HAS THE GOVERNMENT JUST WRECKED NEW EV & HYBRID CAR SALES ?

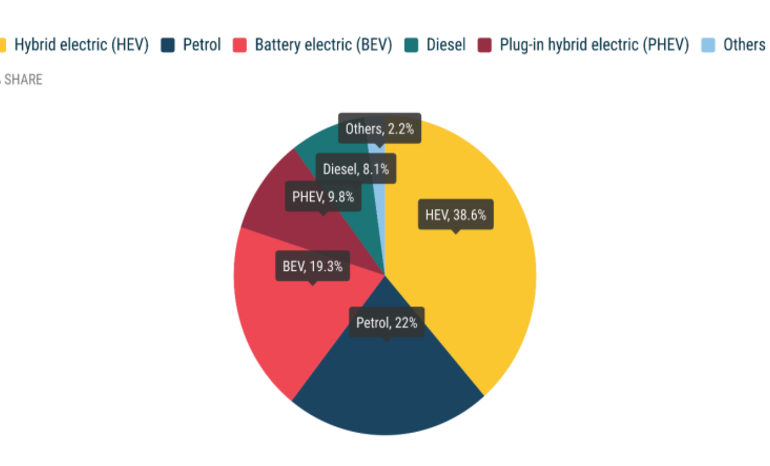

Hi there. Welcome back to the Car UK channel. Right, it is time for a budget roundup. How have we fared the motorist from today’s budget announcement? I’m going to go through it quickly with you cuz it’s getting a bit dark, but we’ll say I want to get this out. I’ve got a few notes here. I was obviously listening to the old wireless today, listening to the budget as it announced picking up anything to do with the motorist. Now, there’s lots of policies that have been announced today. We’re not a political channel here, so we’re not going to be talking too much about anything else on that, but we will talk about the motorists because that is what this channel is about, talking about cars and of course anything to do motoring wise. And um yeah, I’d have to say actually starting off with some positives um here because there is some negatives, but overall I have to say with for petrol and diesel owners particularly, we’ve not done too bad. I’m quite shocked actually at how little she could could have targeted the chancellor and hasn’t touched. So we’ll start with the positives first. Bit of good news before we ended a bit of doom and gloom which I like. Uh which is that um first off well fuel duty that’s the one we got to talk about has been frozen. Fuel duty now been well I think 16 17 years now it’s been frozen for and it’s been frozen again. I don’t think anyone expected that. A lot of people were expecting from the Westminster bubble we’re talking about fuel duty going up. That was a big fear amongst um obviously motorists as a whole because no one wants to pay more fuel duty. Prices of fuel although the price of oil per barrel is quite low actually. Um the fuel at the pumps is not particularly cheap and it’s not cheaper than it was before Russia’s involvement in Ukraine which obviously sent oil prices through the roof. It has come down a bit since then but it’s nowhere near what it was. And I think that introducing a policy that would have got rid of the fuel duty freeze would have put a lot of motorist’s bills up and would affect businesses as well and could even affect prices. This is the problem that we have. It’s not just about the motorist getting to to work, what we put in fuel, you know, few pence here going up per liter obviously affects us. It’s not great. But for businesses, it can be crippling. If you’ve got fuel prices going up, the cost of getting those goods and services moved around costs even more. And inevitably, those costs are put on us. So there is a real sort of further economic worry here if you start messing around with fuel duty. I suspect that they wanted to put it up. They reckon that they’ve lost about 120 billion governments over the last 15 16 years by not putting fuel duty up. But what other damage would it have caused the economy by making things even more expensive than they already were by putting the cost of basically all the goods and services that we need to transport around the UK and of course our costs as well that we have in our pocket uh being severely affected by a fuel duty rise. So that is a really welcome one. So big shock wasn’t expecting it but great news. Other great news insurance premium tax rises uh they are not coming. Bit of a worry that insurance premium taxes would have gone up. Basically, if you have any insurance policy in the UK, there is a a duty put on top of that. Whatever the premium is, that’s insurance premium tax. So, if it’s health insurance, normally people have that, but travel insurance with one house insurance, car insurance, major ones. If insurance premium tax goes up and there was say some threatening of that happening, it puts up your insurance premiums and that’s not on top of the insurance company like to put up your premiums just for any excuse anyway. So, that is good. That is frozen once again. That’s good news. So your insurance premium at least from the government side is not going to go up because of them next year. Another good one is classic car tax. That has been uh left alone. There was worries about classic car tax being uh the exemption sorry for free road tax for classic cars going that has been left alone. So that’s good news. I’m really pleased with that one. As someone who has classic cars and is involved in the car trade, I want to see classic cars be exempt from road tax. We always had a situation up until 97 where cars of a certain age were exempt from road tax duty. That was taken away by the Labor government in 97. It was brought back in 2015 mainly down to the fact that the amount of money that is generated from the classic car market that goes out into the economy is far outstrips the duty that you would collect. So basically it’s an incentive and there will arguments and I understand that to say that we should all pay something if you have a car on the road. I get it. for I personally think that it’s a good idea that’s been left alone. Yes, I probably have a bit of skin in the game dealing in classic cars, but for me it’s good news. I’m sure there’ll be others that will disagree with that, but if you are certainly a classic car motorist, it is good news for you today. And finally, as well, another positive I’ve got here, and I’ve only just got a little bit of an outline of this one. We need to get some more information on it. U hopefully this does come to something, which is a fuel finder scheme. So basically, it’s about getting more