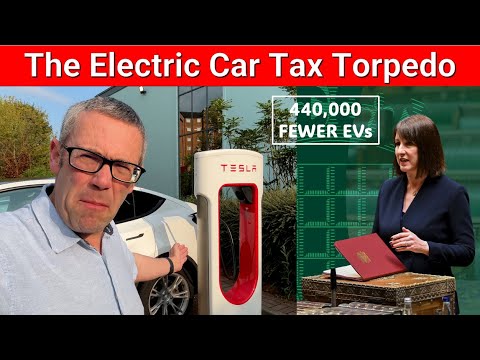

Tax EVs off the road – has the UK government gone MAD?

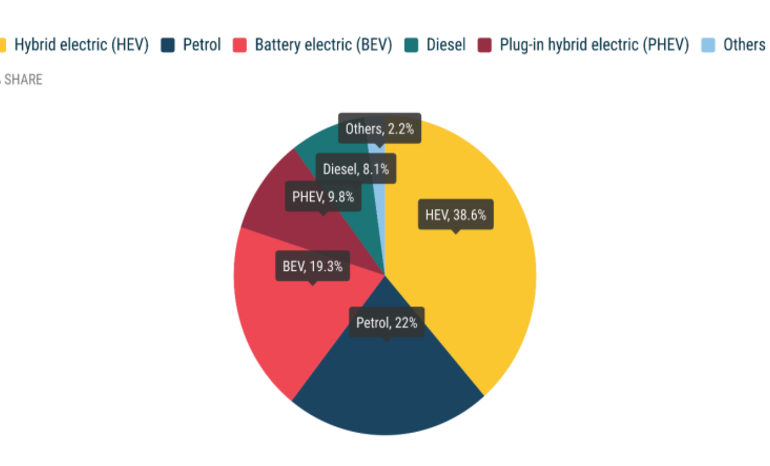

Has the UK government just torpedoed its own EV strategy? Hello again, YouTube, and welcome back to Just Get a Tesla. And in an absolutely chaotic UK budget, we’ve seen a number of different announcements. Some good, some bad, some utterly ridiculous. But the biggie, the absolute biggie is a new tax on EVs, which according to their own statistics, people, this is the UK government, it is going to reduce the number of electric vehicles on the road by 440,000 cars. 440,000 fewer EVs on the road by 2031 with the new tax that we’re going to talk about in a second. And let’s just put that into context. Here and now in the UK in November of 2025, there are 1.7 million EVs registered and on the roads. Okay. So, we are talking about reducing that number by a quarter. a quarter of EVs at the moment going off the road because of people being put off EVs by this new tax. It’s an enormous number. And okay, so the number of EVs is projected to grow every year from here until we get to 2031. I accept that. But taking a quarter of today’s number off the road in the future is massive. The government have absolutely torpedoed their own policy of getting us all into EVs. So what exactly is it that they’ve done which has this enormous effect? Let’s just talk about that. So I would say that in this budget there were good, bad, and ugly things for EV drivers. And there were a couple of good things. So, the biggie is that at the moment in the UK, if you buy any car that’s more than £40,000 as a list price, you have to pay the luxury vehicle tax uh after the first year. Basically, for 5 years, I think it is. It’s £425 of additional vehicle excise tax that you pay. Well, that’s now going to change for EVs only, and it is increasing to a £50,000 threshold. So that means that most Teslas will no longer be hit with the luxury car tax. So that is a big big big thing. There’s an additional 200 million pounds going in to EV charging, which again is a good thing. That is not at all bad news. The bad news, the bad news is that they are going to impose this thing called an electric vehicle excise duty. So, the way that car pricing works in the UK, if you’re watching this from outside, is that we have what everyone lovingly describes as a tax disc, but it’s not. It’s not even physically a disc anymore. It’s just paid online. And officially, it’s called vehicle excise duty. It’s paid upfront for the year to come by the owner of the car. Okay. There will now be an additional electric vehicle excise duty which is paid alongside it for EVs from April 28 with this new tax. And as was predicted, it’s going to be per mile. And it’s 3 p per mile for an EV and 1 half p per mile for a plug-in hybrid vehicle. Now, I confess when this rumor leaked before the budget, I just poked a stick at it and laughed a little bit because with respect to it, it had come out in the Daily Telegraph, which hates EVs and hates government bureaucracy, and all felt a little bit too obvious. Why on earth would the government do anything as stupid as that? And then you sit through today’s budget and realize, oh, that’s why because they’re just completely stupid. So, Mayor Kulpa, guys, I was saying nasty things about the Daily Telegraph, who actually happened to be right on this one. It’s baffling to me what’s just been announced. Completely baffling because according to its own statistics, so the Office of Budget Responsibility in the report, which was of course leaked immediately before the budget, what on earth were they doing there? But according to the OBR’s own assessment of this tax, it will remove 440,000 EVs off the road by 2031. Okay, this is crazy. This is utterly crazy. They accept what this is going to do, which is that psychologically people are going to say, “Well, I’m not paying that tax. Why should I pay an extra tax to drive an EV? I’ll carry on driving my petrol car. And from a maths perspective, anybody who’s saying that is wrong. What they’re saying doesn’t actually stack up. But I understand why they would be saying it. So, let’s just quickly do the maths and then I’ll explain why they don’t matter at all. So as things stand at the moment, road fuel duty which is paid on petrol and diesel that is 52.95 per liter. Okay? So every single liter of petrol and diesel that you buy currently is 52.95 p is just the tax. You then pay VAT on top of the tax. Okay? So the tax is ratable which is a wonderful wonderful scam. An average petrol car does 36 mp gallon according to Grock and the average petrol car does 7,000 miles a year again according to Grock. So if you put all of those things in together and you take the fuel duty and you add the VAT on the duty, it’s 7.8 p per mile here and now in 2025. if you want to drive a petrol car and that’s an average. So some cars will do an awful lot more miles per gallon than the 36 average which this uses. Absolutely the case. Some it will not be as much as that. But as an average it’s a smidge under 8p a mile. So 3p a mile for an EV is obviously a significantly lower number. you would pay less per mile to drive an EV under this uh new stupid tax than you would if you drove a petrol car. And that’s with today’s fuel duty. They have committed to