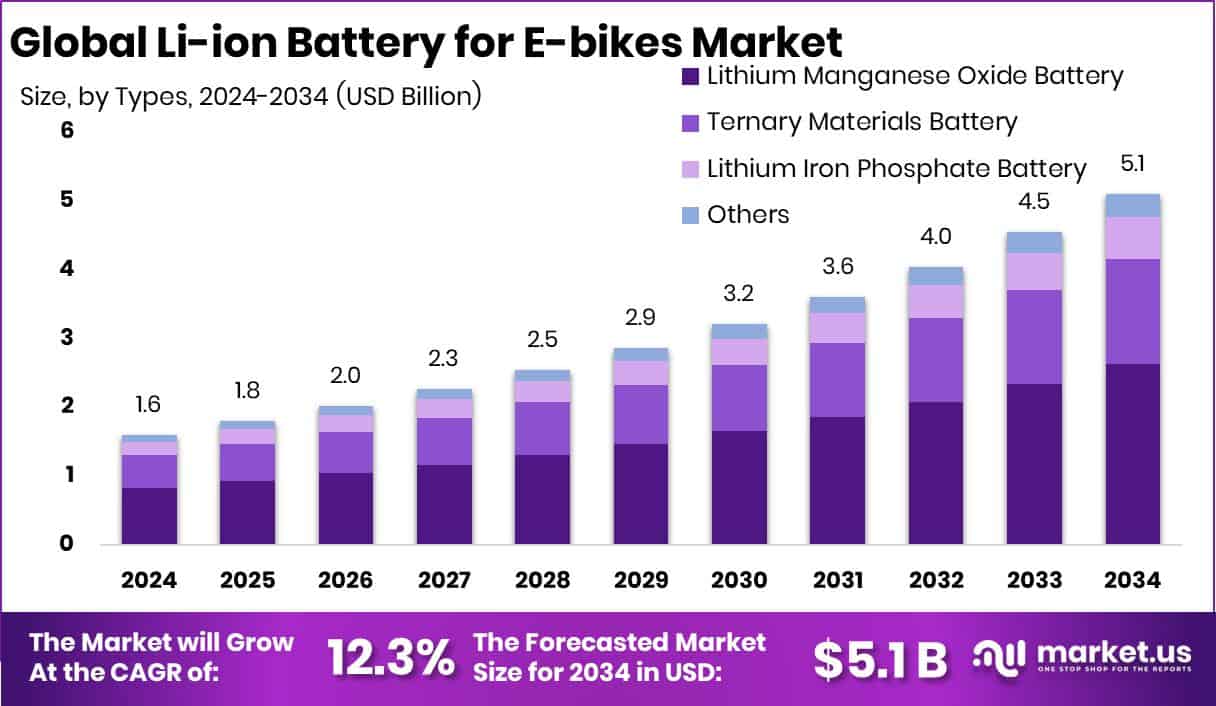

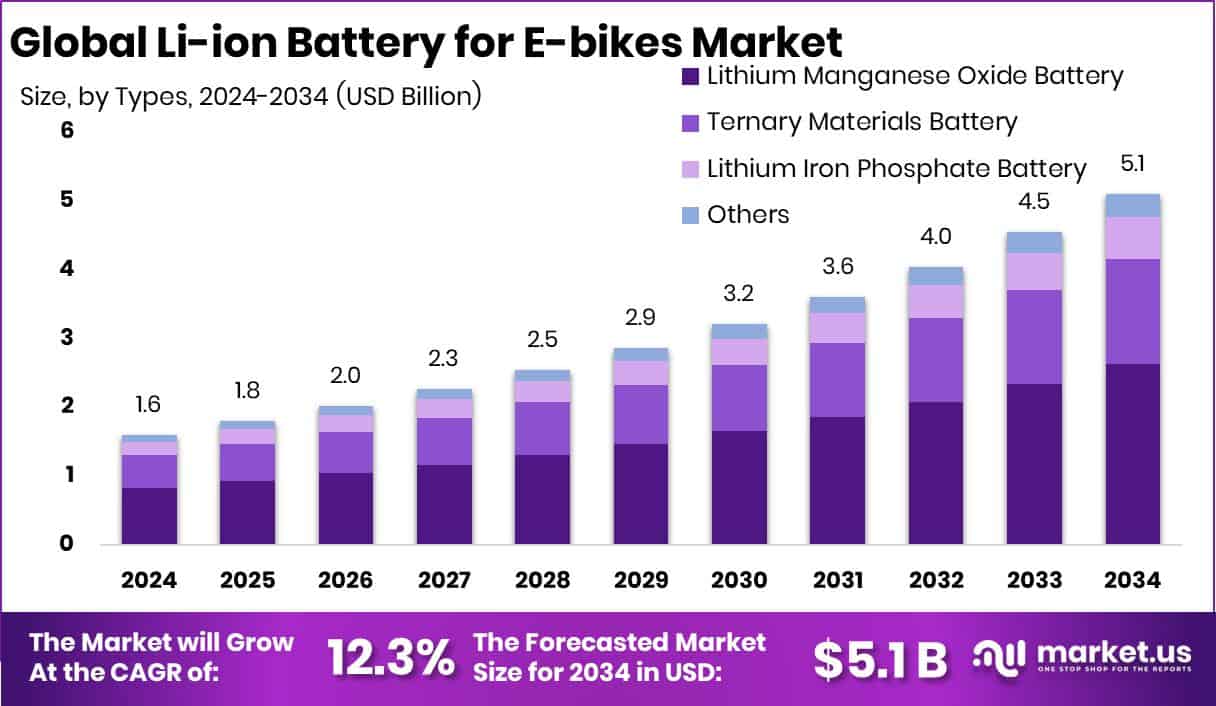

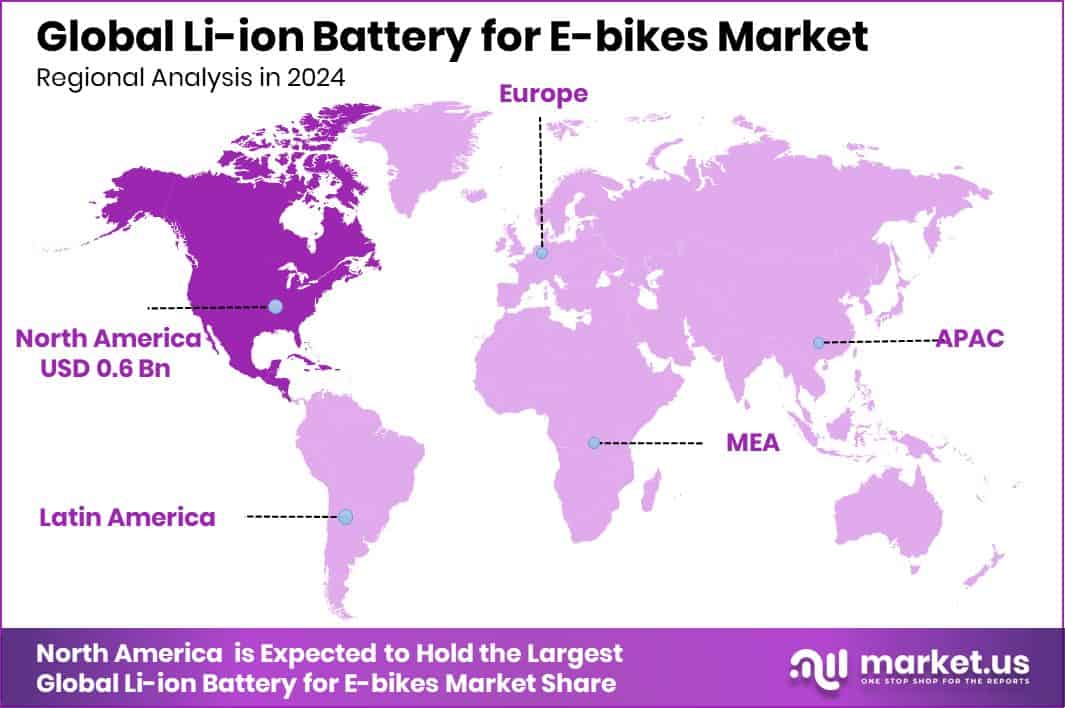

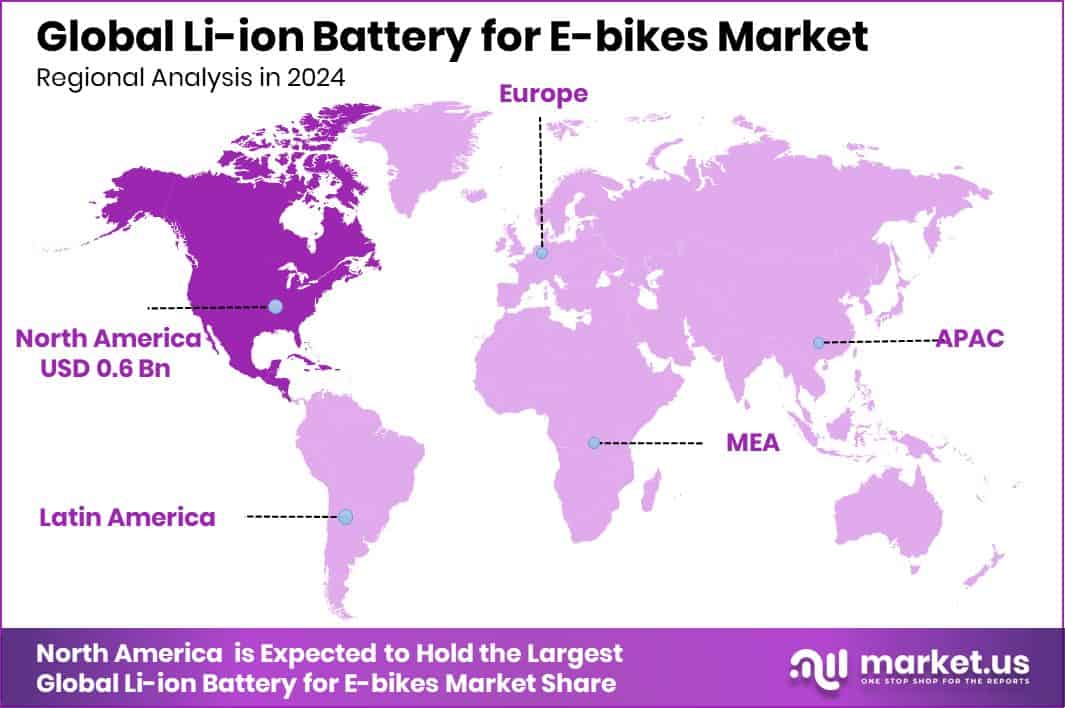

The Global Li-ion Battery for E-bikes Market is expected to be worth around USD 5.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 12.3% from 2025 to 2034. Li-ion Battery for E-bikes Market in North America totals USD 0.6 Bn with 39.80% share.

A Li-ion battery for e-bikes is a rechargeable energy storage unit that powers electric bicycles. It is valued for its light weight, high energy density, fast charging ability, and long cycle life. These batteries support smooth pedal assistance, longer riding ranges, and reliable performance across urban commuting and leisure cycling.

The Li-ion battery for e-bikes market includes battery packs, cells, battery management systems, and recycling activities linked to electric bicycle use. The market is shaped by growing urban mobility needs, cleaner transport goals, and deeper integration of battery innovation into light electric vehicles beyond cars and buses.

Growth factors center on public investment and technology push. Governments are strengthening battery ecosystems, with initiatives such as over $4.2 million awarded to lead critical minerals research, $3 billion floated to strengthen EV and grid batteries, and another $3 billion planned for 25 battery manufacturing projects. Europe is also advancing, with Portugal securing a role in a €2.9 billion clean-tech effort.

Demand is rising as cities favor compact electric mobility. E-bikes need safe, affordable batteries, driving interest in supply security, recycling, and alternative chemistries. A lithium-ion battery recycling startup recently raised $3.7 million, reflecting demand for circular battery solutions.

Opportunities extend beyond lithium alone. A non-lithium battery startup securing $78 million in Series C funding highlights growing interest in safer, cost-stable technologies. Together, funding flows show long-term expansion prospects for e-bike battery innovation and production.

Key Takeaways

The Global Li-ion Battery for E-bikes Market is expected to be worth around USD 5.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 12.3% from 2025 to 2034.