transparency between petrol stations and fuel stations uh about how they uh basically regulate pricing and how they promote pricing, giving you more access to where’s got the cheapest fuel and being more accurate on that as well. So updating it, having a bit obligation on fuel stations, obligating them to make telling you that where the fuel where they’ve got fuel in stock, so you’re not traveling somewhere where it hasn’t got any fuel. Ideally, if you’re quite isolated out in the stick somewhere, it’s quite far to travel to get petrol. You don’t want to go there and realize that they’ve not got any in. So, it’s about allowing those garages to force them to update you quickly or update the public quickly about where has got fuel and where hasn’t. And about pricing, that’s the big one. So, it will be a case of you’ll be able to find more easily and have access to the latest live pricing of fuel in your area. I think it’s a very, very good policy. Yes, we already have websites that now already track that. But this is about making sure that people the garages sorry are obligated within 30 minutes to update any changes which is really really good. Could save you a lot of money when filling up the differences between 1 and 6 p in some area per liter. So it could actually introduce a massive saving to the motorist and I say that is got to be welcomed. I say a lot more details still come on it. It’s still very raw but it sounds positive to me. I’m quite pleased with that one. Right, the negatives. And of course, where we’re going to kick off, we’ve got paper mile. Of course, we’re going to start there. Paper mile, as we all suspected, has been introduced for electric vehicles. 3 p per mile on your journey from 2028 onwards. Quite surprised they have delayed it that far, but I suspect that there’s a lot more to do on this. How you going to implement it, stuff like that. So, they probably need that time to to do that. So, yeah, 3 p per mile. Look, if you’re an EV owner today, you’re worse off in the future under this scheme than you would have been yesterday. Uh because you’re going to now have to pay a duty, but you weren’t paying. Some would argue that we should all pay something. If you petrol diesel cars, they are paying fuel duty. Others would argue that they bought electric car because they were cheaper to run and they were incentivized to do so. And this is an unfair scheme and it is, but it’s about the government. It’s not about the emissions or anything like that. It’s nothing to do with it. It’s just a case of the petrol and diesel cars which they slate to death which creates some huge amounts of revenue is slowly going to dwindle down and has been dwindling down and will get worse over the next few years that’s causing a big black hole in the in the finances that been brought into the treasury. They’ve had to come up with another scheme paper mile they think is the answer. I think if you’re electric vehicle owner today I suspect you already realized this was coming that you’ve had a bad deal to be honest with you. You know, this is not great for pushing electric cars at all. Not that I’m a massive fan of them, but look, everyone’s going to have their own choices. This is more burden on the motorist. You’re already paying high electric prices anyway to to let to charge up these vehicles, which is also taxed. Um, as well, you pay levies and stuff like that. So, yeah, it’s not great really, but inevitably it was going to happen. My worry is that this creeps into something else. So it becomes the rate will go up over time and it will expand into other vehicles particularly back to combustion engines. So they’re trying to when trying to phase out combustion engines and trying to get people off the road particularly in the 2030s who are still using petrol and diesel cars they might just then put it on uh on those users as well. Depends who the government is. But yeah, you could see how it could creep. We’ve seen things like this happen before. New taxes come along and they start off with, “Oh, it’s only little. It’s not too bad.” But it expands then years later into something vast. I can think of VAT. That was a one that was brought in the 1970s. Only a small tax. It was very small on luxury goods. Now it’s pretty much attached to anything you buy. I mean, I bought some brake pads before. How could you say they are luxury goods? They’re a necessity to stop the car. Uh but they incur VAT. It just went out of control. VAT. And fuel escalator was one in the ’90s. We used to have very cheap fuel until the mid ’90s. and the chancellor then I think it was Kenneth Clark actually introduced uh fuel escalator which pushed the price of fuel up considerably over the next sort of 5 to 10 years. So you can see how these policies start off small but then can turn into something really big. So mission creep you have to worry about. So yeah, I’m worried about that one. We’ll see how we go. I think that will be the norm paper mile in 10 years time sadly. Uh hybrid users, you’re also going to get hit by paper mile. is one that you should be really worried about if you’re a hybrid owner. Why would you go and buy a hybrid after 2028 now? Because not only are you going to have to pay fuel duty because you still need petrol and diesel in your hybrid to charge up the batteries, uh you’re also going to have to pay road tax, uh also this new pay per mile at 1.5 p per mile. So yes, it’s less, but you’re still paying. And if your hybrid was over £40,000, if you’ve