freeze that until next April. I actually think that it’s going to increase going forward from there. So the amount of tax is going to increase and therefore the gap is going to widen. Here’s why that doesn’t matter. Okay, people are going to react to this at a very basic emotional level. Why should I have to pay an extra tax if I buy an EV? I’m going to keep my petrol car. That’s it. That’s going to be the response. And as a trained negotiator, I can tell you now that you cannot disarm an emotional objection with a factual response. People who react emotionally to something aren’t interested in the facts because it’s it’s about human instinct. It’s about human nature. And the human nature response to this additional tax on EVs is not to have an EV. That’s what this is going to do. And their own numbers admit it. 440,000 EVs off the roads versus what there would have been by 2031. So, I honestly do not get this. I do not get this. Okay. So, if you’re going out and buying a new car and you’re going out and buying an EV, the chances are you’re still going to be better off because that 425 quid a year in luxury car tax that you are going to be paying even if you then take the extra average annual mileage that an EV does at 8,000 miles, which is more than a petrol car at 7,000 miles, and you do 3p a mile on 8 half th000, it’s 255 5 quid. So you’d save 425 quid and then pay 255 quid back again. So you’d still be better off buying uh 45 grand EV versus a 45 grand petrol car. And that’s to say nothing about the cheaper running costs, not having to get it serviced, not having to keep buying brakes and tires and all of the other reasons why EVs are just better than petrol. But none of that is going to matter because up here people are going to say, “I don’t want to have to pay this extra tax.” It’s that simple. And I haven’t even got started on how on earth this is supposed to work because it’s when they said initially it’s going to be per mile and you’ve got to declare your mileage and you got all of the stuff about, well, it’s some kind of, you know, bean counter kind of thing. But no, they’re going to have an additional vehicle excise duty. So, VED, which everybody pays, there will then be EVED, which you have to pay alongside it. I honestly don’t know how this is going to work. How are they going to check this thing? People have suggested, well, it’ll be when the car gets. Well, what if you’re not keeping the car until the point where it needs anote? Or are they going to say you have to have an annualote check for an EV from the very beginning just so that we can check and police the mileage? What if you drive abroad? I drove my previous car abroad. I’m going to be driving this car abroad. How exactly am I supposed to prove to them that, oh, no, no, no, no, no. I might have done 8,000 mi, but I did 1,500 of those in Spain. How am I supposed to prove that so that I’m not being overcharged? Again, up here, all of this just becomes no, I won’t bother. I’ll just have petrol. And it could be worse because if you have got petrol and electric, so a plugin hybrid, you’re paying one and a half p a mile without really getting the benefits of having an EV. So again, that one just doesn’t really make any sense. And the final point on this because this is a short reaction video. None of this none of this changes the reality of the situation which is we are moving to a post petrol world where EVs are everything. That is already happening. And I know there’s been some suggestions about oh this is the nanny state UK government etc. I could vote for this other party and they’ll get rid of all of that. As I said on my previous video talking about this, because this is happening everywhere, you can vote for whoever you like in the UK and they could abolish the move to EVs tomorrow. And Ford is still not going to make and sell a petrol Fiesta just for the UK. We’ll end up taking cars from developing markets where petrol is still a thing. That is what we would be fed, right? Maybe they’ll import some American cars, assuming that the American manufacturers haven’t all gone bust, which is where they’re currently heading. I don’t know. Either way, our transition to EVs is set for 2035. So, in 10 years time, you will not be able to buy anything other than an EV in the United Kingdom as it’s set. Let’s say it slips a bit further, it becomes 2040, whatever. if they’re going to put this tax on and it is going to have a massive slowdown effect on the take up of EVs, that task just becomes even harder. The psychological barrier to having an EV, which we’ve all been fighting for the last few years about it’s not difficult to go on long trips. It’s not more expensive to own. No, the battery isn’t going to wear out on eight years. And no, it’s not going to burn you to death. We’ve been fighting all of this fear, uncertainty, and doubt. And now we’ve got the government sticking in the biggest one of all, which is we’re going to tax you. They are truly off their heads. Completely mad from a policy perspective. Completely mad. That’s what I think. What do you think? Let me know in the comments. It’s not a long video. It’s an quick reaction video to what’s been announced today. I think they’re crackers. What do you think? Let’s have a debate about it. And I will see you back here very soon on Just Get a Tesla.