In the Li-ion Battery for E-bikes Market, lithium manganese oxide batteries lead with a 51.4% share due to safety and stability.

Retail distribution dominates the Li-ion Battery for E-bikes Market with a 71.3% share, driven by direct consumer purchases.

North America market strength reflects 39.80% dominance driven by e-bike adoption reaching USD 0.6 Bn.

By Types Analysis

Lithium manganese oxide dominates the Li-ion Battery for E-bikes Market 51.4%.

In 2024, Lithium Manganese Oxide Battery held a dominant market position in the By Types segment of the Li-ion Battery for E-bikes Market, with a 51.4% share. This strong position reflects its balanced performance in terms of safety, thermal stability, and cost efficiency, which aligns well with everyday e-bike usage.

Lithium manganese oxide batteries are preferred for urban and commuter e-bikes, where consistent power output and moderate range are essential. Their stable chemical structure supports smooth acceleration and reliable operation under varying riding conditions. In addition, these batteries are easier to integrate into compact e-bike designs due to their favorable power-to-weight ratio.

The 51.4% share also indicates wider acceptance by e-bike assemblers seeking dependable battery solutions that deliver steady performance without added system complexity, reinforcing their leading role within this market segment.

By Application Analysis

Retail leads Li-ion Battery for E-bikes Market with 71.3% adoption.

In 2024, Retail held a dominant market position in the By Application segment of the Li-ion Battery for E-bikes Market, with a 71.3% share. This dominance highlights the strong role of direct consumer purchases, where individual riders actively choose replacement or upgrade batteries based on performance needs and riding habits.

Retail channels support wide product visibility and easier access for end users, especially for daily commuters and leisure riders. The 71.3% share reflects growing consumer awareness around battery life, charging reliability, and compatibility with existing e-bike models.

Retail availability also allows quicker adoption of newer battery models without long procurement cycles. As e-bike ownership expands across urban areas, retail continues to serve as the primary application channel, strengthening its leading position within this segment.

Key Market Segments

By Types

Lithium Manganese Oxide Battery

Ternary Materials Battery

Lithium Iron Phosphate Battery

Others

By Application

Driving Factors

Extended Riding Range Boosts Consumer E-Bike Adoption

A major driving factor for the Li-ion Battery for E-bikes Market is the strong push toward longer riding range and better daily usability. Riders now expect batteries that last through full commutes without frequent charging, making performance a key buying decision.

Technology improvements are directly supporting this demand. For instance, Gogoro’s new battery delivering up to 170 km cruising range highlights how range expansion is reshaping consumer expectations. Such advancements reduce range anxiety and make e-bikes practical for longer urban and suburban travel.

Longer-lasting batteries also improve convenience for delivery riders and shared mobility users who rely on consistent uptime. As battery efficiency improves while keeping weight manageable, adoption rises across age groups and income levels. This focus on extended range continues to accelerate demand, reinforcing battery performance as a core growth driver for the e-bike ecosystem.

Restraining Factors

High Battery Costs Limit Wider E-Bike Reach

One major restraining factor in the Li-ion Battery for E-bikes Market is the high cost linked to battery materials and processing. Even though e-bikes are cheaper than electric cars, the battery still makes up a large share of the total vehicle price.

Price-sensitive consumers often delay purchases or choose lower-capacity options, which slows market expansion. Costs are influenced by reliance on imported materials, energy-intensive manufacturing, and supply chain volatility.

Industry efforts are underway to control this challenge, including Mitra Chem raising $50M to develop cheaper, domestic battery materials. While such initiatives aim to reduce long-term costs, price pressure remains a short-term barrier. Until material sourcing becomes more stable and affordable, battery pricing will continue to restrict broader adoption across emerging and mass-market e-bike segments.

Growth Opportunity

Local Battery Manufacturing Creates Strong Market Expansion

A key growth opportunity in the Li-ion Battery for E-bikes Market lies in expanding domestic battery cell manufacturing. Local production helps reduce import dependency, improve supply reliability, and lower long-term costs for e-bike battery packs. This shift supports faster product availability and better alignment with regional riding needs.

A major step in this direction is Amara Raja’s plan to invest over Rs 1,000 crore in its Li-ion cell business in FY26, signaling strong confidence in future demand. Such investments encourage ecosystem development around materials, assembly, and skilled labor.