already bought it, that was you’re still paying 5 years of showroom tax as well, which is really expensive. Although that is about to go up to 50,000. So, we’ll talk about that as well, which is showroom tax. This is a policy that I really dislike because it basically punishes car manufacturers. It’s really bad for the industry. Why should you be taxed for buying a particularly expensive car? And I’d argue that 40 grand these days for a car, bearing in mind no one actually really goes out and spends 40 grand on a car these days. They usually get them on lease or PCP or whatever. Or some some people get on high purchase, although mainly PCP. You get some generic cars now that are fall into this luxury tax band of 40 grand and above that aren’t really luxury cars. Look, I know the cost of gone up, but you know, it’s if you’re going to have a car policy or tax, sorry, that’s based on luxury cars, it should be for luxury cars. And I don’t see some cars at 40 grand falling into that, particularly a lot of them electric vehicles as well, which the government is also trying to promote you to buy. That’s been pushed up to 50 grand from 40 grand to 50 grand. However, only for electric vehicles. So, if you still got a petrol or diesel car that’s over 40 grand or a hybrid, you still got to pay this ridiculous uh showroom tax for the next 5 years. I mean, it’s just absurd. It’s just a terrible, terrible policy. It’s not going to go. Um, it was actually introduced by the Conservatives actually, I believe. I don’t like it. It’s a really damaging policy. I don’t see why you should be penalized for buying a car that’s 20,000 or 50,000. What difference does it really make? I think we all pay enough anyway. It’s just another claw for money. Reality, more money for the Treasury, which reality they don’t really deserve to be honest with the motorist. I think we pay enough. Other things as well, briefly, with the mobility scheme, this was a big one that everyone’s been talking about. getting rid of the luxury cars out of the mobility scheme for people who are on the PIP models that are being killed off or called. This is an interesting one because it’s actually obviously someone at the Department of Transport or the mobility scheme. Someone somewhere has had to come up with make some models of cars that they deem to be luxury. They have deemed cars like Alfa Romeo, Audi, BMW, Lexus, Mercedes-Benz uh to be luxury vehicles. Look, I’m not going to get too much into this because it’s starting to go towards general politics and I’m trying to focus on the motorists. At the end of the day, it’s going to be damaging for those manufacturers who make those vehicles that they can’t now sell those cars to the mobility scheme. Some would argue that, you know, you shouldn’t have high valued cars on the mobility scheme. But at the end of the day, the people who are going in and getting these cars on the mobility scheme, they’re paying large amounts down out of their own money. Should it really affect should be bothered about it? I think it’s more just sort of a case of it’s an appeasement policy just to say that really if you’re on benefits you should have cars that are suited to your need and that actually should be the case and we shouldn’t really be pushing these posh cars towards individuals on mobility. I I don’t know is the honest answer to that one. It doesn’t really bother me that one but I can completely understand why it might bother some other people. I don’t know about that one anyway. It’s not really a major one affecting the motorist at all. Um, so yeah, let me know your thoughts on those policies, particularly fuel duty, you pleased about that one. The obviously the big one, which is the paper mile. If you have a hybrid, I want to hear from you in the comments. What’s your thoughts on that? Will you buy another one later, particularly after 2028, or are you going to turn away from them? Any thoughts on the classic car tax and this new fuel finder scheme as well, which should hopefully save us a few pence per liter at the pumps by shopping around a bit and pro promoting a bit of competition. I quite like that policy. I think you might have gathered that by now. Hopefully, it turns into something decent and not just some flung idea that that never gets properly set up. We’ll see. Anyway, let me know your thoughts in the comments section. For what it’s worth, I think we have done all right today. If you unless you are a hybrid or electric vehicle owner, I don’t think that the motortorist has done too bad out of this. If you’re a petrol diesel owner, I think you’ll be quite pleased with today’s budget. But bear in mind, this is only one budget. We still got next year, haven’t we? So, we’re only safe for so long. Any wrap it up there. Thank you for watching. I hope you all have a fantastic rest of the week and I’ll see you all in the next one.

Hi all

in this video I talk about the latest news from the 2025 Budget effecting the motorist. Which taxes are going up and new policy’s to be introduced 🤔

#carauction #caruk #wheelerdealers #flippingcars #auction #carsales #usedcars #usedcars #motortrade #sellingcars #usedcardealership #cheapcars #mg #mattarmstrong #budget2025

00:00 Start / Intro

00:57 Fuel Duty Freeze

02:45 Insurance Premium Tax

03:24 Classic Car Tax

04:27 Fuel Finder Scheme

05:54 Pay Per Mile EV’s

08:56 Pay Per Mile Hybrid Cars

09:20 Showroom Tax

11:02 Motability Scheme Luxury Cars

TO CONTACT ME PLEASE EMAIL ME AT

carukchannel@gmail.com