My reaction to the UK budget! An EV tax will kill the EV future. That’s according to the government, not me. 440,000 fewer EVs are now forecasted to be on UK roads by 2031 thanks to the new 3p per mile tax. So why have they done it???

I am doing Movember to raise money for men’s mental health charities. Please sponsor my moustache! https://uk.movember.com/mospace/15417051

Welcome to Just Get A Tesla! Despite all of the new EV competitors I am going to show you why instead of looking at something else, you should Just Get A Tesla!

New Tesla videos every Monday, Wednesday and Friday!

Help support the channel – why not buy me a coffee!

https://www.buymeacoffee.com/JustGetATesla

Buy a Tesla with my referral code: ts.la/ian294246

Please subscribe – so many more Tesla videos on their way! youtube.com/@JustGetATesla

MILIBRICKS: https://milibricks.co.uk – 10% off with the code “GET”

STELLAR STATIONERY: https://stellarstationery.co.uk – 10% off with the code “GET”

3W: https://uk.3wliners.com/?ref=GETATESLA & use the code GETATESLA

JOWUA: https://www.jowua-life.com/justgetatesla for a 5% discount

EVBASE: https://www.evbase.com/?bg_ref=y34fcJAGYo 26% off when you use the code “JGAT”

TESLOGIC: https://teslogic.co/discount/GET

#tesla #teslamodely #modely #ev

#evcharging #charging #longrange #teslalife #justgetatesla