As domestic cell capacity grows, manufacturers can scale faster and respond quickly to market needs. This creates a favorable environment for affordable, locally made batteries, strengthening the adoption of e-bikes across mass and premium segments.

Latest Trends

Rising Battery Innovation Backed by Strong Funding

A key latest trend in the Li-ion Battery for E-bikes Market is rapid innovation supported by increasing financial backing for advanced battery development. Companies are focusing on improving battery efficiency, safety, and lifecycle to meet rising e-bike usage in urban transport. This trend is clearly reflected in recent investments, such as Altmin securing US$100 million for lithium-ion battery innovation in India, aimed at strengthening technology capabilities and production quality.

Alongside this, UNIGRID Battery is closing $12 million in funding to scale up production, showing growing confidence in next-generation battery solutions. These investments support better energy density, faster charging, and longer battery life for e-bikes. As innovation accelerates, improved battery designs are becoming a defining trend, shaping future performance expectations and market competitiveness.

Regional Analysis

North America leads the Li-ion Battery for E-bikes Market with a 39.80% share valued at USD 0.6 Bn.

North America dominates the Li-ion Battery for E-bikes Market with a clear leadership position, holding 39.80% share and a market value of USD 0.6 Bn. This dominance is supported by strong e-bike adoption across urban commuting, recreational riding, and last-mile delivery usage. Consumer preference for high-performance batteries and established charging infrastructure further reinforces regional strength.

Europe represents a mature and steadily expanding market, driven by widespread acceptance of e-bikes for daily transportation. Strict urban mobility rules and a cultural shift toward cycling support consistent battery replacement demand and long-term usage, keeping the regional market structurally stable without aggressive volatility.

Asia Pacific continues to show broad market participation due to large population bases and growing use of electric two-wheelers. Strong manufacturing presence, cost-focused battery solutions, and sustained urban congestion challenges support ongoing demand for Li-ion batteries in e-bikes across both developed and developing economies.

Middle East & Africa reflect a developing market stage, where adoption is gradual and linked to urban infrastructure development. Growing awareness around electric mobility alternatives and compact transport solutions is shaping early demand for e-bike batteries in select urban centers.

Latin America shows emerging interest in e-bikes as an affordable mobility option. Expanding urban populations and improving access to electric bicycles contribute to consistent, though moderate, demand for Li-ion batteries across the region.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Samsung SDI plays a meaningful role in the global Li-ion Battery for E-bikes Market through its strong focus on high-density and safety-oriented lithium-ion cell technologies. The company’s deep experience in compact battery design supports stable performance, long cycle life, and consistent power delivery—key needs for e-bike applications. Its emphasis on quality control and thermal stability positions it well for premium and commuter e-bike segments that demand reliability and durability in daily use.

LG Chem brings long-standing chemical and battery expertise to the Li-ion Battery for E-bikes Market. The company’s strength lies in material science, which supports balanced energy density, durability, and improved charging efficiency. LG Chem’s battery solutions are well-suited for e-bikes requiring lightweight construction without sacrificing range. Its continued focus on scalable cell production and chemistry refinement supports broader adoption across mid- to high-performance e-bike models.

A123 Systems is recognized for its lithium-ion technology designed around safety, power output, and long life cycles. The company’s battery platforms are suited for e-bikes operating under demanding conditions, such as frequent charging and varied riding loads. Its technical focus on durability and power consistency supports applications where reliability and performance stability are critical to end-user satisfaction.

Top Key Players in the Market

Samsung SDI

LG Chem

A123 Systems

BYD

Toshiba

Murata Manufacturing

EVE Energy

Amperex Technology

Phylion Battery

Lishen

Recent Developments

In November 2024, LG Chem signed a non-binding offtake agreement with ExxonMobil for up to 100,000 metric tons of lithium carbonate. The lithium is intended for use in LG Chem’s cathode and battery production.

In October 2024, Samsung SDI displayed a wide range of its batteries for mobility at the expo, including all-solid-state batteries, “46-phi cylindrical” cells, LFP+ batteries, prismatic P6, and 21700 cylindrical batteries in mass production.

Report Scope